Market value expectations interpretation: The future of Layer3 (L3) full-chain identity and token distribution protocol

远山洞见2024/07/30 04:01

By:远山洞见

I. Project introduction

Layer3 is a full-chain identity and distribution protocol where cryptocurrency consumers discover new projects and projects reward their on-chain activities.

By aggregating user activities across multiple chains and dApps, Layer3 generates a unified view of user identities on the chain and achieves highly targeted and efficient token distribution. Projects built on Layer3 can programmatically route tokens to the right users at the right time based on various criteria such as time triggers, asset ownership, on-chain activities, credentials, social graphs, and task participation.

Its core product, CUBE, serves as an ERC-721 token that records credentials for customer engagement tasks, promoting identity unification and activity traceability.

*

II. Project highlights

1. Innovative full-chain identity and token distribution protocol: Layer3 aggregates user activity across multiple blockchains and dApps to create a unified on-chain identity view for users, enabling efficient token distribution.

2. Layered staking model: Users can obtain maximum rewards by staking and actively participating in Layer3, including passive income and other governance tokens, as well as increased protocol practicality.

Community allocation ratio is significant: 51% of the L3 token supply is reserved for the community, ensuring that community members can obtain tokens and participate in the Layer3 ecosystem.

4. CUBE Dynamic NFT: ERC-721 tokens minted by users after completing tasks, recording users' participation in applications, chains and ecosystems of different tasks, which helps to improve the enthusiasm of customer engagement projects.

Layer3 has served over 3 million unique users in over 150 countries, handling over 100 million interactions.

III. Market value expectations

Layer3 overlaps with similar projects such as Galxe, Zearly, RabbitHole, and QuestN in terms of target market and functionality, but also has a unique positioning. Galxe focuses on credential data networks and reputation systems, Zearly is committed to providing early access and NFT rewards, RabbitHole drives customer engagement through tasks and education, and QuestN increases user interaction through gamification tasks. These projects all utilize the earn-to-learn and play-to-earn models to attract customer engagement in the Web3 ecosystem to varying degrees.

Benchmarking the same track has been issued currency project Galex, GAL after upgrading to G, the total amount of 12 billion, the current circulation market value of 382 million US dollars, market value ranking 210, L3 total about 3.30 billion, the initial airdrop will distribute 250 million tokens to early users and community members, the remaining distribution will be gradually released, while with the L3 layered pledge and destruction mechanism, assuming full circulation state, the total number of L3 tokens is about a quarter of GAL, its circulation market value or should be four times the circulation market value of GAL, about 1.50 billion US dollars.

Of course, this is just a preliminary estimate, and the actual market value will be affected by multiple factors such as market dynamics, project progress, and external economic environment.

IV. Economic model

Layer3's token model revolves around L3 tokens, which are the governance and utility tokens of the platform. It includes the following key elements:

The total supply of L3 tokens is 3.30 billion, and the specific distribution and release are as follows:

51 per cent (approximately 1.69 billion) were allocated to the community;

25.3% is allocated to core contributors.

23.2% allocated to investors.

0.5% allocated to consultants.

The initial airdrop during TGE is 7.5% of the total supply, with 200 million L3 (6%) allocated to early users and S1 participants, and 50 million (1.5%) allocated to S2 participants. The snapshot of early users and S1 was taken on May 10, 2024, and the snapshot of S2 will be taken on July 22, and the airdrop query page will be launched on the 24th.

The token usage and reward mechanism are as follows:

1. Layered Staking: Users can stake L3 tokens to obtain passive income (L3), participate in governance voting, and obtain other tokens (such as OP, ARB, DEGEN). Layered Staking is divided into three levels, and the reward increases with the number of tokens staked and user engagement rate.

2. Destruction mechanism: In order to access the Layer3 protocol and network, users and the community must purchase and destroy L3 tokens. This mechanism is used to issue tasks, deploy incentives, and obtain CUBE credentials. In addition, users can also obtain privileges in the partner ecosystem by destroying tokens.

Airdrop and community rewards are as follows:

The L3 token plan has conducted multiple airdrops, aiming to reward early users and community participants, and promote alignment between long-term users and the ecosystem. The initial airdrop has increased to 7.5% of the total supply.

V. Team and financing

The team of Layer3 was co-founded by Brandon Kumar and Dariya Khojasteh. Brandon Kumar has extensive experience in blockchain and cryptocurrency technology, while Dariya Khojasteh has a deep background in User Experience and Market Strategy. Together, they are committed to building Layer3 into a revolutionary cryptocurrency distribution and customer engagement platform.

In terms of financing, according to Rootdata data, Layer3 recently completed a $15 million Series A financing round led by ParaFi and Greenfield Capital. Other investors include Electric Capital, Immutable, Lattice, Tioga, LeadBlock, Amber Group, and Bitpanda.

Previously, Layer3 also conducted a $2.50 million seed round in 2021, with a total financing amount of $17.50 million.

VI. Risk Warning

1. The crypto market is highly volatile, and the value of L3 tokens may be influenced by market sentiment and the external environment.

2. Layer3 relies on multi-chain support and the overall stability of blockchain technology, and may face risks such as Technology Implementation and security bugs.

VII. Official links

Website:

https://layer3.xyz/

Twitter:

https://x.com/layer3xyz

Discord:

https://discord.com/invite/layer3

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Solana Could Remain Rangebound Near $230–$240 After False Breakout, Possibly Testing $220–$230

Coinotag•2025/09/17 18:15

Midweek CoinStats: DOGE May Consolidate Near $0.27, Could Break Toward $0.30–$0.35

Coinotag•2025/09/17 18:15

SHIB May Remain Sideways Near $0.000013 After False Breakout, Could Test $0.00001290

Coinotag•2025/09/17 18:15

Trending news

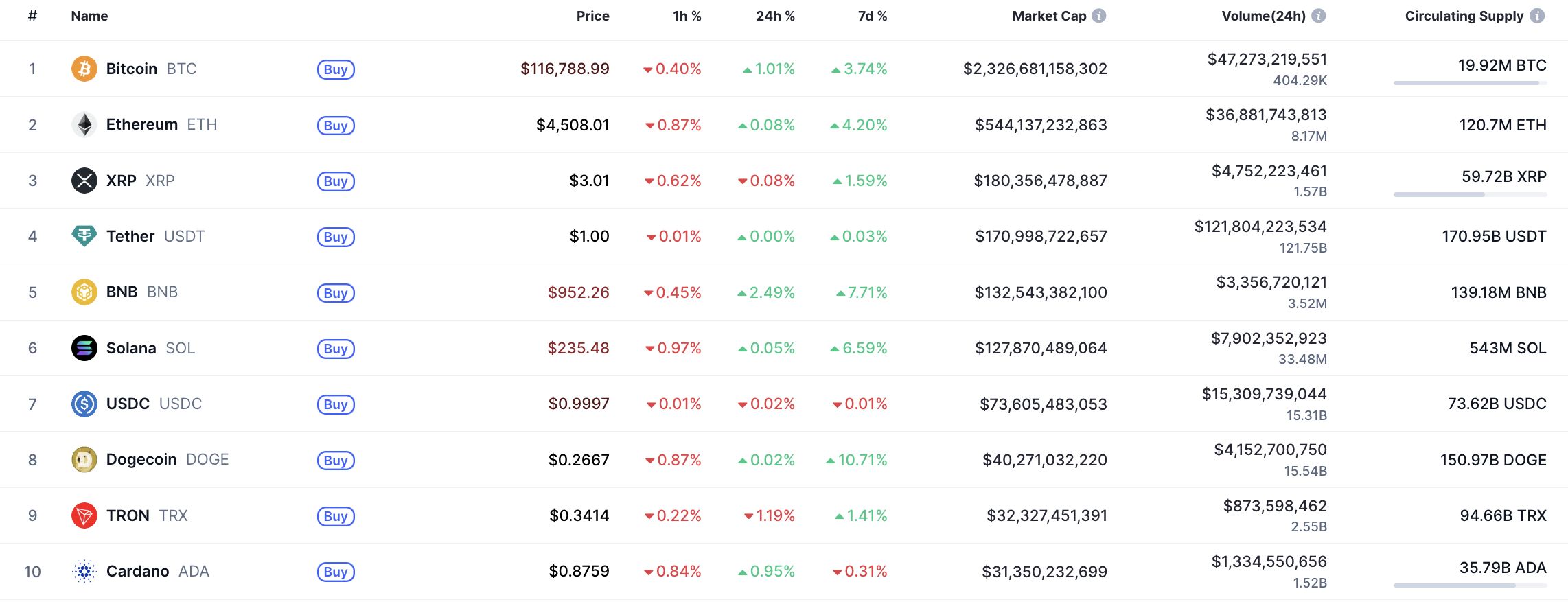

MoreCrypto prices

MoreBitcoin

BTC

$115,655

-0.80%

Ethereum

ETH

$4,485.83

+0.02%

XRP

XRP

$3.02

-0.63%

Tether USDt

USDT

$1

-0.02%

BNB

BNB

$955.12

+0.23%

Solana

SOL

$236.06

-0.73%

USDC

USDC

$1

+0.05%

Dogecoin

DOGE

$0.2674

-0.13%

TRON

TRX

$0.3398

-0.78%

Cardano

ADA

$0.8740

-0.21%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now