- Bitcoin crashed, failing to retain prices above $67,000, and is trading at $64,000.

- Bitstamp said that it would begin Mt. Gox repayments on July 25.

- Ethereum ETFs saw outflows worth $150 million as ETH fell by more than 7%.

The crypto market experienced a sharp downturn over the last 24 hours after Bitcoin (BTC), the world’s largest digital asset, briefly surged to $67,000 but failed to maintain momentum, falling nearly 2%.

As of this writing, Bitcoin is trading at $64,314, according to CoinMarketCap data , but remains up over 6% in the past 30 days. Since July 2023, BTC has surged an impressive 120.79%, outperforming numerous other digital assets.

A major reason for Bitcoin crashing is the ongoing repayments from the defunct crypto exchange Mt. Gox. Approximately 22 hours ago, Arkham Intelligence data revealed that a Mt. Gox wallet transferred 37,477 BTC (valued at nearly $2.4 billion) to an unknown wallet. Notably, the exchange’s trustees have recently executed several transfers to Bitstamp, a partner assisting with the repayment process.

Bitstamp confirmed on X (formerly Twitter) that it has received BTC from Mt. Gox, and is “working diligently to distribute them to our Bitstamp customers who are Mt. Gox creditors,” noting a separate distribution process for UK creditors.

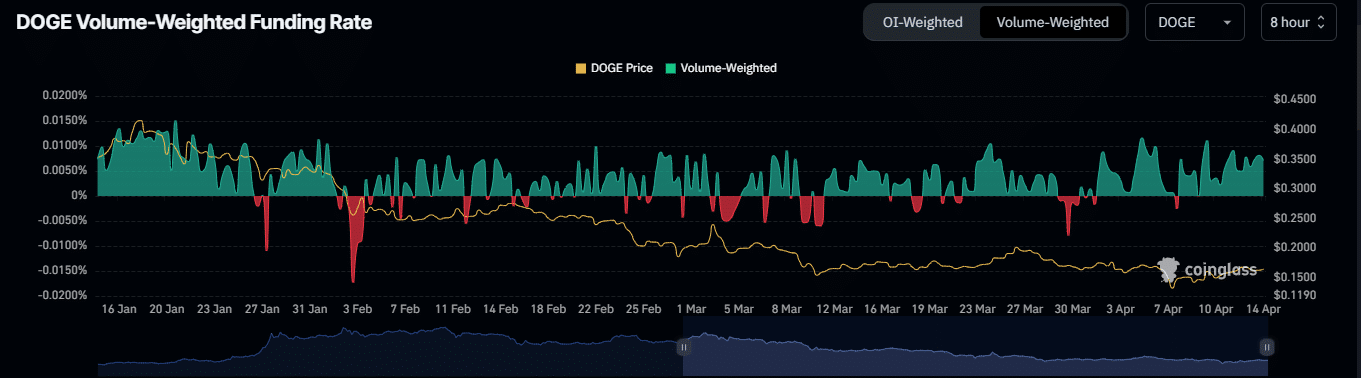

With repayments set to begin on July 25, panic has gripped the market, turning investor sentiment bearish. Coinglass’ Liquidation Map indicates that over $1.2 billion in Bitcoin shorts could be wiped out if BTC exceeds $67,000, with $2.5 billion in liquidations possible if it surpasses $70,000. Conversely, if Bitcoin drops below $63,000, $540 million in Bitcoin shorts could be liquidated, suggesting a predominantly bearish short-term outlook among investors.

Despite the approval of spot Ethereum exchange-traded funds (ETFs), which recorded $106 million in net inflows and over $1 billion in volumes , Ether crashed by 7% in the past 24 hours and at the time of publication, is trading at $3,168, with a 20% drop in trading volume as per CoinMarketCap data .

While Ethereum ETFs had a successful first day with $106 million in inflows, the second day saw net outflows worth $133.16 million, with $326 million leaving Grayscale’s ETHE, as per the data from SoSoValue. However, spot ETH ETF trading volumes remained above $1 billion, signaling potential bullish sentiment for the future.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.