US Ethereum spot ETFs see $133 million outflows one day after strong debut

Key Takeaways

- Spot Ethereum ETF flows turned negative on the second day.

- Fidelity's Ethereum Fund outperformed BlackRock's Ethereum ETF, which led the first day with over $266 million.

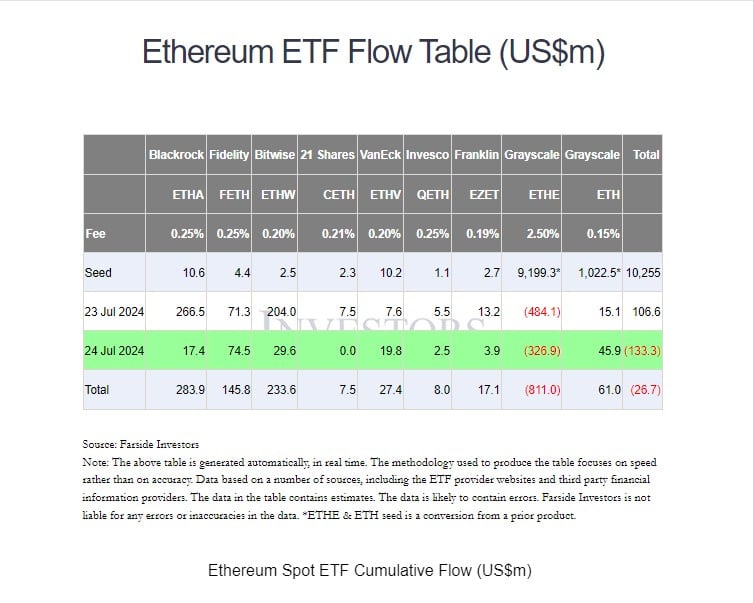

US spot Ethereum exchange-traded funds (ETFs) have seen a decline in net inflows after a strong start with almost $107 million. According to data from Farside Investors, investors withdrew around $133 million from these products on the second day of trading.

Fidelity’s Ethereum Fund (FETH) outpaced BlackRock’s iShares Ethereum Trust (ETHA) to become the day’s leader with $74.5 million in net inflows. Meanwhile, BlackRock’s fund took in nearly $17.5 million on Wednesday.

Source: Farside Investors

Source: Farside Investors

On the first day of trading, ETHA led the pack with over $266 million. ETHA’s flows and additional inflows from seven other Ethereum ETFs managed to offset massive outflows from Grayscale’s Ethereum ETF (ETHE) on its debut day.

However, a similar dynamic did not play out on the second day. Grayscale’s ETHE bled nearly $327 million, bringing the total outflows to $811 million since the fund’s conversion. After the second trading day, ETHE’s assets under management dropped to $8.3 billion , down from $9 billion prior to the debut of spot Ethereum ETFs.

In contrast, the Grayscale Ethereum Mini Trust (ETH), a spinoff of Grayscale’s ETHE, recorded approximately $46 million in inflows. The fund is among the lowest-cost spot Ethereum products in the US market.

Bitwise’s Ethereum ETF (ETHW) witnessed over $29 million in net inflows, while VanEck’s Ethereum ETF (ETHV) reported $20 million. Other gains were also seen in Franklin’s EZET and Invesco/Galaxy’s QETH.

21Shares’s Core Ethereum ETF (CETH) saw zero flows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Market Insights: Short-Term Recovery Signals for BONK, ALCH, and Bitcoin

In Brief Analyst Pseudonym identifies recovery signals in BONK, ALCH, and Bitcoin. Short-term trading strategies recommended for cautious positions. Increasing interest in meme tokens amid market volatility.

Ethereum Price Fluctuations Ignite Technical Analysis and Strategic Forecasts

In Brief Ethereum's price fluctuations shift focus to technical indicators among market players. Analysts signal potential recovery and long-term growth opportunities for Ethereum. Competition from networks like Solana raises challenges for Ethereum's market position.

Market Turmoil: Investors React as OM Coin Crashes 90%

In Brief OM Coin experiences a dramatic 90% drop, alarming the crypto market. IP Coin's price decline raises investor concerns about potential panic sales. Support levels for IP Coin are being closely monitored following recent fluctuations.

Market Moves: LINK Coin Faces Challenges as Tariff Uncertainty Looms

In Brief Market uncertainty continues to impact altcoin prices significantly. LINK Coin faces critical price thresholds that could determine its future direction. The macroeconomic landscape heavily influences investor sentiment in cryptocurrency markets.