Ethereum ETFs Debut with Strong Launch, Sparking Optimism for Future Crypto Funds

On July 23, the launch of Ethereum ETFs generated considerable buzz in the cryptocurrency sector.

Bitwise Asset Management’s Matt Hougan praised the impressive debut of these ETFs, suggesting it could pave the way for similar products, such as a Solana ( SOL ) ETF.

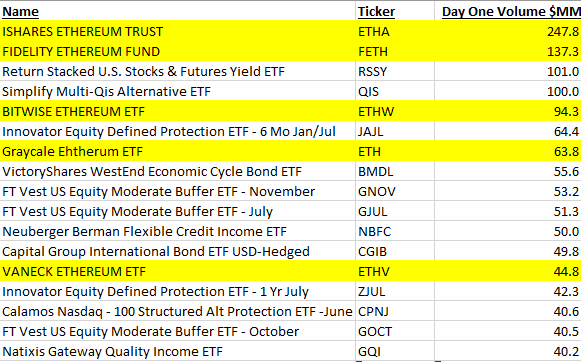

Hougan observed that the Ether ETFs, including Bitwise’s own ETH ETF, had a standout first day, drawing over $200 million in investments for ETHW alone. Overall, trading volumes exceeded $500 million, marking a significant achievement compared to average ETF launches.

The enthusiasm surrounding the Ethereum ETFs hints at a broader shift in crypto investments. Hougan anticipates that by 2025, the market will see a diverse range of crypto and index-based ETFs. Additionally, filings for a Solana ETF by VanEck and 21Shares suggest other altcoins might soon follow.

READ MORE:

Should We Expect a Spot XRP ETF in the United States?BlackRock’s ETH ETF led the day with $265 million in inflows, while Fidelity’s ETH ETF secured over $70 million. Conversely, Grayscale’s ETHE fund saw substantial outflows totaling $484 million.

Looking forward, Hougan expects a surge in institutional investment in both Bitcoin and Ethereum ETFs. Analysts project that Ether ETFs could attract over $10 billion in the first year. The SEC’s approval of Ethereum ETFs also fuels speculation about future ETF launches for other cryptocurrencies, potentially including Solana and XRP by 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoiners Called It First: US Economic Data Proves Pompliano Right

Solana Skyrockets 40%, Breaking Past the $125 Milestone

New US Bill Targets Carbon Emissions From Bitcoin Mining and AI Data Centers

The Clean Cloud Act would authorize the EPA to impose annual carbon limits on facilities using over 100 kilowatts of IT power, with escalating penalties for those exceeding the cap.