Decoding the Banana Zone: 6 economic indicators reveal that prices may rise

Original author: CRYPTO, DISTILLED

Original translation: TechFlow

You may have heard of the banana zone, but do you know when it actually arrives?

(Note: Banana Zone refers to a special period in the financial market during which asset prices may rise sharply)

Here are 6 key metrics you can’t miss:

1. Small-cap stocks and the real economy

Indicator 1 : Russell 2000 Index ($IWM)

Insight : $IWM represents small-cap stocks and has recently started to break out. This index is an important indicator of the health of the real economy. As corporate earnings increase, more money usually flows into these assets.

Source: @pakpakchicken

2. Rising risk appetite

Indicator 2 : Russell 2000 ($IWM) and Nasdaq 100 ($QQQ) trading volume

Insight : $IWM trading volume also reflects the market’s risk appetite. Recently, $IWM’s trading volume exceeded $QQQ ($14 billion vs. $12 billion). This rare situation last occurred in 2017, indicating that investors are more inclined to “risk-on”.

Source: Eric Balchunas

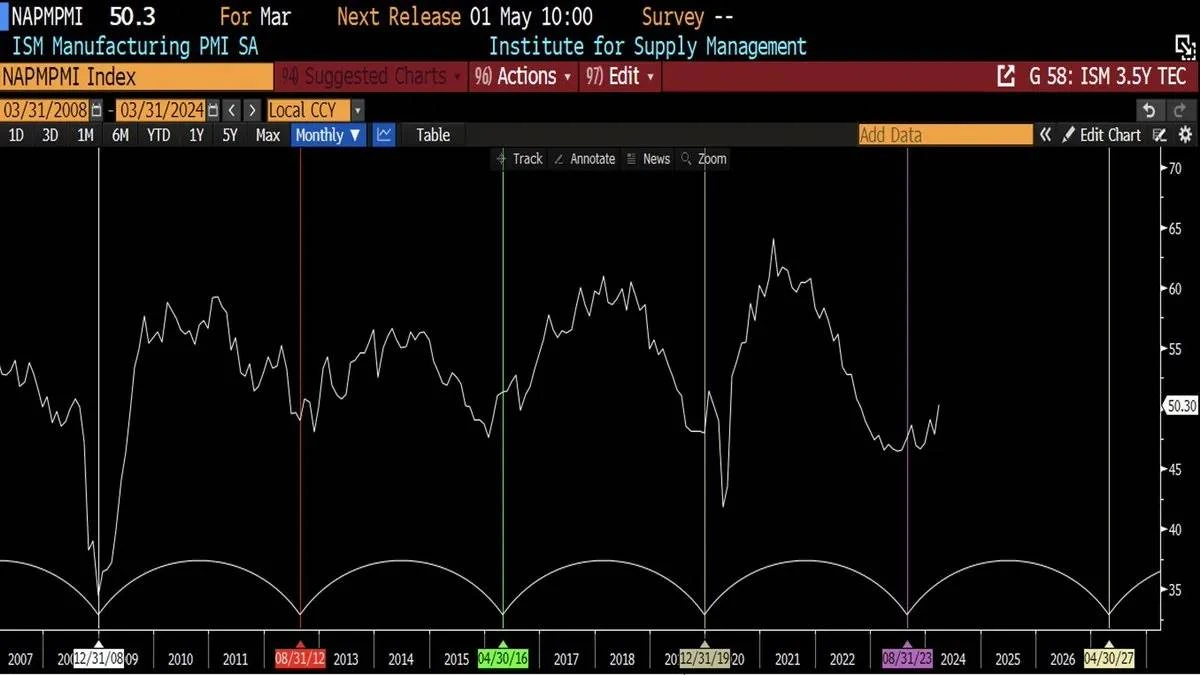

3. ISM Manufacturing Index

Indicator 3 : ISM Manufacturing Index

Insight : The index is crucial to understanding the business cycle. Its cyclicality emerges approximately every four years, driving liquidity trends. Raoul Pal predicts that the index will peak in mid-2025.

Source: RaoulGMI on X

4. Fed Liquidity

Indicator 4 : Federal Reserve’s H4.1 data

Insight : Monitoring the Fed’s “money printing” activity is critical as liquidity drives the cryptocurrency market. Check H 4.1 data every Thursday (EST).

Source: MartyParty on X

5. People’s Bank of China (PBoC)

Indicator 5 : PBoC liquidity injection

Insight : Second only to the Federal Reserve, the People’s Bank of China plays a major role in global liquidity dynamics. Watch the PBoC’s liquidity injections, which are starting to show movement.

Source: @tomasonmarkets on X

6. Corporate FOMO

Indicator 6 : Corporate BTC purchases

Insight : Large companies buying $BTC can trigger market frenzy. For example, Tesla bought $1.5 billion of $BTC in 2021, influencing the last cycle. Watch for similar moves by other companies like Dell.

Source: Google

Original link

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Gains Edge in ETF Race Over SOL and DOGE, Says Kaiko

Strive Pushes Intuit to Add Bitcoin to Treasury

Strive urges Intuit to hold Bitcoin in its treasury to hedge against AI-driven disruption risks.Bitcoin as a Hedge Against AI Disruption?Why Bitcoin, and Why Now?BTC in the Boardroom

JP Morgan Predicts Imminent Interest Rate Cuts

JP Morgan forecasts upcoming rate cuts, signaling a major shift in U.S. economic policy that could impact markets and crypto alike.JP Morgan Signals Upcoming Interest Rate CutsWhy Rate Cuts Matter for MarketsCrypto Could See Renewed Interest

Raydium launches Launch Lab, a token issuance platform