Is Bitcoin (BTC) on the Verge of a $70K Milestone?

- Bitcoin surpassed $65K resistance, reaching a 41-day high.

- Recent decline with 37.4k BTC whale transfer and overbought RSI.

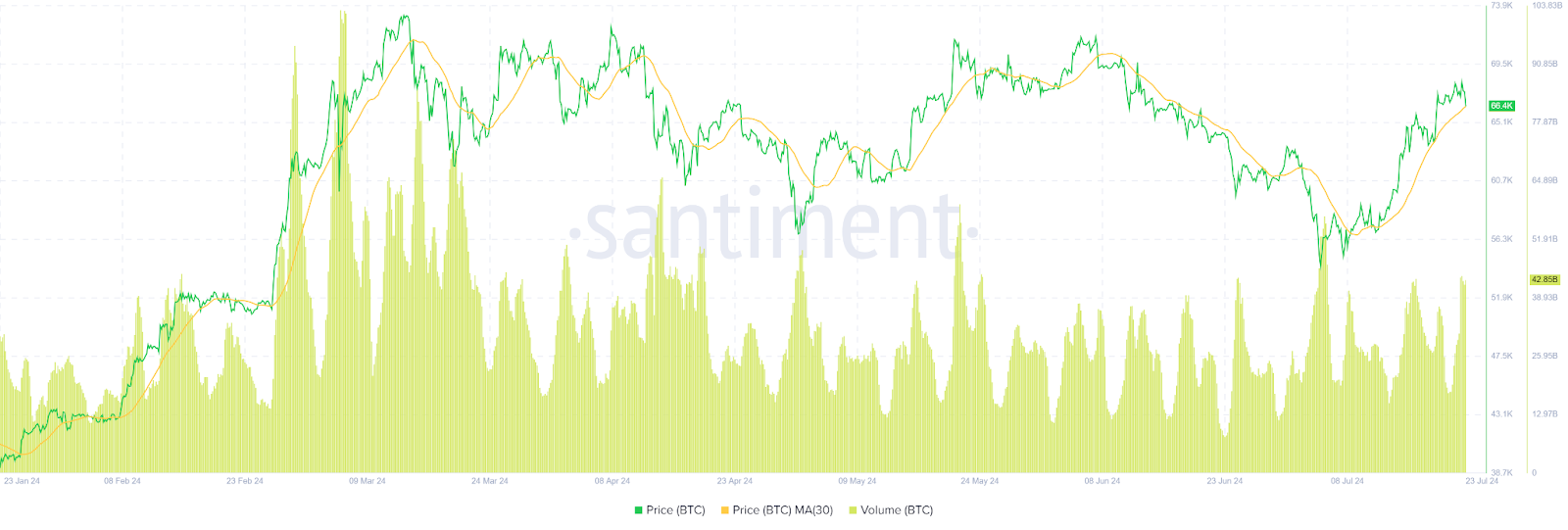

Bitcoin bulls have had a tumultuous week, breaking the $65,000 resistance after nearly a month and reaching a 41-day high of $68,474 yesterday. This peak came just hours before US regulators approved spot Ethereum exchange-traded funds, a move expected to impact the market positively. However, Bitcoin has declined 1.46% in the past 24 hours, despite a 48% increase in trading volume.

Meanwhile, the recent price dip coincides with a significant whale movement, with 37.4k BTC transferred between unknown wallets. Additionally, the daily Relative Strength Index ( RSI ) indicates that Bitcoin has reached an overbought situation, suggesting a potential for a price correction.

July has been eventful for Bitcoin, with several major occurrences impacting its price. The German government made substantial transfers , and Mt. Gox began repaying BTC to creditors, causing the price to dip below $57,600. Despite these setbacks, analysts maintain a positive outlook on Bitcoin, citing its historical ability to recover and return to bullish trends.

Analysts suggest that if Bitcoin surpasses the $69,000 mark, it could reach new highs. Notably, 93% of Bitcoin addresses are in profit after Bitcoin’s recent move to $67,000, indicating strong market support.

What Can Bitcoin Traders Expect?

Bitcoin’s recent price action reflects a bullish trend, highlighted by its breach of the $68,870 resistance level. Analysts predict that Bitcoin can potentially test the $72,272 level soon. However, if bears regain control, Bitcoin could retrace to $60,892 initially and potentially fall further to $57,861 in a more pronounced decline.

Looking back, Bitcoin’s performance in July has been marked by significant events and market movements. Despite some fluctuations, the overall sentiment remains bullish. The approval of spot Ethereum ETFs by US regulators is expected to positively impact the market, potentially boosting Bitcoin’s price shortly.

In conclusion, Bitcoin’s recent activity suggests a robust bullish trend with potential for further gains. While short-term corrections are possible, the overall outlook remains positive. Analysts forecasting new highs if key resistance levels are breached.

Highlighted News Of The Day

Michael Saylor Shares Bitcoin’s Gain Since 2020, Outpacing SP 500

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Market Insights: Short-Term Recovery Signals for BONK, ALCH, and Bitcoin

In Brief Analyst Pseudonym identifies recovery signals in BONK, ALCH, and Bitcoin. Short-term trading strategies recommended for cautious positions. Increasing interest in meme tokens amid market volatility.

Ethereum Price Fluctuations Ignite Technical Analysis and Strategic Forecasts

In Brief Ethereum's price fluctuations shift focus to technical indicators among market players. Analysts signal potential recovery and long-term growth opportunities for Ethereum. Competition from networks like Solana raises challenges for Ethereum's market position.

Market Turmoil: Investors React as OM Coin Crashes 90%

In Brief OM Coin experiences a dramatic 90% drop, alarming the crypto market. IP Coin's price decline raises investor concerns about potential panic sales. Support levels for IP Coin are being closely monitored following recent fluctuations.

Market Moves: LINK Coin Faces Challenges as Tariff Uncertainty Looms

In Brief Market uncertainty continues to impact altcoin prices significantly. LINK Coin faces critical price thresholds that could determine its future direction. The macroeconomic landscape heavily influences investor sentiment in cryptocurrency markets.