How much capital will the ETF bring to Ethereum? Who can benefit continuously?

Original source: ASXN

Original translation: TechFlow

The Ethereum ETF will be launched on July 23. The market has overlooked many dynamics associated with the ETH ETF that do not exist in the BTC ETF. We will explore liquidity forecasts, the unwinding of ETHE, and the relative liquidity of ETH:

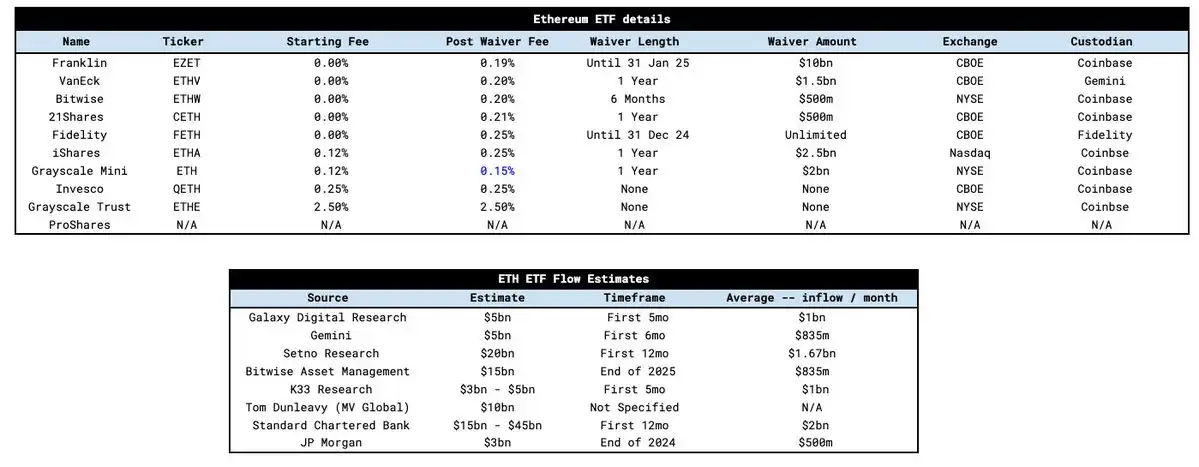

The fee structure of the ETF is similar to that of the BTC ETF. Most providers waive fees for a specified period to help accumulate assets under management (AUM). Similar to the BTC ETF, Grayscale maintains its ETHE fee at 2.5%, an order of magnitude higher than other providers. The key difference this time is the introduction of the Grayscale mini ETH ETF, which did not exist in the previous BTC ETF.

The mini trust is a new ETF product from Grayscale with an initial disclosed fee of 0.25%, similar to other ETF providers. Grayscale's strategy is to charge those inactive ETHE holders a 2.5% fee while directing more active and fee-sensitive ETHE holders to their new product rather than to low-fee products such as Blackrock's ETHA ETF. After other providers cut Grayscale's 25 basis points in fees, Grayscale reduced the mini trust fee to just 15 basis points, making it the most competitive product. In addition, they will transfer 10% of ETHE AUM to the mini trust and gift this new ETF to ETHE holders. This transition is done on an equal basis, so it is not a taxable event.

The result is that outflows from ETHE will be more moderate than from GBTC, as holders are simply transferring to the mini trust.

Now let’s look at liquidity:

There are many estimates of ETF liquidity, and we’ve included some below. Normalizing these estimates gives an average of about $1 billion per month. The highest estimate provided by Standard Chartered is $2 billion per month, while the lowest estimate provided by JPMorgan is $500 million per month.

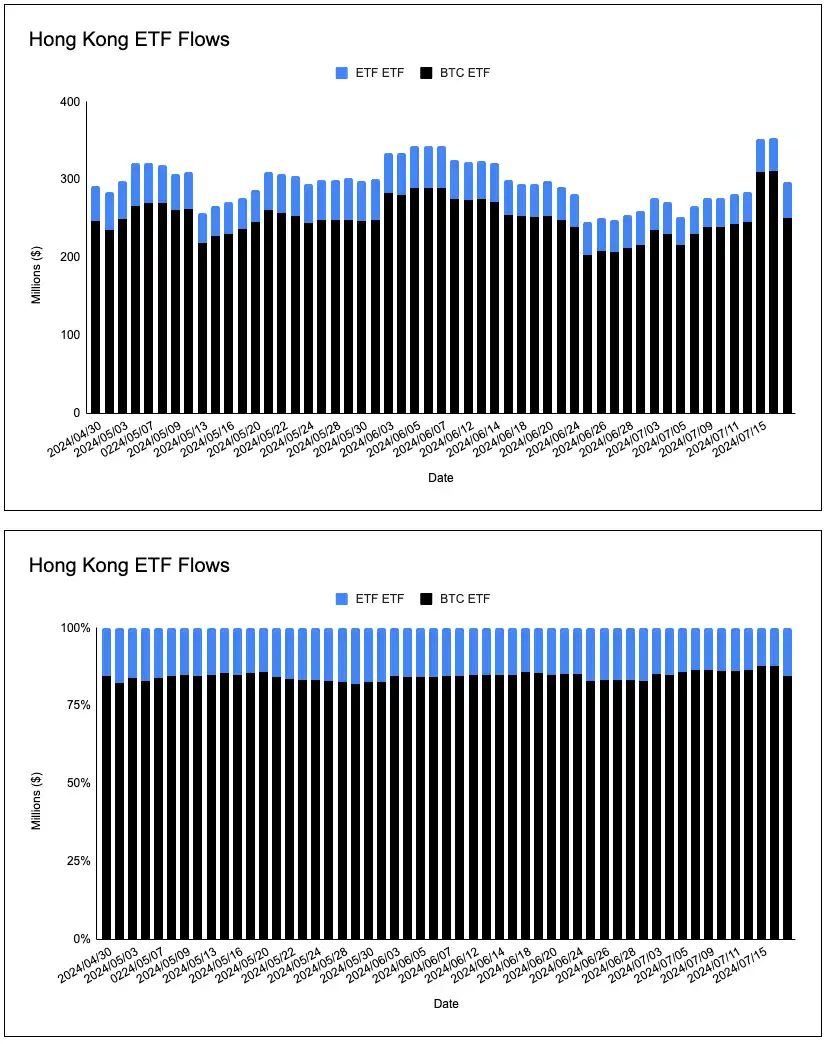

Fortunately, we can use data from Hong Kong and European ETPs, as well as the disappearance of the ETHE discount, to help estimate liquidity. If we look at the distribution of AUM across Hong Kong ETPs, we come to two conclusions:

The AUM ratio of BTC and ETH ETPs is more skewed towards BTC relative to market cap. The market cap ratio is 75:25, while the AUM ratio is 85:15.

The BTC to ETH ratio in these ETPs is relatively constant and consistent with the ratio of BTC market cap to ETH market cap.

In Europe, we have a larger sample size - 197 crypto ETPs with a total assets under management (AUM) of $12 billion. After analyzing the data, we found that the AUM distribution of European ETPs is roughly in line with the market cap of Bitcoin and Ethereum. Solana's allocation ratio is too high relative to its market cap, which sacrifices "other crypto ETPs" (anything not BTC, ETH, or SOL). Solana aside, a trend begins to emerge - the distribution of AUM between BTC and ETH globally roughly mirrors the proportions weighted by market cap.

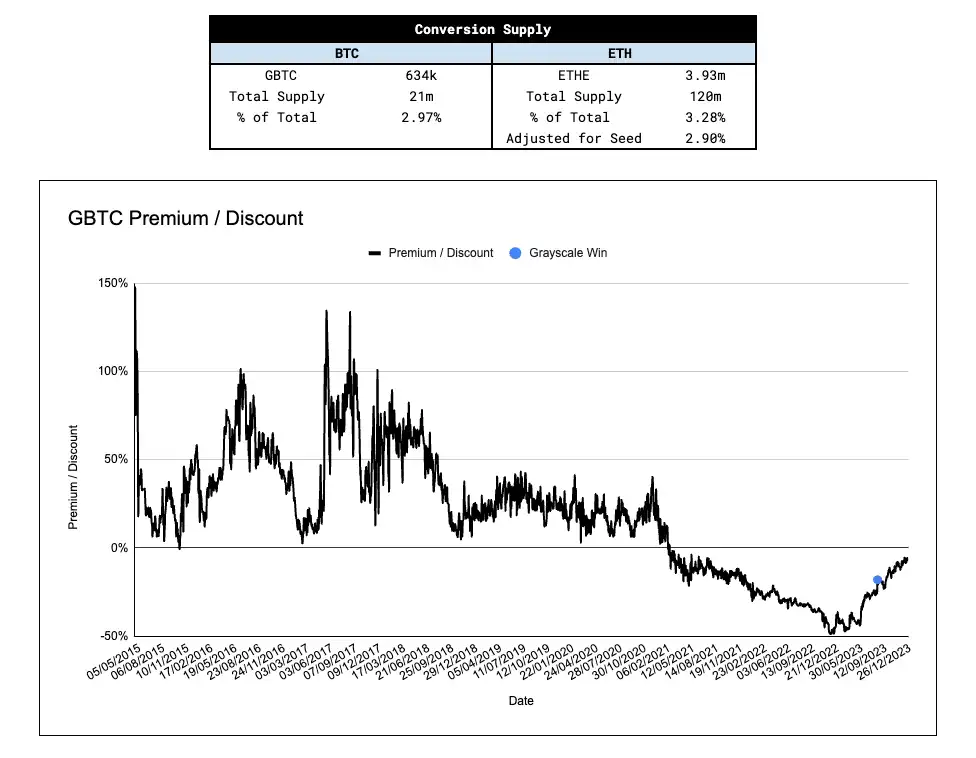

Given that the cause of GBTC outflows was the “sell the news” narrative, it is important to assess the potential for ETHE outflows. In order to simulate potential ETHE outflows and their impact on price, it is helpful to look at the percentage of ETH supply in the ETHE vehicle.

After adjusting for Grayscale mini seed capital (10% of ETHE AUM), ETHE is used as a vehicle where the supply of ETH as a percentage of total supply is similar to when GBTC was launched. While it is not clear how much of the GBTC outflows are turnover vs. exits, if we assume that the proportion of turnover vs. exits is similar, then the impact of ETHE outflows on price will also be similar to GBTC outflows.

Another key piece of information that most people overlook is ETHE's premium/discount to Net Asset Value (NAV). ETHE has been trading within 2% of NAV since May 24th - while GBTC first traded within 2% of NAV on January 22nd, just 11 days after GBTC converted to an ETF. The approval of the spot BTC ETF and its impact on GBTC is gradually being priced in by the market, and the situation of ETHE trading at a discount to NAV has been more clearly communicated through GBTC. By the time the ETH ETF goes live, ETHE holders will have 2 months to exit ETHE at close to NAV. This is a key factor that will help curb outflows from ETHE, especially direct outflows from the market.

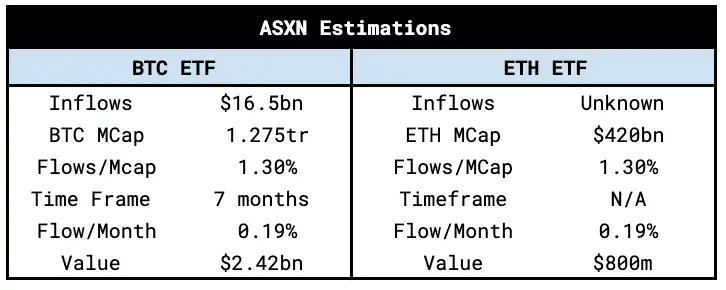

On ASXN, our internal estimate is between $0.8 billion and $1.2 billion in monthly inflows. This is calculated by taking the market cap weighted average of monthly inflows into Bitcoin and adjusting for Ethereum’s market cap.

Our estimate is supported by global crypto ETP data which suggests that market cap weighted baskets are the dominant strategy (we may see a similar strategy adopted by the rotation flow of the BTC ETF). Additionally, we are open to potential upside surprises due to ETHE trading at par prior to launch and the introduction of mini trusts.

Our ETF inflow estimates are proportional to their respective market caps, so the impact on price should be similar. However, one also needs to assess how much of the asset is liquid and ready to sell - assuming that the smaller the “float”, the more sensitive the price will be to inflows. There are two specific factors that influence ETH's liquid supply, namely native staking and supply in smart contracts. As a result, there is less liquid and sellable ETH than BTC, making it more sensitive to ETF flows. However, it is important to note that the liquidity gap between the two assets is not as large as some have suggested (ETH's cumulative +-2% order book depth is 80% of BTC's).

Our estimate of liquid supply is as follows:

As we approach ETF launches, it is important to understand Ethereum's reflexivity. The mechanism is similar to BTC, but Ethereum's burn mechanism and the DeFi ecosystem built on it make the feedback loop more powerful. The reflexive cycle goes something like this:

ETH flows into ETH ETF → ETH price increases → increased interest in ETH → increased DeFi/chain usage → improved DeFi fundamentals → increased EIP-1559 burn → reduced ETH supply → increased ETH price → more ETH flows into ETH ETF → increased interest in ETH → …

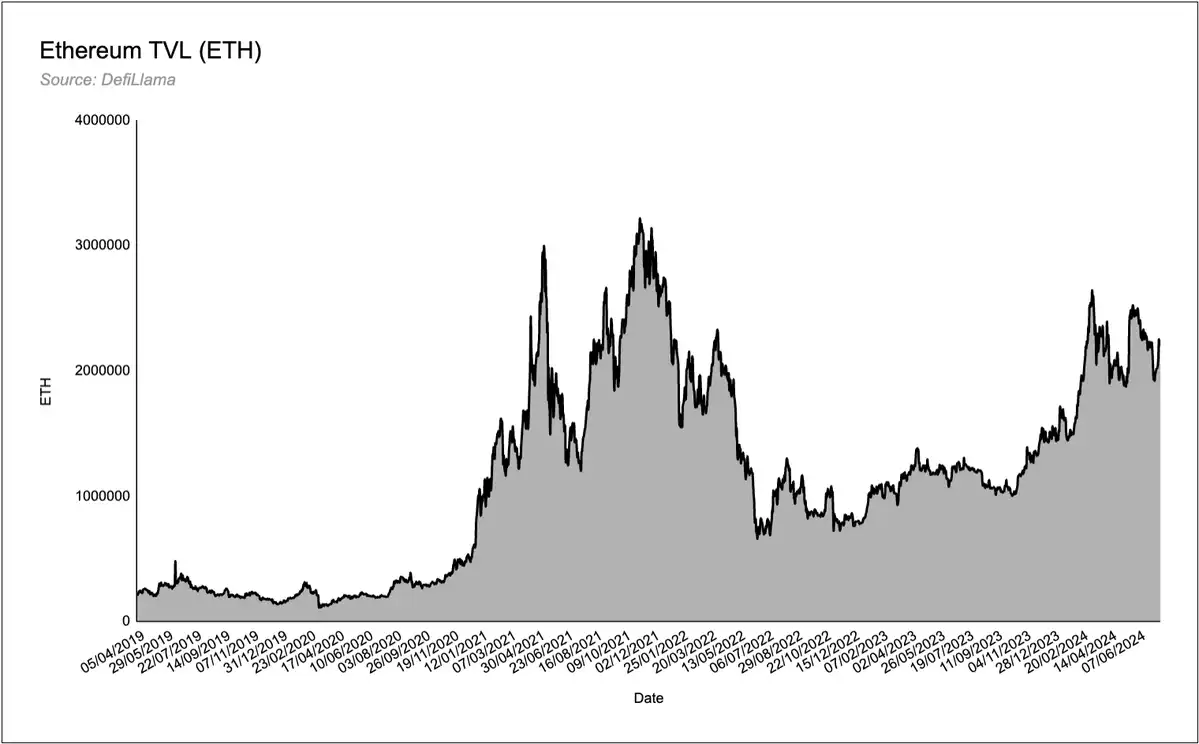

An important factor missing from the BTC ETF is the “wealth effect” of the ecosystem. In the emerging Bitcoin ecosystem, we don’t see a lot of gains being reinvested into base layer projects or protocols, despite some small interest in ordinals and inscriptions. Ethereum, as a “decentralized app store”, has an entire ecosystem that will benefit from continued inflows into the base asset. We believe that this wealth effect has not received enough attention, especially in the DeFi space. There is 20M ETH ($63B) of total value locked (TVL) in Ethereum DeFi protocols, and as ETH price rises, ETH DeFi becomes more attractive as TVL and revenue in USD surge. ETH has a reflexivity that does not exist in the Bitcoin ecosystem.

Other factors to consider:

What will the rotation flow from BTC ETF to ETH ETF look like? Assume that there is a portion of BTC ETF investors who are unwilling to increase their net crypto exposure but want to diversify. In particular, traditional finance (TradFi) investors prefer market capitalization weighted strategies.

How well does traditional finance understand ETH as an asset and Ethereum as a smart contract platform? Bitcoin's "digital gold" narrative is both simple and well-known. How well is Ethereum's narrative (such as the settlement layer of the digital economy, the three-point asset theory, tokenization, etc.) understood?

How will previous market conditions affect ETH's flow and price trend?

Decision makers in traditional finance have chosen two crypto assets to connect their worlds - Bitcoin and Ethereum. These assets have become mainstream. How the introduction of spot ETFs changes how traditional finance capital allocators think about ETH, given that they are now able to offer a product that can charge fees. Traditional finance's desire for yield makes Ethereum's native yield through staking a very attractive proposition, and we believe that staking ETH ETFs is a matter of time, not a question of if. Providers can offer zero-fee products and simply stake ETH in the background to earn returns that are an order of magnitude higher than a normal ETH ETF.

Original link

欢迎加入律动 BlockBeats 官方社群:

Telegram 订阅群: https://t.me/theblockbeats

Telegram 交流群: https://t.me/BlockBeats_App

Twitter 官方账号: https://twitter.com/BlockBeatsAsia

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple Agrees to Settle SEC Lawsuit Over XRP Sales

Zerebro Founder Surfaces; Suicide Staged

Ethereum Foundation Allocates $32.65M for L2 and Education

Bitcoin Options Expiry Anticipates Market Volatility