Bitcoin–Another All-Time High Attempt Before Going Parabolic?

Institutional Crypto Research Written by Experts

👇1-10) This week is packed with potential market-moving events. Rumors are rife that the SEC may settle a major case, and former President Trump is set to deliver a highly anticipated speech in Nashville. Speculation is high that he will announce Bitcoin as a strategic reserve asset, which could trigger a parabolic rise in Bitcoin's price.

👇2-10) With Joe Biden dropping out of the US Presidential race, no credible candidate can seriously challenge Donald Trump. The November election appears to have been decided without a single vote. For Bitcoin, a pro-crypto administration will enter the White House. Historically, this meant that the SEC chair resigned when a new administration was elected, despite SEC Chair Gensler’s term ending on June 5, 2026. He will most likely resign by January/February 2025.

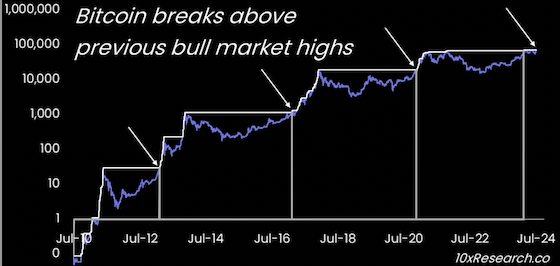

Bitcoin tended to rise parabolically once above previous all-time highs.

👇3-10) Previous examples are: Appointed by President Obama, Mary Jo White served as SEC Chair from April 2013 to January 2017. She resigned in November 2016 after Trump was elected, marking the shift from a Democratic to a Republican administration. President George W. Bush appointed Christopher Cox as SEC Chair from August 2005 to January 2009. He resigned as Obama took office, transitioning from a Republican to a Democratic administration. Appointed by President George W. Bush, Harvey Pitt served from August 2001 to November 2002. Pitt resigned shortly after the 2002 midterm elections amid political pressure.

👇4-10) Multiple reports and rumors have suggested that former President Donald Trump might announce Bitcoin as a strategic reserve asset for the U.S. during his speech at the Bitcoin 2024 conference in Nashville (July 27, at 2 p.m.). Vivek Ramaswamy and Senator Cynthia Lummis have advocated integrating Bitcoin into the U.S. financial system as a strategic reserve. They argue that Bitcoin's decentralized nature and increasing global acceptance could enhance economic resilience and stability.

👇5-10) If Trump announced that Bitcoin would play a much larger role within the US financial reserve management, then the US Treasury would be on board, which would have large implications for the crypto industry. With Blackrock’s Larry Fink and JP Morgan’s Jamie Dimon being floated as Trump’s favorite Treasury Secretary candidates and a potential shift in SEC leadership, the US crypto landscape might change dramatically.

👇6-10) It remains to be seen how much of this shift would be implemented compared to an election vote (and campaign funding) exercise, but the burden of proof is many months, if not years, away. Until then, the Bitcoin community can assume that the political tailwinds can continue to support the price of Bitcoin. Traders should aim to position themselves for a breakout.

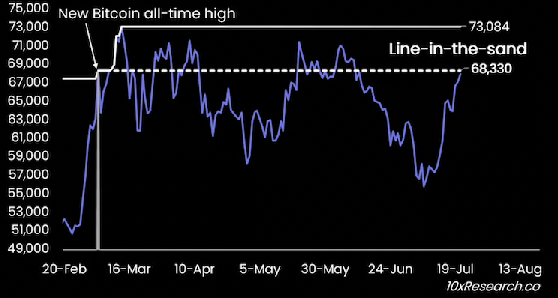

👇7-10) Taking profit, or even shorting Bitcoin ahead of Trump’s Nashville speech, could turn out to be an expensive exercise, especially as Bitcoin is once again trading near the previous bull market’s all-time high (68,300), defined as the line in the sand and which Bitcoin would successfully trade above if a parabolic move would occur as happened after new bull markets successfully closed above the highs of the previous bull market.

👇8-10) The U.S. government currently holds approximately 212,847 Bitcoins, valued at around $15 billion, a fraction of its gold reserves, which total approximately 261.5 million troy ounces, valued at about $600 billion. Doubling those Bitcoin holdings ($15bn) is nearly equivalent to the $16bn of net Bitcoin Spot ETF inflows year-to-date but would undoubtedly be even more influential from a signaling impact.

Bitcoin is once again challenging the 2021 previous all-time high.

👇9-10) Although the monthly technical indicators were exhausted when Bitcoin lost momentum above 70,000 in March, a break above the 68,300 line in the sand must be considered significant. Similarly, as the second leg in mid-2021, Bitcoin rallied to new all-time highs despite the technicals indicating a momentum peak already reached in April of that year.

👇10-10)Despite being a week full of other notable events, Trump’s Nashville speech will be essential. Those other events will be less critical, such as the Ethereum ETF launch on Tuesday (July 23) or the US GDP report on Thursday (July 25), which could print higher according to some ‘now forecasts’ indicating that the two Fed rate cuts might be ambitious. The Fed’s favorite inflation data point, PCE (July 26), could also be less critical than in previous months as CPI has already confirmed the drop in inflation. There is also a rumor that the Ripple Labs (XRP) vs. SEC case will announce a settlement this week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Surges 7%, Is the "Digital Gold" Narrative Back?

The US Dollar Index and US stocks are expected to face further downward pressure, while Bitcoin and Gold will become the go-to safe haven assets for mainstream funding

Circle Launches Stablecoin-Based Payment Network for Cross-Border Transfers

Near Protocol (NEAR) To Continue Rebound? Key Harmonic Pattern Signaling an Upside Move