US Bitcoin ETFs see record $17B in net inflows

The consistent inflows into Bitcoin spot ETFs signal a robust and growing demand for regulated Bitcoin investment vehicles.

In a landmark achievement, US Bitcoin spot exchange-traded funds (ETFs) have cumulatively netted over $17 billion in inflows, setting a new record.

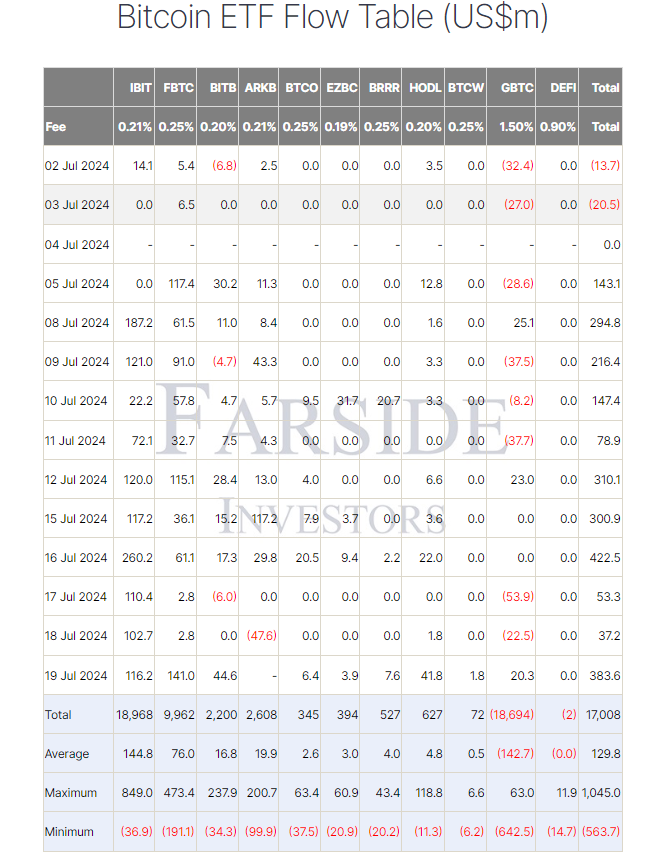

According to data monitored by Farside Investors, the net inflows were driven primarily by BlackRock's IBIT, which alone accumulated $18.968 billion. Fidelity’s FBTC also contributed significantly, with net inflows of $9.962 billion.

Record-breaking net inflows

Conversely, Grayscale’s GBTC experienced a substantial net outflow of $18.694 billion, highlighting a shifting preference among investors. On Wednesday, July 17, the 11 US spot Bitcoin ( BTC ) ETFs recorded a total daily net inflow of $53.35 million, marking the ninth consecutive day of positive inflows.

However, this figure was notably lower than the $422 million net inflow seen on Tuesday, July 16. Despite this, BlackRock's IBIT continued to lead , posting the most significant net inflows of the day at $110.37 million and achieving a trading volume of $1.21 billion.

Fidelity’s FBTC was the only other fund to report net inflows on July 17, adding $2.83 million. In contrast, Grayscale’s GBTC and Bitwise’s BITB faced net outflows of $53.86 million and $6 million, respectively. Seven other funds, including ARK Invest and 21Shares’ ARKB, reported zero flows for the day.

The total trade volume for US spot Bitcoin ( BTC ) funds on July 17 was $1.79 billion, a significant drop from March’s peak when daily volumes exceeded $8 billion. Before the current record high, these ETFs had amassed a total net inflow of $16.59 billion since their launch in January, reflecting steady investor interest despite fluctuations in daily inflows.

BlackRock's Bitcoin bet

This record-setting inflow highlights the increasing acceptance and integration of Bitcoin into mainstream investment portfolios. BlackRock's Bitcoin ( BTC ) holdings have surged above $20 billion in value, driven by the firm’s recent acquisition of 4,004 additional Bitcoin ( BTC ) and a 3% increase in Bitcoin’s ( BTC )price since the market closed on Monday.

The fund initially surpassed $20 billion in assets under management in late May, coinciding with Bitcoin’s ( BTC ) rapid ascent toward $70,000 , earning it the distinction of being the most prominent Bitcoin ( BTC ) ETF globally.

Bitcoin ( BTC ) is currently priced at $66,994, a 2.33% reduction from $65,470 on July 17 after it fell to a near five-month low of $53,600 on July 5.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin price hits 7-week high as Trump softens tone on trade war

Bitcoin’s price is still climbing following its Easter weekend rally, with several analysts calling recent macroeconomic events bullish for the market.

Research Report | Initia Project Details & INIT Market Cap Analysis

Shiba Inu Enters Accumulation Phase—Could SHIB 17X From Here?

Ethereum Reclaims $1,800 Amid Renewed Market Optimism

Ethereum breaks past $1,800, signaling bullish momentum and renewed confidence among crypto investors.What’s Fueling the Bullish Momentum?What’s Next for ETH?