The Scoop: Mixed sentiments and the evolving crypto market

The crypto market has felt strange recently — not quite bullish, yet not quite bearish. Is conference fatigue to blame?This column is adapted from The Scoop newsletter.

The crypto market has felt strange recently. It's not quite bullish, yet not quite bearish. Prices seem to be holding steady in the wake of the assassination attempt on former President Donald Trump.

That makes sense. Setting aside the political implications of this weekend’s event, which is beyond our scope, there are clear market implications. Trump's survival after being shot at significantly boosts his image and, consequently, his election odds. As discussed last week , a Trump win is bullish for crypto and is part of the 2024 Trump Trade.

Still, sentiment feels bearish. Even on Twitter, following ETHCC, people don’t seem very convinced that coins will perform well in the short to medium term.

Starting with a quick thought, two tweets from ETHCC resonated with Laura throughout the weekend, capturing some aspects of the current state of the industry. The first tweet is by Jack Purdy, Director of Sales at Messari, who said people in crypto don’t realize how lucky they are:

Yet, conference fatigue is real. Maybe crypto is overly focused on meetings rather than building. However, to play devil's advocate, the number of conferences in the crypto industry makes sense. The industry is nascent and disparate. Unlike other industries, especially before the pandemic, crypto isn't localized in one hub or city. Therefore, chains need to cross the globe to promote, pitch, and strike deals.

You might like or dislike a city, but it shouldn’t deter you from attending a conference where the main purpose is to learn or do business. Even though Brussels might not be the best city we’ve visited, it fulfilled its purpose: discussing world-changing tech that can create generational wealth and potentially generational-changing technology. While the location is important from a travel perspective (how long will it take to get there? Is it visa-friendly?), it shouldn’t be the primary factor in deciding whether to attend a conference. Define your own metrics. It’s fair to acknowledge that location will attract different audiences.

Brussels was ideal for community and developers, while larger, more expensive cities tend to attract institutions and larger capital allocators. When Laura was in consulting, she had to travel to remote locations in New Jersey, and she would take Brussels over that any day. The second tweet, which is most reflective of this cycle, is from Maggie Love, founder of SheFi:

In line with this tweet, it makes us feel a little nostalgic for the years 2018 to 2020 when the industry was much smaller. We had monthly meetups where people gathered to eat pizza, discuss ideas, challenge each other, and leave with new knowledge and friendships. But this new dynamic speaks to the reality of the industry today, where there are more chains — more chains that people take seriously, at least. And that translates into what we would describe as the ongoing BD (business development) wars between the chains — many of whom have recently raised multi-billion dollar clips. It’s much harder to have fun, light-spirited meet-ups when you are all competing for the same multi-million dollar business deals from firms like LG and JPMorgan.

While Frank was in Italy and Laura didn’t attend the main event, she participated in many side events and summits, and most people shared this sentiment. There were bright spots, however. The RWA Summit, in particular, stood out for its excellent organization and its focus on collaboration among builders with a shared mission. These builders are creating products with both crypto and non-crypto partners, many of which are already revenue-generating companies.

Each cycle is different, bringing in new players, behaviors, and ideas. In our opinion, the best way to measure progress is by how much we learn and carry from one cycle to the next. Still, we’ve come a long way. For instance, many people who had little to no access to banking services now have access and can hedge against their local inflationary currency.

Earlier this week, Laura was speaking with Rob Hadick, General Partner at Dragonfly, and he brought a perspective that is worth sharing, highlighting some challenges of the current cycle:

“Broadly, it's clear that there is some burnout across the industry as protocols and those who work at them often feel the pressure to react to public token prices, which are extremely volatile. The things they are building are so complex, and the problems they are addressing are so immense that they take significant amounts of time to achieve their goals and visions. It creates misalignment on how people feel about what they are building vs. how the market is reacting, and requires lots of pre-PMF GTM games.”

Rob also emphasizes the importance of looking at the bigger picture:

“If you zoom out, there is a significant amount of innovation being done in things like scalability, shared security, chain abstraction, tokenization, decentralized infrastructure, cryptography, etc. These are exciting developments, but the early liquid tokens don't allow the teams to focus solely on building for the future and end up creating a PvP GTM culture long before they are ready for that.”

See you at the next conference, friends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arweave (AR) Breaks $7.85, Eyes 100% Surge Toward $15 Target

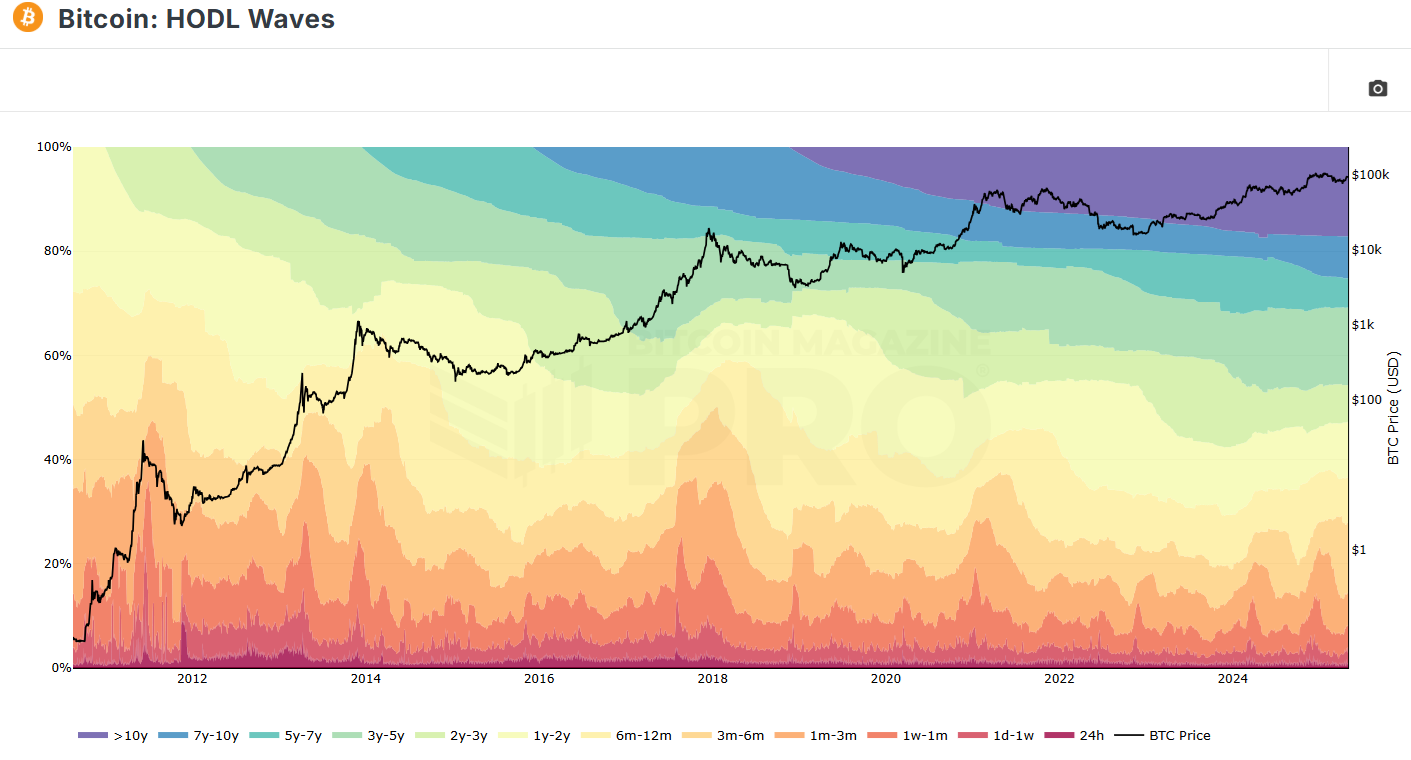

BTC Market Share Rises 88% from 2022 Low, Eyes Critical Compression Level

XRP Breaks at $2.20: Here’s What Traders Must Watch for a Breakout

Long-term BTC holders are back in accumulation mode

Share link:In this post: The period of capitulation and spot selling has ended, and almost all wallet cohorts either hold or accumulate. 87.6% of the BTC supply is in profit, as the coin consolidates around $97,000. Short term buyers are in the money, feeling less pressure for wallets aged less than one month.