Inflows to US Bitcoin ETFs Decline

After the U.S.-based spot Bitcoin ETFs recorded two trading days with a higher net income of $200 million this week, they continued the positive streak on July 11, but more modestly.

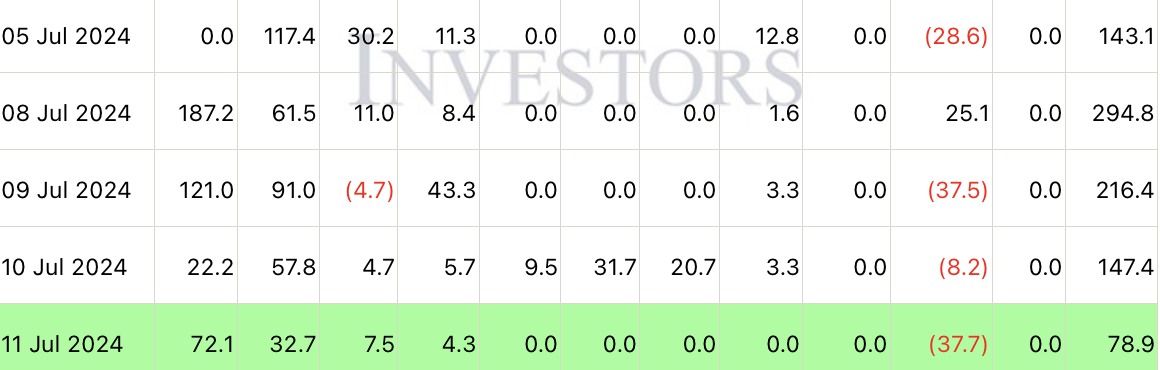

Registering $295 million on July 8, $216 million the day after and $147 million on July 10 , yesterday all-U.S. ETFs attracted just $78.9 million.

On July 11, BlackRock’s ETF, the iShares Bitcoin Trust, attracted $72.1 million, and Fidelity’s Wise Origin Bitcoin Fund followed with $32.7 million.

Bitwise’s BITB ranked third with inflows of just $7.5 million. In total, all U.S. spot Bitcoin exchange-traded funds attracted $78.9 million on the day.

READ MORE:

Crypto market Faces Uncertainty Amid Rate Cut Speculation and Upcoming PayoutsAlthough the last four trading days saw positive overall results – Grayscale Bitcoin Trust (GBTC) again registered outflows of $37.7 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MANTRA Co-Creation: OM token destruction plan will be announced soon

End to Bitcoin’s Price Volatility: Are ETFs the New Stable Investors?

Exploring the Impact of ETFs Buoying Bitcoin and Potential for an $80K Breakout amidst Reduced Market Volatility