US Bitcoin ETF’s Continued With Positive Results on 10 July

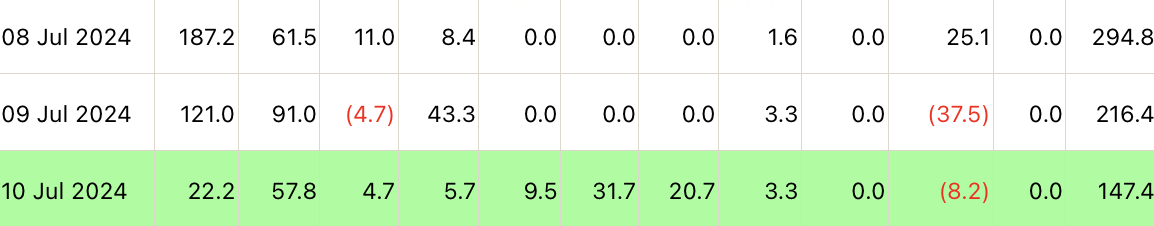

The U.S. spot Bitcoin exchange traded fund (ETF) sector doesn't seem to be losing confidence in the asset, as it posted positive results again on June 10, registering total inflows of $147.4 million.

Leading financial institutions this time were Franklin Templeton (EZBC) and Fidelity (FBTC) with $31.7 million and $57.8 million, respectively.

They are followed by BlackRock’s IBTC with $22.2 million, which still reflects a decline given that this ETF attracted $121 million on July 9.

Also on July 8, IBTC registered an impressive daily inflow of $187.2 million, helping to bring the total for all U.S. spot ETFs to $294 million for the day, registering its strongest day of net inflows in more than a month.

READ MORE:

Cathie Wood Discusses Bitcoin’s Current Bull Cycle and ETF ProspectsGrayscale’s ETF was the only participant to see negative results over the same time period, registering outflows of $8.2 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Price Could Influence Potential Altcoin Recovery Amid Emerging Market Phase

Pepe (PEPE) To Bounce Back? Key Fractal Hints Potential Upside Move

Best Crypto Coins to Buy: Arctic Pablo Coin, Just A Chill Guy, Goatseus Maximus

Key Market Intelligence on June 19th, how much did you miss out on?

1. On-chain Funds: $7M Flows into Avalanche; $13.3M Flows out of Ethereum 2. Largest Price Swings: $RAY, $SPX 3. Top News: JD.com: Expects to Obtain License in Early Q4 This Year and Launch JD Stablecoin Issued on a Public Blockchain