2024 Q2 Crypto Market Report: Ethereum ETF is expected to bring a large amount of incremental funds, and TON ecosystem has grown significantly

Original title: "D11 Labs 2024 Q2 Cryptocurrency Market Insight and Investment Strategy Report"

Original source: D11 Labs

I. Overview of the U.S. Macroeconomy

In the second quarter of 2024, the U.S. economy showed a clear trend of shifting from high inflation and high growth to low inflation and low growth. During this transition, we observed five major macroeconomic trends: continued easing of inflationary pressures, signs of cooling in the job market, a weak real estate market, declining consumer confidence, and stronger expectations of a shift in monetary policy. These trends are interrelated and together shape the overall outlook of the current U.S. economy, while also providing important clues to future economic trends.

II. Detailed analysis of major economic trends

1. Inflationary pressure continues to ease

Key data

• The core PCE price index rose 2.6% year-on-year in May, the lowest level in three years

• The core PCE price index rose only 0.1% month-on-month in May, the lowest point since December 2023

In-depth analysis

The continued easing of inflationary pressure is one of the most notable features of the current US economy. As the inflation indicator favored by the Federal Reserve, the core PCE price index has both lower year-on-year and month-on-month data, which clearly reflects the weakening of price pressure. The formation of this trend is mainly due to the following aspects:

1. The lag effect of the Fed's continuous interest rate hike policy:The impact of the continuous interest rate hike cycle that began in March 2022 has finally been fully manifested in the economic system. The high interest rate environment suppresses total demand, thereby easing inflationary pressure.

2. The gradual easing of supply chain problems:In the later period of the COVID-19 pandemic, the global supply chain continued to repair, and production and logistics bottlenecks were gradually eliminated, which directly eased the price pressure on the supply side.

3. Weakening demand-side pressure:With the slowdown in economic growth, the slowdown in consumer spending growth, and the decline in corporate investment willingness, the overall demand pressure has eased, which has also suppressed price increases to a certain extent.

The easing of inflationary pressure is undoubtedly a positive signal. It not only eases the cost of living pressure on consumers, but also provides greater room for the Fed's future monetary policy adjustments. However, we also need to be wary of the deflationary risks that may be brought about by a too rapid decline in inflation, as well as the potential negative impact on economic growth.

2. Signs of cooling in the job market

Key data

• The number of people continuing to apply for unemployment benefits in the week ended June 15 reached 1.839 million, the highest level since the end of 2021

• The ADP employment report showed that private sector job growth slowed significantly in May

In-depth analysis

The cooling of the job market is a direct reflection of the slowdown in economic growth. The emergence of this trend is mainly affected by the following factors:

a. Slowing economic growth: As economic activity weakens, companies' demand for labor declines. This phenomenon is particularly evident in industries with strong cyclicality.

b. Rising interest rates inhibit corporate expansion: The high interest rate environment increases companies' financing costs, inhibits investment and expansion plans, and thus affects recruitment demand.

c. Layoffs in industries such as technology and finance: These industries are often more sensitive to changes in the economic cycle and have taken the lead in taking layoffs to control costs amid uncertain economic prospects.

Although the cooling of the job market may cause social concern and economic worries in the short term, in the long run, moderate labor market easing will help ease the pressure of wage increases, which will in turn be conducive to a further decline in inflation. However, policymakers need to pay close attention to changes in the job market to prevent the socioeconomic risks that may arise from a too rapid rise in the unemployment rate.

3. Weak real estate market

Key data

• New home sales in May were 619,000 units on an annualized basis, the lowest since November last year and a sharp drop of 11.3% month-on-month

• The supply of new homes for sale in May increased to 481,000 units, the highest level since 2008

In-depth analysis

The weakness of the real estate market is another important feature of the current economic environment. This trend is mainly affected by the following factors:

a. High interest rate environment: The Federal Reserve’s interest rate hike policy directly pushed up mortgage rates, significantly increased the cost of buying a house, and suppressed the demand for buying a house.

b. High housing prices: Although the growth rate of housing prices has slowed down recently, the absolute price level is still high, which affects the purchasing power and willingness of home buyers.

c. Uncertain economic outlook: The cooling of the job market and the expectation of slower economic growth have increased the cautious mood of potential home buyers and delayed their home purchase decisions.

The weakness of the real estate market not only directly affects the construction industry and related industries, but also affects consumer spending through the wealth effect, which drags down overall economic growth. However, in the long run, the adjustment of the real estate market will help correct the bubbles that may have existed before and promote the market to return to rationality. Policymakers need to find a balance between stimulating the real estate market and preventing systemic risks.

4. Decline in consumer confidence

Key data

• The Conference Board Consumer Confidence Index fell in June

• Only 12.5% of respondents expect business conditions to improve in the next six months, the lowest since 2011

In-depth analysis

The decline in consumer confidence reflects the public's growing concerns about the economic outlook. The formation of this sentiment is mainly influenced by the following factors:

a. Continued inflationary pressure: Although the inflation rate has declined, the price level is still higher than before the epidemic, which continues to erode consumers' purchasing power.

b. Increased uncertainty in the job market: Signs of cooling in the job market have increased people's concerns about future income and employment stability.

c. Rising concerns about a recession: As various economic indicators weaken, the market has increasingly discussed that the economy may fall into a recession, affecting consumer confidence.

The decline in consumer confidence may lead to a contraction in consumer spending, which in turn affects economic growth. Given the important position of consumption in the US GDP, this trend deserves the attention of policymakers. Boosting consumer confidence may require efforts in multiple aspects, such as stabilizing employment, controlling inflation, and stimulating economic growth.

5. Expectations of a shift in monetary policy have increased

Key information

• Fed officials expect a possible rate cut before the end of the year

• The market expects a rate cut to begin in September

In-depth analysis

The increased expectations of a shift in monetary policy reflect the market’s judgment on the economic outlook and expectations of the Fed’s policies. This expectation is mainly based on the following considerations:

a. Inflation data continues to improve: The continued decline in inflation indicators such as core PCE has created conditions for the Fed to adjust its monetary policy.

b. Weakened economic growth momentum: Various economic indicators show that economic growth is slowing, which may require more relaxed monetary policy to support.

c. Signs of cooling in the job market: Weaker employment data could prompt the Fed to focus more on employment in its dual mandate of price stability and full employment.

The expectation of a shift in monetary policy could itself have an impact on the economy, for example by affecting investment and consumption decisions through its impact on long-term interest rates and asset prices. However, the Fed still needs to be cautious in adjusting its policy to prevent a rebound in inflation or the emergence of financial stability issues.

III. Comprehensive Assessment and Outlook

Looking at the U.S. economy in the second quarter of 2024, we can see an economy undergoing structural adjustments. The easing of inflationary pressures is undoubtedly a positive sign, but the weakening momentum of economic growth, the cooling of the job market, the weakness of the real estate market, and the decline in consumer confidence all indicate that the economy is facing new challenges.

This change in the macroeconomic environment is pushing the Fed's monetary policy to shift from tightening to neutral or even easing. However, the challenge facing policymakers is to find a balance between controlling inflation and maintaining economic growth. A too-rapid policy shift could trigger a rebound in inflation, while too-slow action could exacerbate downward pressure on the economy.

Looking ahead, the direction of the U.S. economy will largely depend on the following key factors:

a. Inflation: If inflation can continue to fall back to the Fed's target level, it will create room for a more relaxed monetary policy.

b. Job market: Whether the job market can remain relatively stable while the economy slows will directly affect consumer confidence and overall economic performance.

c. Global economic environment: Given the close connection between the U.S. economy and the global economy, the extent of the global economic recovery will have an important impact on the U.S. economy.

d. Fiscal policy direction: With the narrowing of monetary policy space, the role of fiscal policy may become more prominent.

e. Geopolitical risks: Changes in the global geopolitical situation may have an impact on trade, investment and energy prices, and thus affect the US economy.

Fourth, trends in the cryptocurrency industry

Main development trends and events in the cryptocurrency industry in the second quarter of 2024. We focused on the approval progress of the spot Ethereum ETF, the dynamics of cryptocurrency policy supervision, the development of the Memecoin project in the Solana ecosystem, the activeness of cryptocurrency market financing transactions, and the research on the Ton ecosystem. By analyzing these key areas, we aim to provide industry participants and investors with comprehensive and in-depth market insights.

1. Approval progress of spot Ethereum ETF

The approval process of spot Ethereum ETF has made significant progress this quarter, with multiple signs that the U.S. Securities and Exchange Commission (SEC) may be close to approving this important financial product.

Key developments:

a. SEC accelerates approval process: The SEC requires spot Ethereum ETF applicants to speed up the update of 19b-4 documents, a move that is widely interpreted by the market as a signal that the SEC may soon approve spot Ethereum ETFs. This sense of urgency indicates that regulators are actively advancing the approval process and making final preparations for possible approval.

b. Applicants respond positively: Several spot Ethereum ETF applicants have submitted revised 19b-4 documents. This rapid response shows the applicants' strong desire to obtain approval, and also reflects their active communication and cooperation with regulators.

c. S-1 filing modification is nearing completion: The submission modification of the S-1 filing has entered the final stage. This means that key contents such as the structure, operational details and risk disclosure of the ETF have been basically determined, paving the way for final approval.

d. Potential impact of legal challenges: Financial giants such as JPMorgan Chase believe that if the SEC refuses to approve the spot Ethereum ETF, it may face legal challenges. This view increases the possibility of SEC approval because regulators may want to avoid potential legal disputes, especially in the context of having approved the Bitcoin spot ETF.

Impact analysis:

The approval of the spot Ethereum ETF will have a profound impact on the cryptocurrency market:

• Improved market liquidity: The launch of the ETF will provide institutional investors with a regulated, low-risk Ethereum investment channel, which is expected to bring in a large amount of new capital inflows.

• Increased price stability: As market depth increases, the volatility of Ethereum prices may decrease, which is conducive to consolidating its position as a long-term investment asset.

• Industry legitimacy improvement: The approval of ETFs will further enhance Ethereum's position in the traditional financial system and enhance the legitimacy and credibility of the entire cryptocurrency industry.

• Development of the derivatives market: Various financial derivatives based on ETFs may emerge, further enriching Ethereum-related investment tools.

2. Cryptocurrency Policy and Regulatory Dynamics

This quarter, cryptocurrency policy and regulation around the world showed a clear trend of change, especially in the United States, where we observed a series of important legislative and policy adjustments.

Main events and impacts:

a. Passage of the 21st Century Financial Innovation and Technology Act:

- The U.S. House of Representatives passed this important bill, which aims to establish a regulatory framework for digital assets.

- Impact: This marks the beginning of the U.S. government's formal recognition and regulation of the cryptocurrency industry, providing clearer legal guidance for the development of the industry.

- Long-term effects: It is expected to reduce regulatory uncertainty, encourage more institutions to participate in the crypto market, and promote industry innovation.

b. SEC Crypto Asset Accounting Regulation SAB 121 Overturned:

- The U.S. Senate voted to overturn the SEC's SAB 121 regulation.

- Background: SAB 121 requires cryptocurrency custodians to record customer assets as liabilities, which increases the financial burden on institutions.

- Impact: This decision will reduce the cost of cryptocurrency custody services and may stimulate more financial institutions to provide related services.

- Market reaction: It is expected to enhance the overall liquidity and institutional participation in the cryptocurrency market.

c. Political attitude change:

- Former U.S. President Trump said he would stop being hostile to cryptocurrencies and embrace cryptocurrencies.

- Significance: This reflects a potential shift in the attitude of the U.S. political elite towards cryptocurrencies.

- Potential impact: It may affect future policy making and create a more favorable political environment for the cryptocurrency industry.

d. Canada strengthens tax supervision:

- The Canada Revenue Agency announced that it would strengthen the fight against virtual asset tax evasion.

- Trend: It shows that there is increasing attention to cryptocurrency tax supervision around the world.

- Impact: It may lead other countries to follow suit and strengthen tax management of cryptocurrency transactions.

Comprehensive analysis:

These policy changes reflect the trend that cryptocurrencies are gradually integrating into the mainstream financial system. On the one hand, the improvement of the regulatory framework provides clearer guidance for the development of the industry, and on the other hand, it also means that industry participants need to pay more attention to compliance. In the long run, these changes are expected to enhance the stability and credibility of the cryptocurrency market and attract more institutional investors to participate.

3. Development of Memecoin Project in Solana Ecosystem

The explosive growth of Memecoin projects in the Solana ecosystem has become a highlight of the cryptocurrency market this quarter, attracting widespread attention and discussion.

Key Data and Trends:

a. Surge in Token Issuance:

- Nearly 500,000 new tokens are launched on the Solana network every month, most of which are Memecoin.

- This number far exceeds other mainstream blockchain platforms, reflecting Solana's advantages and attractiveness in token issuance.

b. Meme coin issuance platforms have significant revenue:

- The monthly revenue of Meme coin issuance platforms such as Pump.fun has exceeded that of the famous DEX Uniswap Labs.

- This phenomenon reflects the huge size and activity of the Memecoin market.

In-depth analysis:

a. Driven by technical advantages:

- Solana's high throughput and low transaction fees provide an ideal environment for the rapid creation and trading of Memecoin.

- This technical advantage allows small investors to participate in the Memecoin market, lowering the market entry threshold.

b. Community-driven innovation:

- The prosperity of Memecoin reflects the creativity and participation of the cryptocurrency community.

- This phenomenon reflects the essence of decentralized finance (DeFi): users can freely create and trade assets without traditional financial intermediaries.

c. Market Risks and Regulatory Challenges:

- The rapid growth of the Memecoin market also brings bubble risks and potential regulatory challenges.

- The emergence of a large number of low-quality or fraudulent tokens may harm investors' interests and attract the attention of regulators.

d. Impact on the Solana Ecosystem:

- The Memecoin craze has increased the usage and popularity of the Solana network.

- However, over-reliance on Memecoin may distract attention from other more substantial applications.

e. Long-term sustainability issues:

- The long-term sustainability of the Memecoin market is worth paying attention to, and its development model may need to evolve to remain vibrant.

- We may see more Memecoin projects with practical uses or innovative concepts emerge in the future.

Outlook:

While the Memecoin craze demonstrates the vitality and innovative potential of the cryptocurrency market, we also need to be wary of the risks involved. In the future, we may see more standardized and innovative Memecoin projects emerge, as well as the introduction of relevant regulatory measures. The Solana ecosystem needs to find a balance between maintaining innovative vitality and managing risks to achieve long-term healthy development.

4. Cryptocurrency market financing transactions are active

In the second quarter of 2024, the financing activities in the cryptocurrency market showed obvious signs of recovery, especially in the venture capital (VC) sector. This trend not only reflects the recovery of market confidence, but also reveals investors' strong interest in certain segments. However, there is a time lag in the announcement of financing news, so it can only represent the financing situation in the first quarter and last year.

Main observations:

a. Rebound in financing scale:

- The financing scale of the digital asset industry has rebounded significantly, indicating that investors remain optimistic about the long-term prospects of the cryptocurrency market.

- This trend echoes the recovery of the overall cryptocurrency market, reflecting that capital's confidence in the industry is recovering.

Because there is a time lag in the announcement of financing news, it can only represent the financing situation in the first quarter and last year.

b. VC Focus:

- Venture capital institutions are beginning to pay more attention to crypto projects founded by scholars.

- This trend shows that investors are looking for projects with deep technical backgrounds and academic support to reduce investment risks and increase potential returns.

Analysis of key investment areas:

a. AI track:

- A large number of projects in the current market are concentrated in the fields of decentralized computing power, zkML (zero-knowledge machine learning) and GPU computing power aggregation.

- Challenges:

* Aggregated GPU resources vary in quality.

* Network bandwidth limitations affect real computing power aggregation.

* High-end graphics card resources (such as B100) are monopolized by leading companies and countries, limiting the development of decentralized AI reasoning.

- Development Direction:

* Use AI technology to lower the user threshold.

* Explore innovative combinations of tokens and AI applications.

b. DePIN (Decentralized Physical Infrastructure Network):

- Main Challenges: How to effectively incentivize resource providers and how to use mathematical methods to verify the work of resource providers.

- Case study: IO.NET was attacked by hackers using fake hardware information, highlighting the security challenges faced by the DePIN project.

c. Restaking:

- The current trend is to copy EigenLayer's AVS (Actively Validated

Services) and staking models to various blockchains.

- This reflects the market's demand for improved asset efficiency and network security.

d. Infrastructure:

- The Layer2 narrative and modular narrative have come to an end.

- Parallelized EVM (Ethereum Virtual Machine) has become a new hot spot, but there is a risk of overvaluation.

- After the launch of EIP 4844 of ETH 2.0, the overall Gas fee dropped significantly, but the growth of on-chain activities did not meet expectations.

- Future development: The infrastructure track has entered the end of the cycle and needs to find new application growth points.

e. Chain abstraction:

- Goal: Manage all Layer2 accounts through a single Rollup to solve the problem of account fragmentation.

- This trend reflects the market's demand for improving user experience and cross-chain interoperability.

Analysis and Outlook of Investment Trends:

a. Technology-oriented: Investors prefer projects with strong technical backgrounds, especially those solutions that can solve practical problems or improve efficiency.

b. Cross-domain integration: The combination of AI and blockchain has become a hot topic and is expected to continue to attract a lot of investment.

c. Infrastructure optimization: Although infrastructure investment may have passed the boom, projects that optimize existing solutions still have the opportunity to obtain funds.

d. User experience is king: Projects that can simplify user operations and improve usability (such as chain abstraction) may become the next wave of investment hotspots.

e. Increased risk awareness: Investors pay more attention to the security and sustainability of projects. The wave of pure narrative reconstruction has passed, and they pay more attention to cash flow and the growth of application traffic.

V. TON Ecosystem Research

Another hot track that also requires our attention is the development of the Telegram messaging platform and the TON (The Open Network) ecosystem. We explored the rapid growth of Telegram's user base, especially in the Indian market, and examined emerging opportunities within the TON ecosystem. The report focuses on key trends in decentralized finance (DeFi), games, and social applications, providing insights into areas of innovation and investment potential.

1. Telegram's market penetration and user growth

1.1 Dominance in the Indian market

Telegram has experienced significant growth in the Indian market, consolidating its position as the country with the largest user base for the platform:

• India had nearly 87 million monthly active users from January to April 2022.

• India recorded around 70 million app installations between June and August 2022.

• By 2023, Telegram had been downloaded 70.48 million times in India.

These data highlight India’s key role in Telegram’s global expansion strategy, underscoring the platform’s strong appeal in emerging markets.

1.2 Global User Base and Engagement

With over 800 million active users, Telegram has established a major position in the global messaging app market. This large user base spans diverse age groups and interests, providing rich opportunities for developers and businesses.

2. TON Ecosystem: Growth and Opportunities

2.1 DeFi Sector Performance

The TON ecosystem witnessed significant growth in its decentralized finance (DeFi) sector in Q1, laying the foundation for continued expansion in Q2:

• Total value locked (TVL) grew 7x, driven primarily by increased DEX activity and the market dominance of the Tonstakers liquid staking protocol.

• DEX became the best performing DeFi sector on TON, benefiting from a surge in Meme token trading volume and the launch of yield farming pools through The Open League program.

2.2 Surge in Token-Based Activity

The ecosystem has experienced significant growth in token-based related activity:

• Total trading volume on DEXs on TON hit an all-time high of $4.2 million in 90 days, subsequently surpassing $60 million, according to Tonalytica.

• DeDust and STON.fi became the leading venues for liquidity pools launched through The Open League, driving TON’s TVL to increase by more than 9x.

2.3 Liquid Staking Dominates

Liquid staking remains the dominant sector in TON’s TVL, pushing the network up to #17 in the DefiLlama rankings. This trend highlights the growing interest in yield-generating opportunities within the TON ecosystem.

2.4 Emerging Protocols and Infrastructure

Several new protocols and infrastructure developments strengthen the TON ecosystem:

• Evaa Protocol goes live on TON Mainnet with $26.1M in total supply and $12.03M in total borrowings.

• RedStone becomes the first available oracle solution on TON, marking a major milestone for TON DeFi data integrity.

3. Industry Opportunities and Trends

3.1 Top Application Categories

Based on the number of projects and market share, the following application categories show the greatest potential:

a. Games (24 projects, 9.2% market share)

b. DeFi (20 projects, 7.7% market share)

c. Wallets (20 projects, 7.7% market share)

These categories represent the most active areas of development within the TON ecosystem, indicating strong market interest and growth potential.

3.2 Telegram Mini Apps: The New Frontier

Telegram Mini Apps offer developers a unique opportunity to leverage the platform’s massive user base. Key features include:

• Seamless integration with Telegram chat interface

• Built-in payment system supporting both crypto (via TON) and fiat currency transactions

• Viral mechanism leveraging Telegram’s share feature

• Customizable push notifications to increase user engagement

• Flexible deployment options (attachment menu, inline button or menu button)

These features create a fertile environment for developers to create innovative apps that can quickly gain traction in the Telegram ecosystem.

3.3 Games: The Prime Opportunity

Among the various app categories, games stand out as the most promising area of success on Telegram. Several factors contribute to this assessment:

a. Large user base and engagement: Telegram’s over 800 million active users provide a huge potential audience for games. The platform’s diverse user base allows for a wide range of game types, from casual to more complex strategic games.

b. Virality and social sharing: Games are inherently viral, encouraging users to invite friends and share achievements. Telegram’s built-in sharing features amplify this effect, potentially leading to rapid user acquisition at a lower cost.

c. Monetization opportunities: Games offer multiple revenue streams, including in-app purchases, advertising, and subscription services. The integration of TON payments further simplifies the monetization process.

d. Technology and platform support: Telegram’s powerful development tools and APIs make it possible to create sophisticated gaming experiences. Features such as seamless authorization, push notifications, and built-in payments reduce friction in game development and user experience.

e. User experience and feedback: Telegram’s instant messaging feature facilitates rapid iteration based on user feedback, allowing developers to quickly improve and optimize their games.

3.4 Other promising application areas

While games lead the way, several other application categories also show significant potential:

a. Social Finance (SocialFi): Leverage Telegram’s social features to create trust-based financial products, such as group-based micro-loans or collaborative investment tools.

b. Cryptocurrency education and onboarding: Provide easy-to-understand educational content and a low-risk onboarding experience for Telegram’s large number of non-crypto users.

c. Micro-tasks and money-making platforms: Create TON-based platforms where users can earn cryptocurrency by completing simple tasks, attracting users seeking additional sources of income.

d. Decentralized social media monetization: Develop tools for content creators to monetize their presence on Telegram through subscriptions, tips, and content sales.

e. Crypto payment integration: Build simple crypto payment solutions for merchants and service providers on Telegram to solve the pain points of traditional payment systems.

f. Enhanced crypto wallet: Develop a socially integrated crypto wallet to simplify the onboarding process for new users.

g. Decentralized prediction market: Create a TON-based prediction platform covering a variety of topics to attract Telegram's diverse user base.

h. Decentralized storage and content distribution: Use TON for decentralized storage solutions to solve content censorship issues and give creators more control.

10. Traffic aggregation and distribution platform: Use professional traffic delivery engineering technology to match applications suitable for traffic distribution.

4. Notable Ecosystem Projects

Several outstanding projects have emerged within the TON ecosystem:

a. Tonstakers: Leading Liquid Staking Protocol

b. The Open League: A program to incentivize users to interact with the TON project

c. Notcoin: A popular meme token

d. DeDust and STON.fi: Major Decentralized Exchanges (DEX)

e. Storm Trade: Major Derivatives Exchange on TON

f. bemo and Stakee: Emerging Liquid Staking Protocols

g. Whale Liquid by TON Whales: New Liquid Staking Pool

h. Evaa Protocol and DAOLama: Lending Protocols

i. RedStone: The First Oracle Solution on TON

These projects showcase the diverse applications built on TON, highlighting the rapid maturity of the ecosystem.

5. Future Outlook and Recommendations

As the Telegram and TON ecosystems continue to evolve, we anticipate several key trends and opportunities:

a. Enhanced Integration: Greater synergy between Telegram’s social features and TON’s blockchain capabilities, leading to a more seamless user experience.

b. DeFi Innovation: Continued growth of DeFi applications, with a focus on user-friendly interfaces and new financial products tailored to Telegram’s user base.

c. Gaming Ecosystem Expansion: A surge in blockchain games that leverage Telegram’s social features and TON’s fast, low-cost transactions.

d. Education and Onboarding Focus: More resources dedicated to educating and onboarding non-crypto users, expanding the overall ecosystem user base.

For developers and businesses looking to enter the Telegram and TON ecosystem, we recommend:

• Prioritize user experience and seamless integration with Telegram’s existing features

• Focus on applications that leverage Telegram’s social graph and viral sharing capabilities

• Explore innovative monetization models that combine traditional and crypto-native methods

• Invest in educational content and onboarding processes to attract and retain non-crypto users

• Pay close attention to regulatory developments to ensure compliance in target markets

VI. Recommendations for the secondary market:

1. Bitcoin market overview

1.1 Market Performance

After experiencing the dual positive stimulus of the halving event and the approval of the Bitcoin ETF, Bitcoin is currently in a high-level sideways fluctuation stage. This phenomenon reflects the natural adjustment process of the market after digesting major positive news. It is worth noting that the on-chain USDT (Tether) minting volume has shrunk, while the net inflow momentum of the Bitcoin ETF has also slowed down. These indicators suggest that the market may be entering a short-term cooling period.

1.2 Analysis of main influencing factors

a. AI bubble effect in US stocks:

The hot performance of artificial intelligence (AI) related stocks has attracted a lot of investment funds, resulting in the outflow of some funds from the cryptocurrency market. It is worth noting that a large number of retail investors are speculating on AI-related stocks by trading end-of-day options and leveraging, which increases the risk level of the overall market.

b. Bitcoin ETF fund inflow slows down:

The initial launch of Bitcoin ETF brought significant fund inflow, but this trend has weakened recently. The reduction in fund inflow directly affected the upward momentum of Bitcoin price and became one of the important reasons for the current market fluctuations.

c. Investor risk preference change:

For new funds, directly buying Bitcoin seems to be more cost-effective than investing in high-valuation projects. High-valuation projects face the risk of chip dumping, resulting in insufficient buying in the secondary market. On the contrary, Meme Coin, which has high liquidity, has maintained a high turnover rate due to its speculative nature.

d. Lack of innovative applications:

The cryptocurrency market as a whole lacks truly breakthrough application scenarios. Although projects like TON (Telegram Open Network) are trying to force new users through high-traffic platforms, which may become a new breakthrough in the market, other new application directions are still difficult to open a new growth curve.

e. High correlation with US stocks:

Cryptocurrency market prices currently show a strong positive correlation with US stock performance. The real market high is likely to occur after the Fed's first interest rate cut. The market will pay close attention to the performance of CPI (Consumer Price Index) data after the interest rate cut. If a situation similar to the 1970s and 1980s occurs, that is, inflation rebounds strongly again after the interest rate cut, the Fed may quickly restart the interest rate hike cycle.

2. Historical reference: Review of the Fed's monetary policy from 1979 to 1989

In order to better understand the current market environment and possible policy trends, it is necessary to review the evolution of the Federal Reserve's monetary policy between 1979 and 1989:

a. 1979-1981: Aggressive anti-inflation

- Strictly control the growth of money supply

- Significantly increase interest rates, and the federal funds rate once exceeded 20%

b. 1981-1982: Insist on high interest rates

- Maintain high interest rate policy despite a severe economic recession

- Inflation rate began to decline significantly

c. The second half of 1982: Cautious relaxation

- Begin to gradually relax monetary policy

- Allow interest rates to gradually decline to cope with the economic recession

d. 1983-1984 1985-1986: Further easing - Further easing of monetary policy - Continue to lower interest rates to support economic growth 1986-1989: Fine-tuning of policy - Slightly tightening monetary policy again to prevent overheating of the economy - Gradually increase interest rates

This historical experience shows that the Fed may adopt a continuous tightening policy in the face of high inflation, even if it faces the risk of economic recession. At the same time, policy adjustments are often gradual and take a long time to see results. This has important implications for current market participants to understand possible policy trends and market reactions.

3. Market Outlook Analysis

3.1 Short-term Market Outlook

Given the current market conditions, Bitcoin prices may continue to fluctuate in the short term. The main reasons include:

a. The slowdown in ETF fund inflows has weakened the market's upward momentum.

b. Investors’ attention has partially shifted to hot areas such as AI, affecting the inflow of funds into the cryptocurrency market.

c. The market generally awaits clear signals from the Federal Reserve’s monetary policy, leading to cautious trading activities.

3.2 Mid- to long-term development opportunities

Despite some challenges in the short term, the cryptocurrency market still has many development opportunities in the mid- to long-term:

1. Institutional investment continues to increase: As the regulatory environment gradually becomes clearer, more institutional investors may enter the market, bringing more funds and credibility to the industry.

2. Global macroeconomic uncertainty: Under the influence of inflationary pressures, geopolitical risks and other factors, the value of Bitcoin as a hedging tool may be further highlighted.

3. Long-term impact of halving: Although the impact of halving may have been digested by the market in the short term, historical experience shows that halving often has a positive impact on Bitcoin prices in the medium and long term.

4. Increased adoption in emerging markets: As developing countries continue to accept cryptocurrencies, new user groups and market demands may emerge.

This article is from a contribution and does not represent the views of BlockBeats.

欢迎加入律动 BlockBeats 官方社群:

Telegram 订阅群: https://t.me/theblockbeats

Telegram 交流群: https://t.me/BlockBeats_App

Twitter 官方账号: https://twitter.com/BlockBeatsAsia

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What's Going On With L3Harris Stock Today?

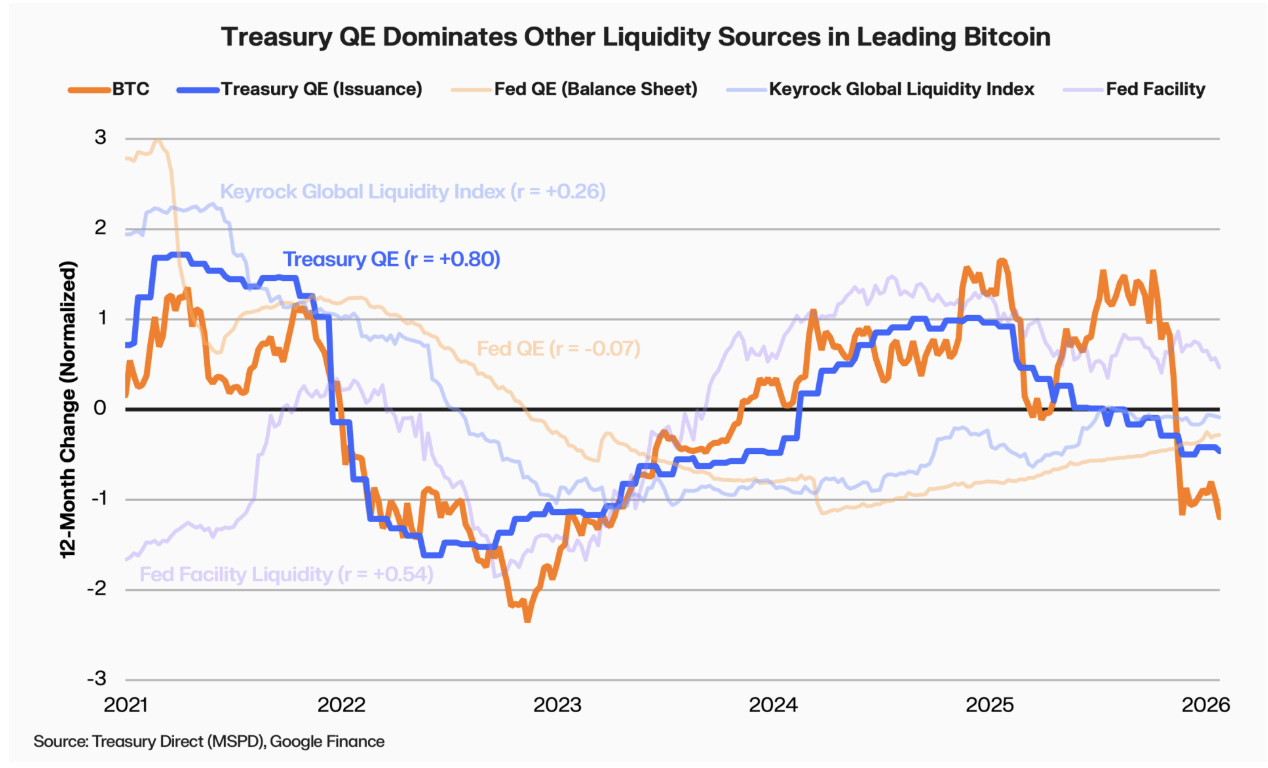

Treasury bills seen as primary driver of Bitcoin's price: Report

What You Should Know About Friday’s Economic Growth Report

Madison Square Garden Sports Weighs Knicks-Rangers Breakup