German Govt Moves Biggest Bitcoin Bag Amid Sell-Off Fears

- The German government is still shuffling Bitcoin.

- Bitcoin has recently experienced a significant price retracement.

- An industry figure has made an intriguing proposal amidst concerns of an imminent dump.

The past weeks have seen the crypto market thrown in shambles, led by major price tumbles for the world’s largest crypto asset, Bitcoin (BTC) . Despite the prevailing hopes for the crypto giant to soon stop its bleeding, Bitcoin’s price has only shed further, dragging the broader market into a sea of red.

With Bitcoin still teetering, fears of market dumps have intensified, and major price movements by portfolio holders are exacerbating concerns.

Another Deutsche Bitcoin Dump?

The German government has been moving BTC in large portions over the past few weeks, and its latest transaction indicates that it is unlikely to stop soon. According to blockchain intelligence platform Arkham Intelligence on Thursday, July 4, 2024, a wallet linked to the government has moved another 1,300 BTC.

Sponsored

Valued at approximately $76 million, the bitcoins were sent to crypto exchanges Bitstamp, Coinbase, and Kraken around 8:00 UTC. This transfer was followed by another 1,700 BTC shortly after, valued at $99 million, marking the largest movement of the government’s assets in recent weeks.

The recent transfers follow past movements of significant amounts of BTC in the past month, when the government labeled wallet shuffles assets across multiple exchanges and addresses.

Sponsored

The frequency of the transactions has raised industry-wide apprehension about a potential market dump. However, amidst the concerns, an intriguing proposition has emerged, a rather generous proposition has emerged to save the day.

HTX CEO Proposes German Govt’s BTC Acquisition

In a recent tweet, HTX CEO Justin Sun shared his willingness to purchase the entirety of the German government’s Bitcoin portfolio. According to Sun, his offer aims to protect the market from a deep price tumble, should the government decide to offload its holdings.

The HTX CEO’s concerns are not isolated, as sell-off fears have intensified across the market in recent days, particularly due to Bitcoin’s severe underperformance. Despite reaching a new all-time high of approximately $74,000 in March 2024, BTC has experienced major price slips, and is currently struggling to regain an upward momentum.

At press time, Bitcoin is trading at $57,930. This marks an approximate 6% decline in the last seven days, a total 18% in the last 30 days, and a staggering 21.71% from it’s all-time peak..

On the Flipside

- Defunct crypto exchange Mt Gox is also spurring sell-off concerns as it gears to repay its extensive list of creditors.

- The German government still holds a total $40,359 Bitcoin in its balance.

- The broader market is anticipating an imminent recovery for Bitcoin this month.

Why This Matters

The recent transfer of 3,000 BTC by the German government is the latest in a series of ongoing transactions. With the hefty balance it sits on, these movements could signal the beginning of a broader unloading strategy by the government.

Read more about the previous transfers by the government in this article:

German Government Shifts $55M BTC Amid Market Downturn

Hopes are increasing for Ethereum ETFs to get the SEC’s approval, read more:

ETH ETF Hope for July Returns as Amendments Roll in

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

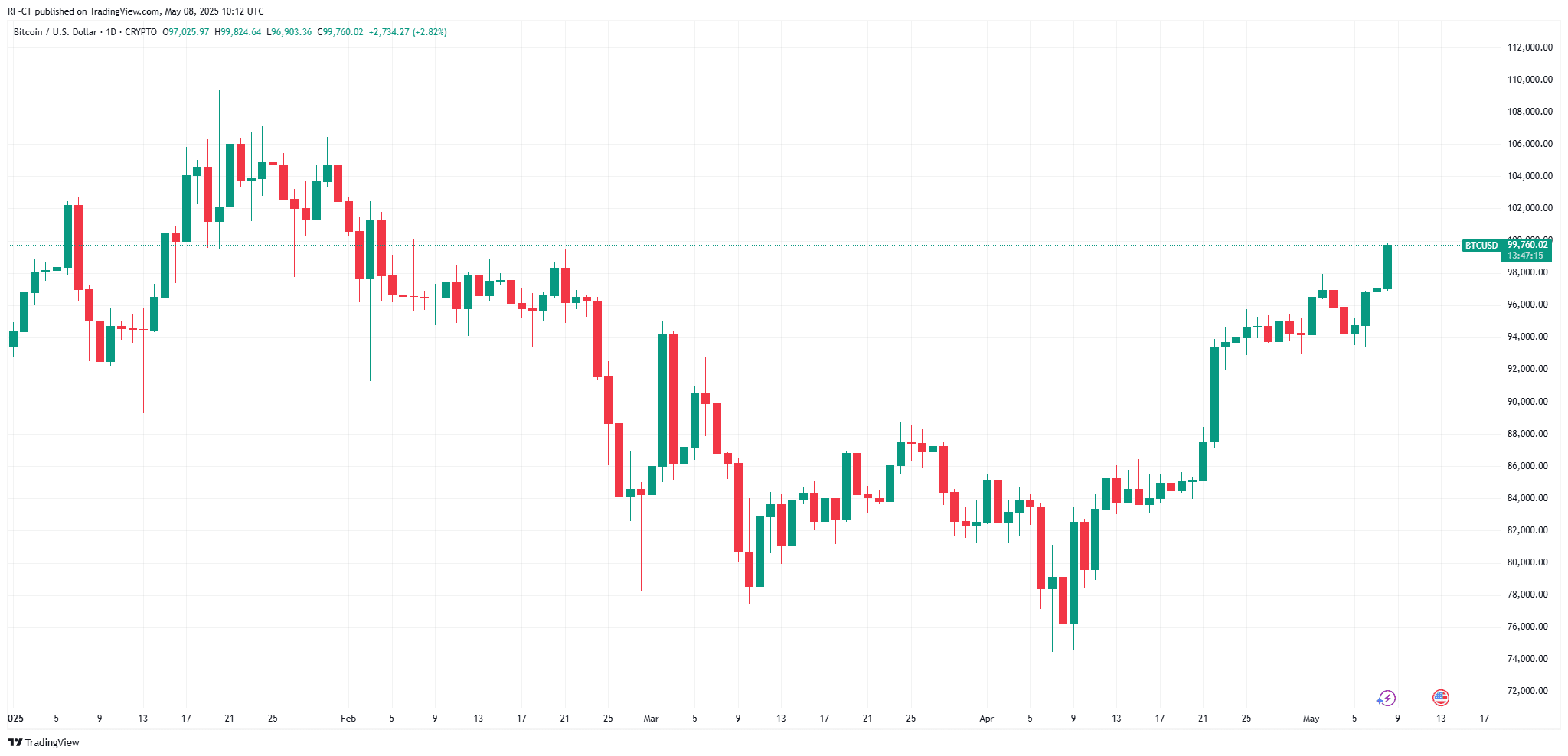

Bitcoin Breaks $100K as BTC Nears New ATH with Bulls Roar in May 2025

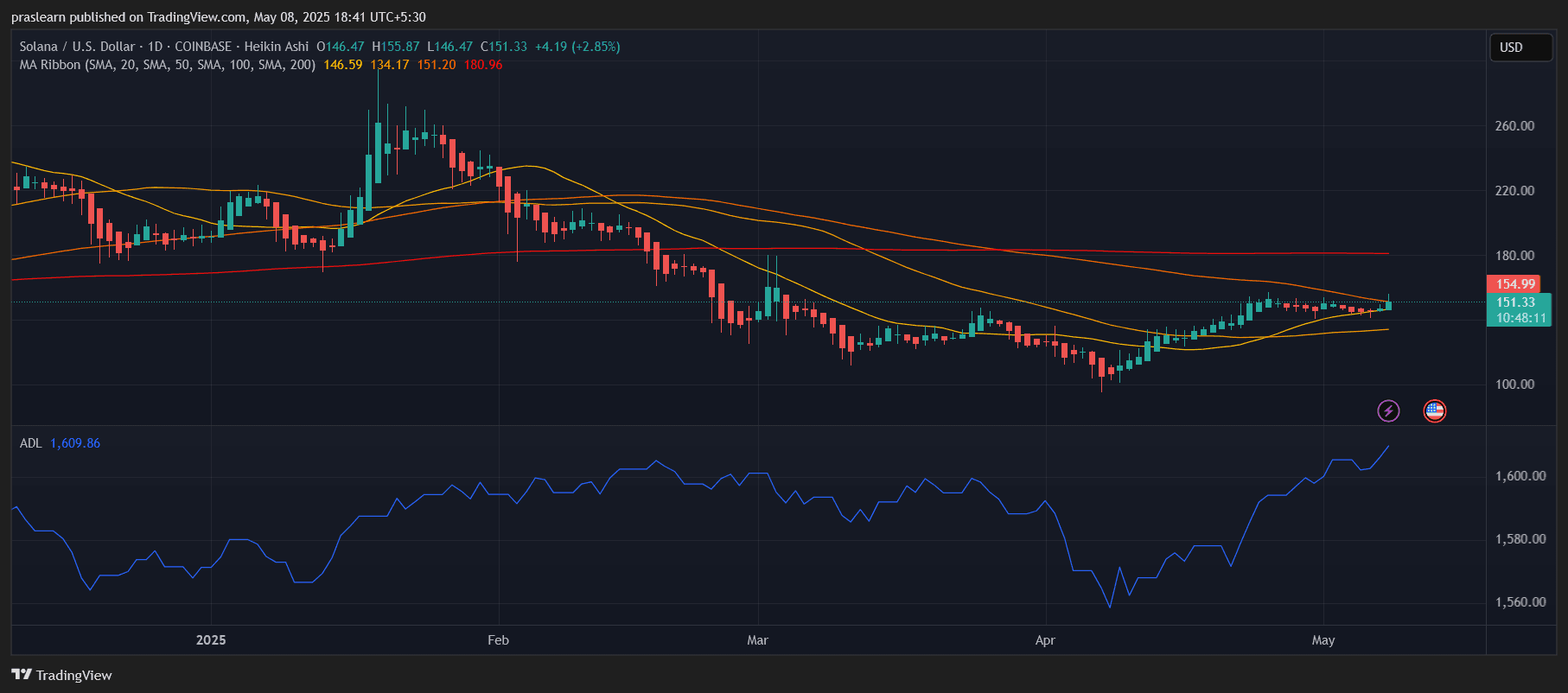

SOL Price Explodes Past $150—What’s Next?

Ethereum Price Prediction: ETH Surges Above $2,000 as Crypto Market Soars