The value of block space has surged, and “fat applications” have an opportunity to rise

Original title: The Privatization of Orderflow and Resurgence of the Fat App Thesis

Original author: Mason Nystrom, crypto researcher

Original translation: Luffy, Foresight News

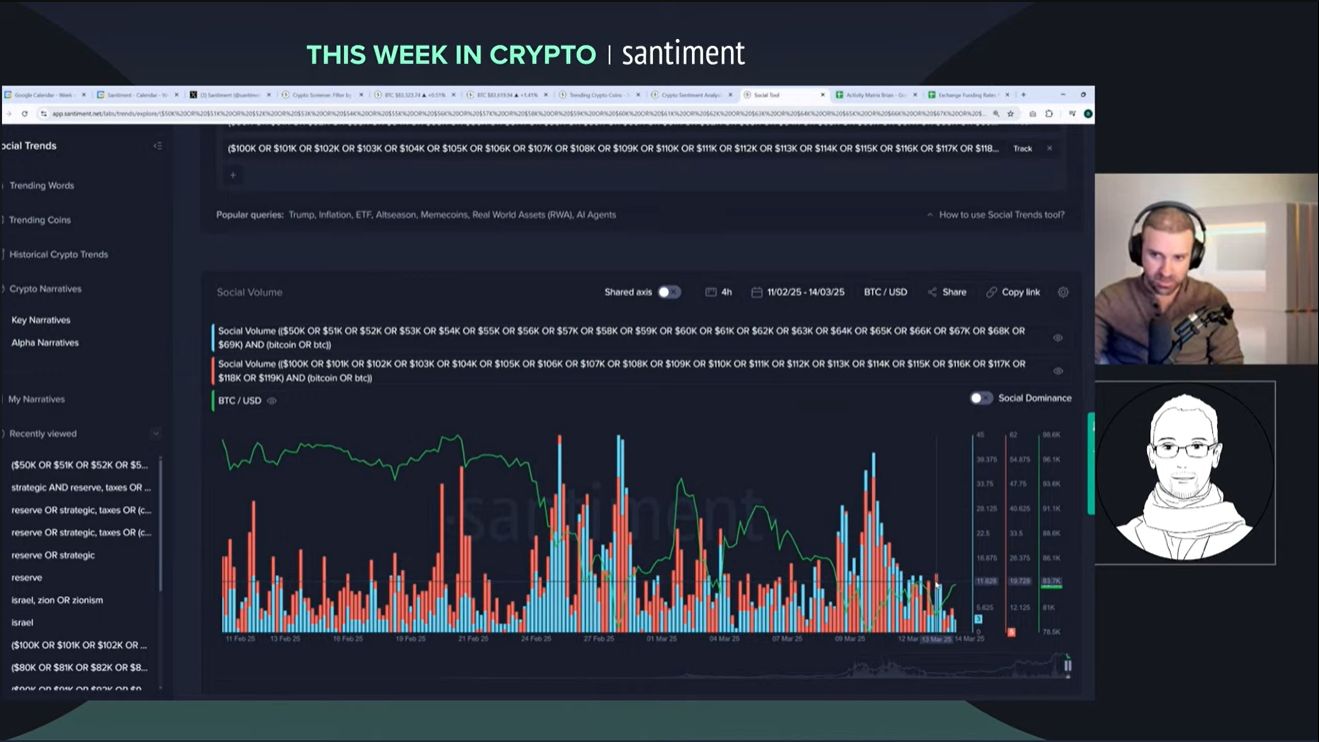

In the past 30 days, Ethereum's order flow volume exceeded $25 billion, and nearly half of it came from proprietary applications. As the value of block space continues to grow and pave the way for "fat applications", the privatization of order flow will continue to grow.

Source: Orderflow.art

So how did we get here? Where are we going in the future?

The DeFi summer gave rise to a large number of prosumers and retail trading, and subsequently gave rise to trading aggregators such as 1inch, which provide users with better price execution through private order routing. Wallets (such as MetaMask) quickly followed suit, realizing that they could profit from providing convenience to users by adding in-app swaps. This proves that there is an extremely valuable business model for any application that controls the attention (and orders) of end users.

In the past two years, we have seen two additional types of players enter the private order flow space: Telegram bots and solver networks. Telegram bots provide users with a convenient way to trade long-tail assets easily in group chats. As of June, Telegram bots accounted for ~21% of trades by number and 11% of trades by volume, most of which were conducted through private mempools.

Source: Dune

On the other hand, solver networks (i.e. Cowswap, UniswapX) have also become the core venue for trading high-liquidity trading pairs (such as stablecoins and ETH/BTC). Solver networks change the order flow market structure by outsourcing the work of finding the best path for transactions to solvers (market makers).

As a result, trading venues have bifurcated, with convenient frontends (including TG Bots, wallet exchanges, and Uniswap frontends) primarily used for long-tail, low-value (less than $100k) trades, while aggregators and solver networks are the preferred venues for larger trades.

If you look more closely, you’ll notice that most private order flow comes from frontends (TG Bots, wallets, and frontends).

The privatization of order flow is even more pronounced when we consider that only 15-30% of Ethereum transactions go through private mempools, meaning that a large portion of private order flow volume is contributed by a small number of exchanges.

Source: Dune

In other words, valuable order flow is more important than the quantity of order flow. The power-law distribution of users and order flow leads to a corollary: applications will account for the largest proportion of total value. In other words, the fat app thesis still holds true.

Towards Fat Apps

While Uniswap’s protocol layer is clearly valuable, the more interesting story is happening at the application layer as Uniswap strives to become a consumer app: verticalizing key components of its stack by expanding the functionality of its interface, mobile wallet, and aggregation layers. For example, Uniswap Labs’ applications (Uniswap’s frontend, wallet, and aggregator UniswapX) accounted for nearly 25% of the $13 billion in private order flow and nearly 40% of total order flow in the past 30 days.

Elsewhere in crypto, applications like Worldcoin account for nearly 50% of Optimism mainnet activity, which has driven Worldcoin to build its own application chain, further highlighting the power of the fat application theory.

Even top NFT projects with strong brands like Pudgy Penguins are building their own chains, with CEO and Chief Pengu Luca explaining that controlling block space is beneficial to the value accumulation of Pudgy's brand and IP.

Looking forward, applications should focus on new types of order flows, including: creating new assets (such as Pump and memecoins), building applications for new user scenarios (such as Worldcoin, ENS), creating vertically integrated better consumer experiences and supporting valuable transactions, such as Farcaster and Frames, Solana Blinks, Telegram and TG applications, or on-chain games.

Final Thoughts on Fat Apps

Once the Appchain Theory becomes an industry consensus, fat apps will become the focus of many people.

My current view on the fat app theory is that we will see most of the value accrue to the application layer, where control over users and order flow puts applications in a privileged position. These applications will likely be combined with on-chain protocols and primitives, similar to today's UniswapX and Uniswap Protocol, Warpcast and Farcaster, Worldcoin and Worldchain. Ultimately, these protocols, especially those with the highest degree of on-chain (such as MakerDAO), can still accumulate considerable value, but applications may capture more value given their proximity to users and the off-chain components that provide moats for the applications.

Finally, I still believe that Layer 1 blockchains (e.g. Bitcoin, Ethereum, Solana) can gain significant value as non-sovereign reserve assets. Given enough time, applications may try to build their own L1s, just as they built their own L2s. But building L2 blockspace is very different from bootstrapping L1 and turning governance tokens into commodities and collateral assets, so this may be a relatively distant question.

The core point is that as more and more applications create and have valuable order flows, the crypto world will re-evaluate applications, and fat applications are the general trend.

Original link

欢迎加入律动 BlockBeats 官方社群:

Telegram 订阅群: https://t.me/theblockbeats

Telegram 交流群: https://t.me/BlockBeats_App

Twitter 官方账号: https://twitter.com/BlockBeatsAsia

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Navigating Crypto Volatility: How Bitcoin and Altcoins Influence Your Trading Choices

Understanding the Impact of Market Volatility on Crypto Trading: A Look at the Risk and Reward in Bitcoin and Altcoins

Crypto Whales Bought These Coins in the Second Week of March 2025

Crypto whales have been active in accumulating BTC, PEPE, and ENS this week, signaling potential price movements despite recent market fluctuations.

James Howells Loses Appeal to Dig Up Landfill for $675 Million Bitcoin Hard Drive

James Howells has faced years of legal setbacks in his attempt to recover 8,000 lost Bitcoins from a Newport landfill. Despite offering millions, he now plans to approach the European Court of Human Rights.