Huge Move Imminent for XRP: Will $0.5 Finally Fall? (Ripple Price Analysis)

Ripple’s price has been fluctuating around the critical support level of $0.47, experiencing minor volatility and sideways movements. This price range has consistently supported XRP, suggesting substantial demand and raising the probability of a mid-term bullish reversal.

XRP Analysis

By Shayan

The Daily Chart

An in-depth look at the daily chart reveals that Ripple has been consolidating within a sideways triangle pattern, signaling a balance between buying and selling pressures and uncertainty about the overall trend direction.

Recently, the price reached the lower boundary of this pattern at $0.47, with sellers struggling to break below this critical threshold.

This range has been in solid support since May 2023, highlighting persistent demand and buying pressure. Consequently, a bullish reversal seems likely in the mid-term, potentially leading to minor bullish movements toward the triangle’s upper boundary.

Conversely, a sudden break below this critical support could trigger significant long-liquidation, causing a sharp decline in the short term.

The 4-Hour Chart

On the 4-hour chart, Ripple exhibits a short phase of lateral movement and uncertain price action around the crucial $0.47 support range, forming a bearish continuation flag pattern.

The price recently dropped to the pattern’s lower trendline and the key $0.47 support area.

If sellers manage to break through this level, a significant and rapid bearish move is anticipated. However, the MACD indicator has recently turned green, indicating a potential bullish rebound. This signal, combined with the prevailing demand near this critical support, suggests increased buying pressure and the likelihood of a mid-term bullish reversal.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

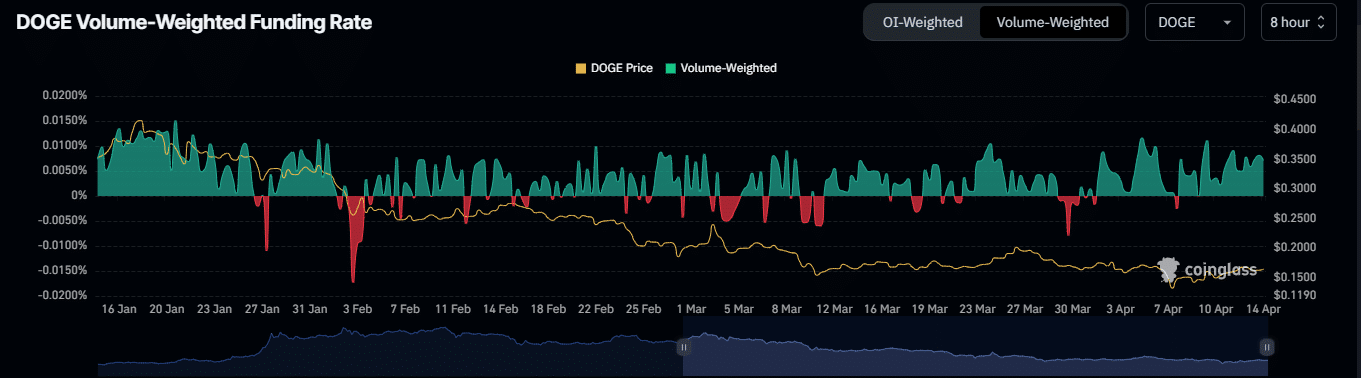

Potential Dogecoin Rally Ahead as Key Support Level and Increased Buying Interest Emerge

Market Insights: Short-Term Recovery Signals for BONK, ALCH, and Bitcoin

In Brief Analyst Pseudonym identifies recovery signals in BONK, ALCH, and Bitcoin. Short-term trading strategies recommended for cautious positions. Increasing interest in meme tokens amid market volatility.

Ethereum Price Fluctuations Ignite Technical Analysis and Strategic Forecasts

In Brief Ethereum's price fluctuations shift focus to technical indicators among market players. Analysts signal potential recovery and long-term growth opportunities for Ethereum. Competition from networks like Solana raises challenges for Ethereum's market position.

Market Turmoil: Investors React as OM Coin Crashes 90%

In Brief OM Coin experiences a dramatic 90% drop, alarming the crypto market. IP Coin's price decline raises investor concerns about potential panic sales. Support levels for IP Coin are being closely monitored following recent fluctuations.