Ethereum ETF issuers working to address 'reasonable' comments from SEC by Friday: Sources

Prospective Ethereum ETF issuers are responding to the comments received from the SEC last week, according to two sources, and aim to hand them back in this week.The sources described the comments as “light” and “reasonable.”

Prospective spot Ethereum ETH -1.34% ETF issuers received comments from the SEC last week regarding their S-1 forms with a deadline of this Friday to get them turned around, according to two sources.

While the issuers saw their 19b-4 forms approved in May, they still need the S-1 forms to become effective before trading can begin — a process with no strict deadline. These forms are currently being reworked and sent back to the SEC for further comments before being reworked again until they’re ready.

A source at one issuer said the latest round of comments were “reasonable” and that they’re looking forward to approval soon. A source at another issuer described the comments as “light.”

“I suspect you'll see people file pretty quickly this week and then we'll see how many more turns of the wheel are required,” the second source said.

Bloomberg Senior ETF Analyst Eric Balchunas — who had posted on X that he had heard similar comments about the progress of the S-1 forms — said he was moving his over/under date for the launch of the products to July 2. He noted this was a best guess.

The issuers handed in the first main drafts of their S-1 forms on May 31, following the approval of the 19b-4 forms. While they had initially expected comments to be provided the following week, it took two weeks for them to come in.

The SEC hasn’t clarified when the S-1 forms will be approved — beyond saying sometime this summer — Chair Gary Gensler said the timings would largely depend on how fast the issuers responded to the agency’s feedback.

It’s unclear how big the impact of the Ethereum ETFs will be, but some analysts predict they may see up to 20% of the flows that the Bitcoin ETFs saw.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

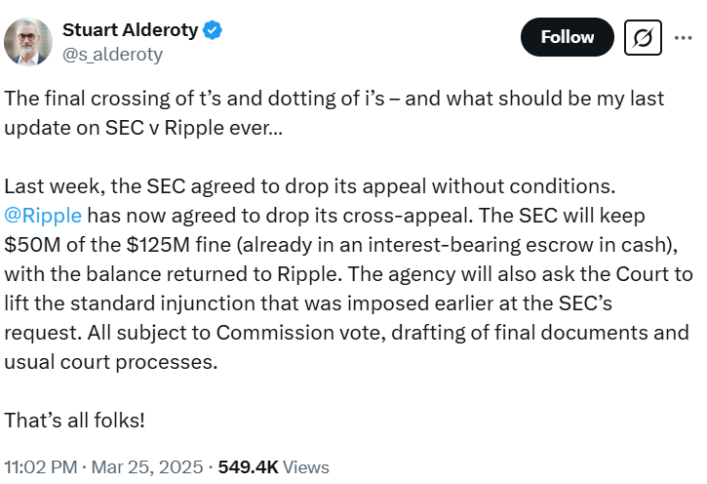

SEC vs Ripple Case Dropped Forever! Case settled for $50M

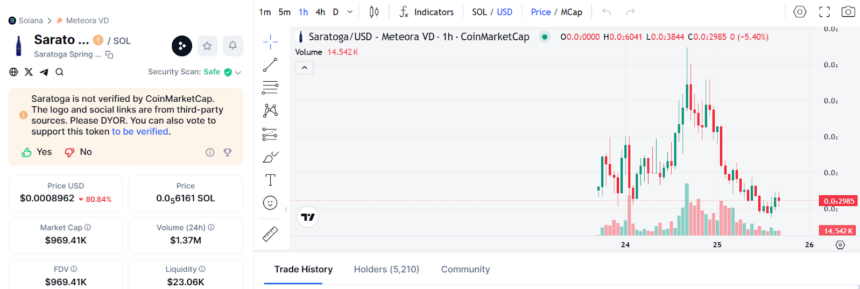

4AM Fitness Influencer Inspires Morning Routine Memecoin

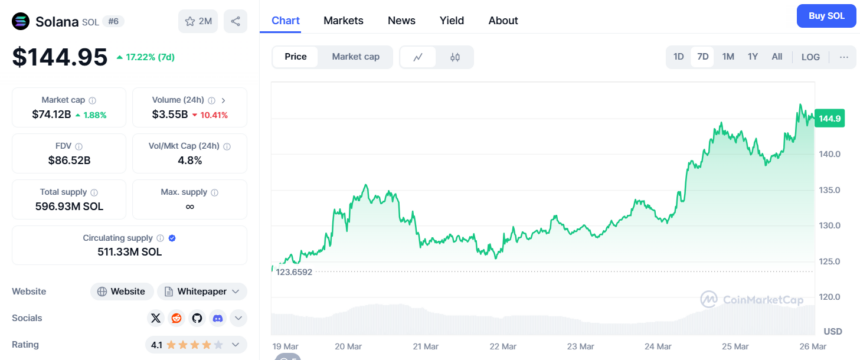

Fidelity Files For Spot Solana ETF with Cboe; SOL Price Pumps to $146