Hashdex files for joint Bitcoin and Ethereum spot ETF in the US

Asset manager Hashdex filled in a joint spot exchange-traded fund (ETF) indexed to Bitcoin (BTC) and Ethereum (ETH) weighted by market cap, as reported by Bloomberg ETF analyst James Seyffart. The decision comes three weeks after Nasdaq withdrew Hashdex’s proposed Ethereum ETF, as reported by Crypto Briefing. The final deadline for SEC approval should be set for the first week of March 2025.

Notably, Seyffart highlights that the application includes “language to allow the addition of other digital assets,” if and when they are approved by the US regulator. The analyst shares his belief that Hashdex might try to offer a hybrid ETF in the US, such as the HASH11 product offered in Brazil.

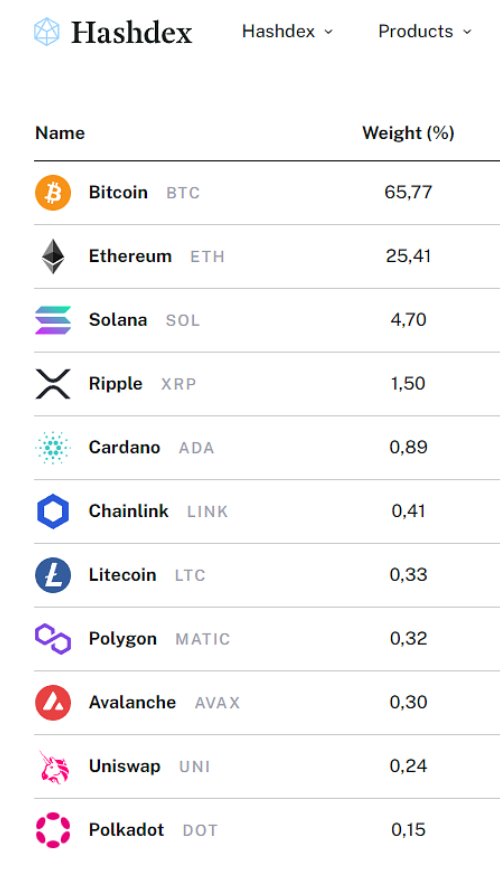

The HASH11 follows the Nasdaq Crypto Index (NCI), which consists of 11 different crypto with different weights.

NCI composition. Image: Hashdex/James Seyffart

NCI composition. Image: Hashdex/James Seyffart

“So bringing something like this to the US makes complete sense as a future goal,” said Seyffart. According to data aggregator bold.report , the HASH11 presents over $511 million in assets under management (AUM) and nearly 7,700 BTC.

However, it is still too early to say how open the SEC is to approving spot ETFs indexed to other tokens. In a recent participation on CNBC’s Squawk on the Street, SEC Chairman Gary Gensler told host Jim Cramer that the crypto market still lacks disclosure.

“Let me say something more broadly about crypto markets: right now, without pre-judging anyone, these tokens, whether the ones Jim listed or other tokens, have not given you the disclosures that not only do you need to make your investment decisions, but also are required by the law,” said Gensler.

Therefore, although Hashdex opens up its filing for potential stance changes on the SEC, they might not come so soon.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

100% rebate for KYB users: Earn fee rebates on EUR bank deposits!

[Initial listing] Bitget to list Talus (US) in the Innovation and AI zone

Bitget Trading Club Championship (Phase 21)—Up to 1250 BGB per user, plus a ZETA pool and Mystery Boxes

Bitget Spot Margin Announcement on Suspension of MDT/USDT, RAD/USDT, FIS/USDT, CHESS/USDT, RDNT/USDT Margin Trading Services