LinqAI (LNQ): Transforming the Business World with AI Solutions

0x762024/06/18 09:39

Show original

By:0x76

Project Overview

LinqAI is at the forefront of integrating innovative technology with practical business solutions, focusing on creating versatile artificial intelligence that adapts to any business environment, including both traditional industries and the emerging Web3 sector. This AI aims to automate monotonous tasks, thereby improving employees' quality of life by giving them more time to focus on complex and creative tasks. This not only enhances work-life balance but also significantly boosts overall business efficiency.

EarnAI is LinqAI's core product, providing users with the ability to earn passive income by holding $LNQ

EarnAI is a loyalty program that rewards $LNQ holders. Essentially, it transfers a portion of the revenue generated from SaaS fees and other income streams and returns it as rewards to token holders.

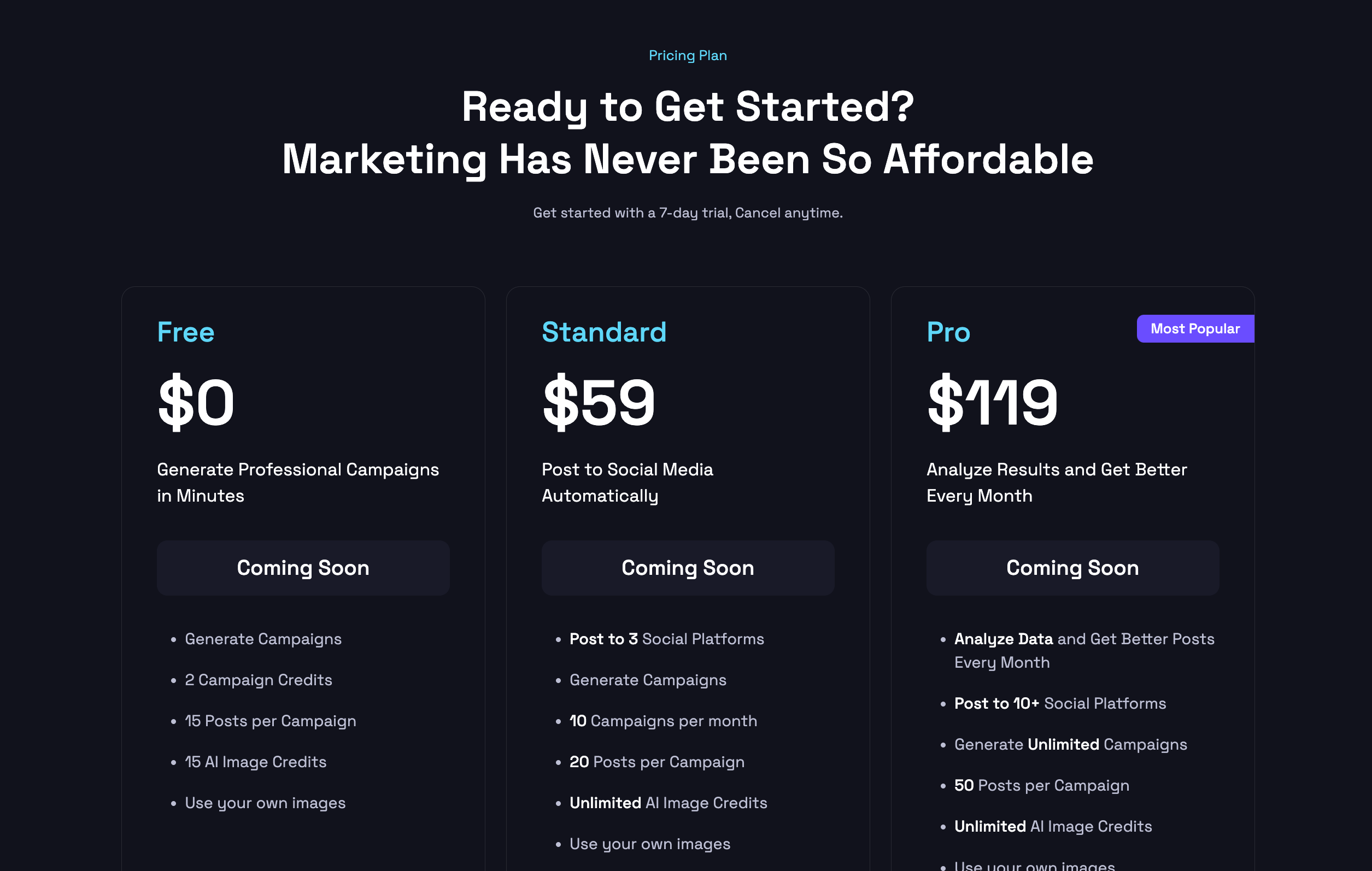

SaaS Subscriptions

Each AI tool (e.g.,

Marketr) will be created on a SaaS model that allows for both B2B and B2C use cases. Each AI tool will allocate 15% of its revenue to EarnAI. The more these products become mainstream and utilized, the higher the EarnAI rewards. As multiple AI tools are developed, the number of EarnAI reward streams multiplies.

Token Tax

A portion of the token tax (15%) is redistributed back to EarnAI rewards. This is proportionally allocated to token holders. The more tokens a user holds, the higher their reward allocation. *Minimum required amount

Community-Driven Revenue Allocation

EarnAI stands out with its democratic approach to revenue utilization. A portion of the earnings from AI tool subscriptions is allocated to a public pool, with the $LNQ token holder community deciding its monthly distribution:

For community members holding 100,000 $LNQ or more, 50% of #EarnAI's monthly income (15% from taxes and SaaS subscriptions) will be airdropped to their wallets, regardless of the chosen method

7.5% airdropped in $ETH (proportionally - based on $LNQ held)

7.5% deployed to one of the following three options:

Token Market Optimization (Buyback and Burn)

Strategically buying back and retiring $LNQ tokens to optimize supply and demand, potentially increasing its market value positively.

Liquidity Support (Adding Funds to Increase Liquidity Pool)

Diversifying investments into liquidity by purchasing $LNQ and $ETH in equal proportions and contributing to Uniswap LP, thereby enhancing market stability.

Liquidity Mining

Injecting funds into farming operations, thereby extending its lifespan beyond the initial two years. This strategy focuses on sustainability rather than increasing immediate returns.

Enhancing token mining and tokenomics

Liquidity mining plays a crucial role in the EarnAI ecosystem, distributing 20 tokens every 15 seconds.

Reward distribution is tiered based on the lock-up period, incentivizing longer commitments:

20 tokens are distributed as rewards to 3 farms every 15 seconds. The breakdown of these 12 tokens is as follows:

Quantum Farm - 180-day lock-up: 12 tokens per block (15 seconds)

Tensor Farm - 90-day lock-up: 6 tokens per block (15 seconds)

Byte Farm - 60-day lock-up: 2 tokens per block (15 seconds)

In short, the longer the tokens are locked, the higher the reward ratio

Market Cap Analysis

The current FDV of LNQ is $110 million. In comparison, projects in the AI sector such as ARKM have an FDV of $1.58 billion, FET at $3.1 billion, AGIX at $1 billion, and WLD's FDV even reaching $27.6 billion. LNQ can be considered one of the few low-FDV projects in the recent AI sector. Additionally, LNQ is one of the few WEB3 projects that have started exploring paid services. If this model can be validated, it will bring continuous cash flow to LNQ, benefiting the project's development.

Tokenomics

The $LNQ token is an ERC-20 token based on the

Ethereum

blockchain and is an important part of the LinqAI ecosystem. The total supply is 1 billion, aimed at providing ample liquidity for users and investors. 85% of the tokens are frozen for the first month after launch, with subsequent linear unlocking. The token distribution is as follows:

Early Investors: 5% (50,000,000 $LNQ)

Private Round: 10% (100,000,000 $LNQ)

Public Round: 5% (50,000,000 $LNQ)

Marketing: 17% (170,000,000 $LNQ)

Partners: 8% (80,000,000 $LNQ)

Exchange Liquidity: 15% (150,000,000 $LNQ)

Team and Advisors: 20% (200,000,000 $LNQ)

Farming/Ecosystem: 20% (200,000,000 $LNQ)

It is worth noting:

The LNQ token was launched on Uniswap at a price of $0.0035 per LNQ. (0xd4f4d0a10bcae123bb6655e8fe93a30d01eebd04)

The locked supply represents tokens that will be reserved and not immediately sold on the market. These can be used for future development,

partnerships, or other strategic purposes.

The circulating supply at launch represents tokens that will be immediately traded on exchanges.

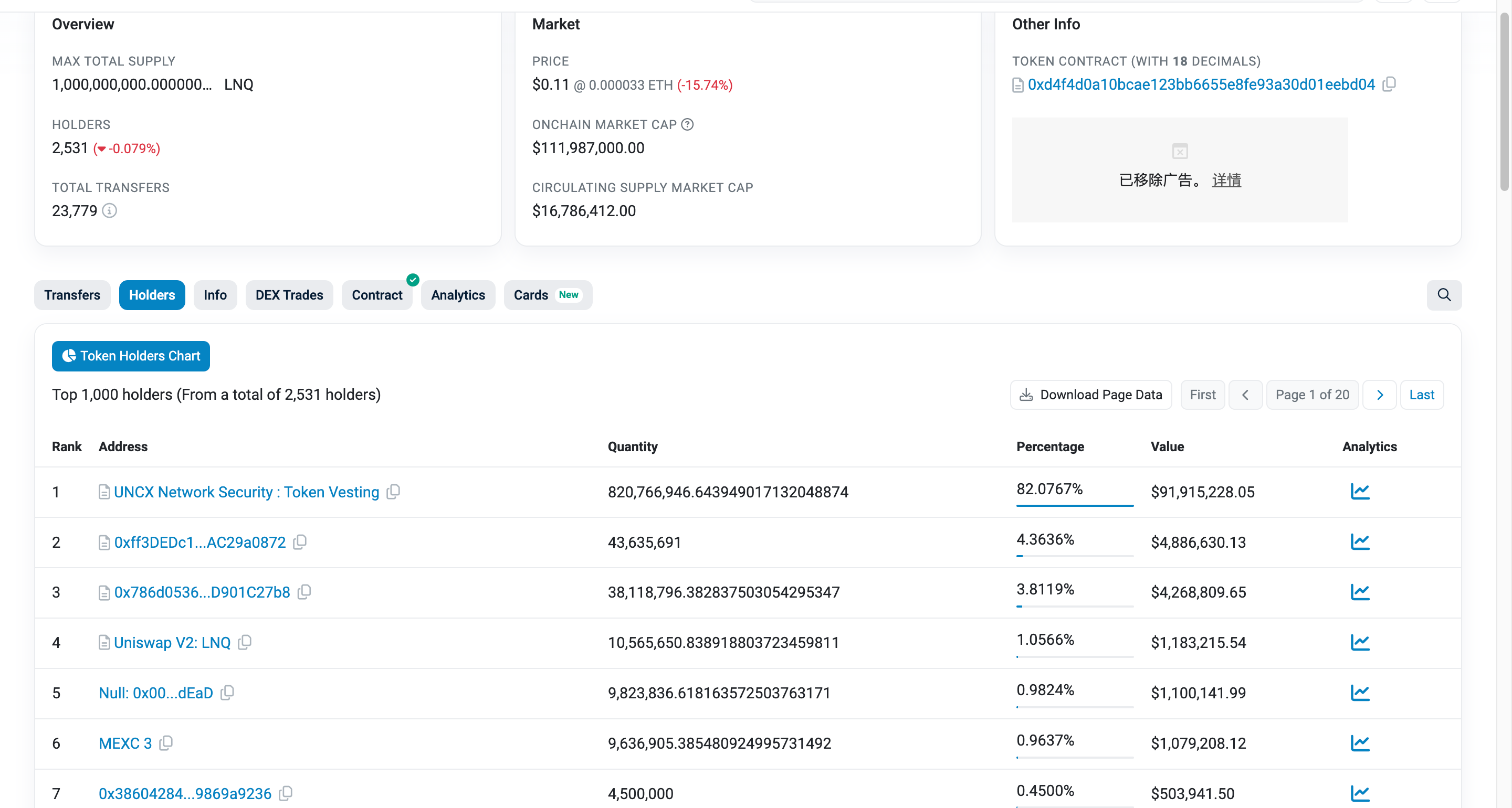

On-Chain Holdings

According to data from the etherscan browser, as of June 18, the largest LNQ holding address is the token lock-up address, holding a total of 82.0767% of LNQ tokens. The LNQ liquidity pool on Uniswap holds 1.0566% of the token supply. There are a total of 2,531 on-chain holding addresses, with the Top 100 addresses holding 97.74% of LNQ tokens.

Related Links

Official Website: https://www.linqai.com/

X: https://x.com/linq_ai

Block Explorer: https://etherscan.io/token/tokenholderchart/0xd4f4d0a10bcae123bb6655e8fe93a30d01eebd04

2

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Ether retail longs metric hits 94%, but optimism could be a classic bull trap

Cointelegraph•2025/10/17 02:33

Bitcoin options markets highlight mounting fears as traders brace for more pain

Cointelegraph•2025/10/17 02:33

$15 Billion Changes Hands: How Was the So-Called Decentralized BTC "Seized" by the US Government?

With the transfer of 127,271 BTC, the United States has become the world's largest sovereign holder of bitcoin.

BlockBeats•2025/10/17 02:27

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$109,157.89

-2.13%

Ethereum

ETH

$3,930.82

-2.28%

Tether USDt

USDT

$1

-0.04%

BNB

BNB

$1,152.46

-2.92%

XRP

XRP

$2.36

-2.77%

Solana

SOL

$186.89

-3.72%

USDC

USDC

$0.9999

-0.01%

TRON

TRX

$0.3171

-1.47%

Dogecoin

DOGE

$0.1903

-3.40%

Cardano

ADA

$0.6514

-3.08%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now