Crypto Users Are Comparatively Impatient

From Paul Veradittakit

Do Crypto Users Need an Intervention?

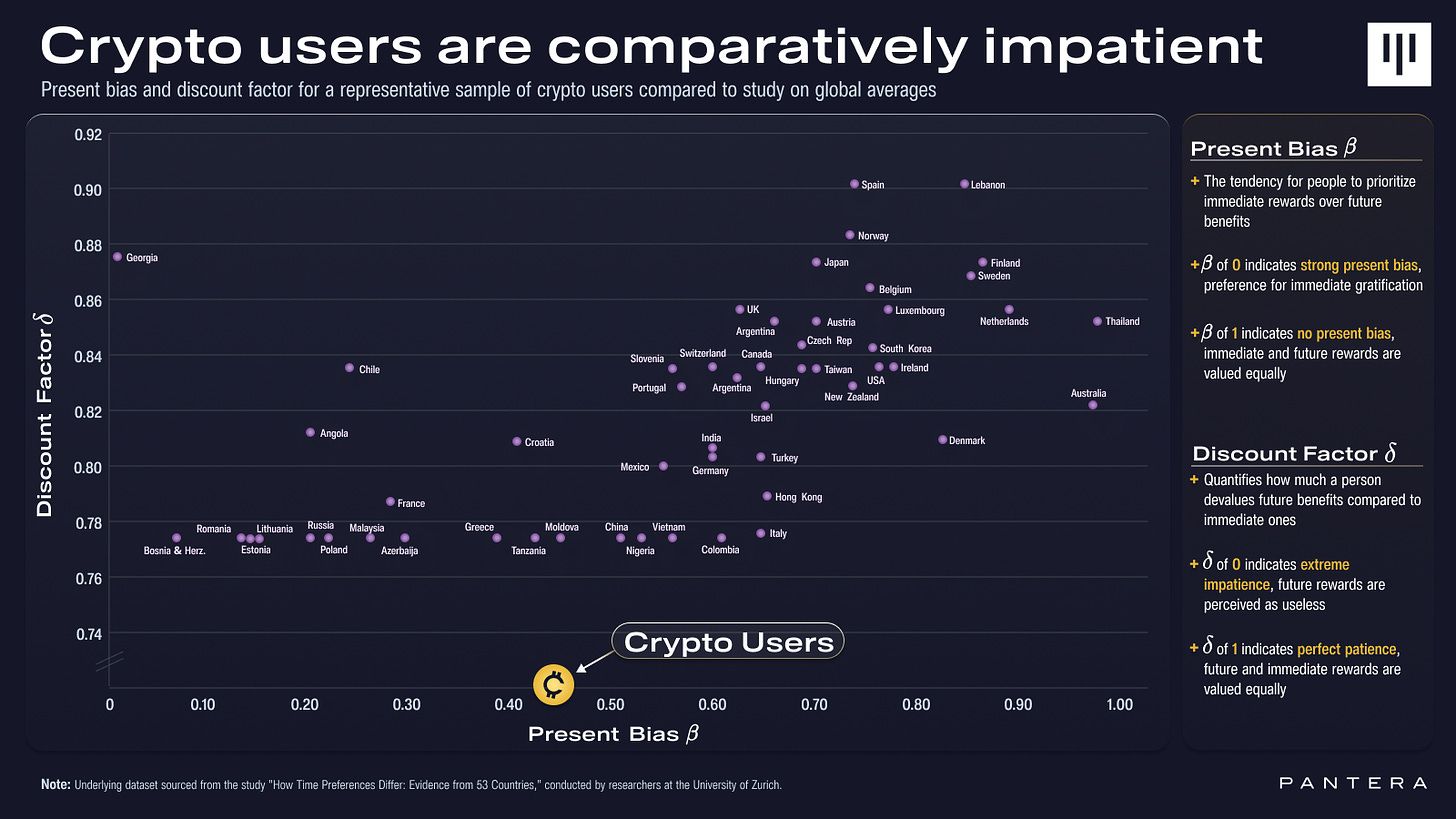

- A study by Pantera Research Lab found that crypto users exhibit a high present bias and low discount factor, indicating a strong preference for immediate gratification.

- The quasi-hyperbolic discounting model, characterized by parameters such as present bias (ꞵ) and the discount factor (𝛿), is useful for understanding the tendency of individuals to prefer immediate rewards over future gains, a behavior particularly pronounced in the volatile and speculative crypto market.

- This research can be applied to optimize token distributions, such as airdrops which serve to reward early users, decentralize governance, and market new products.

Introduction

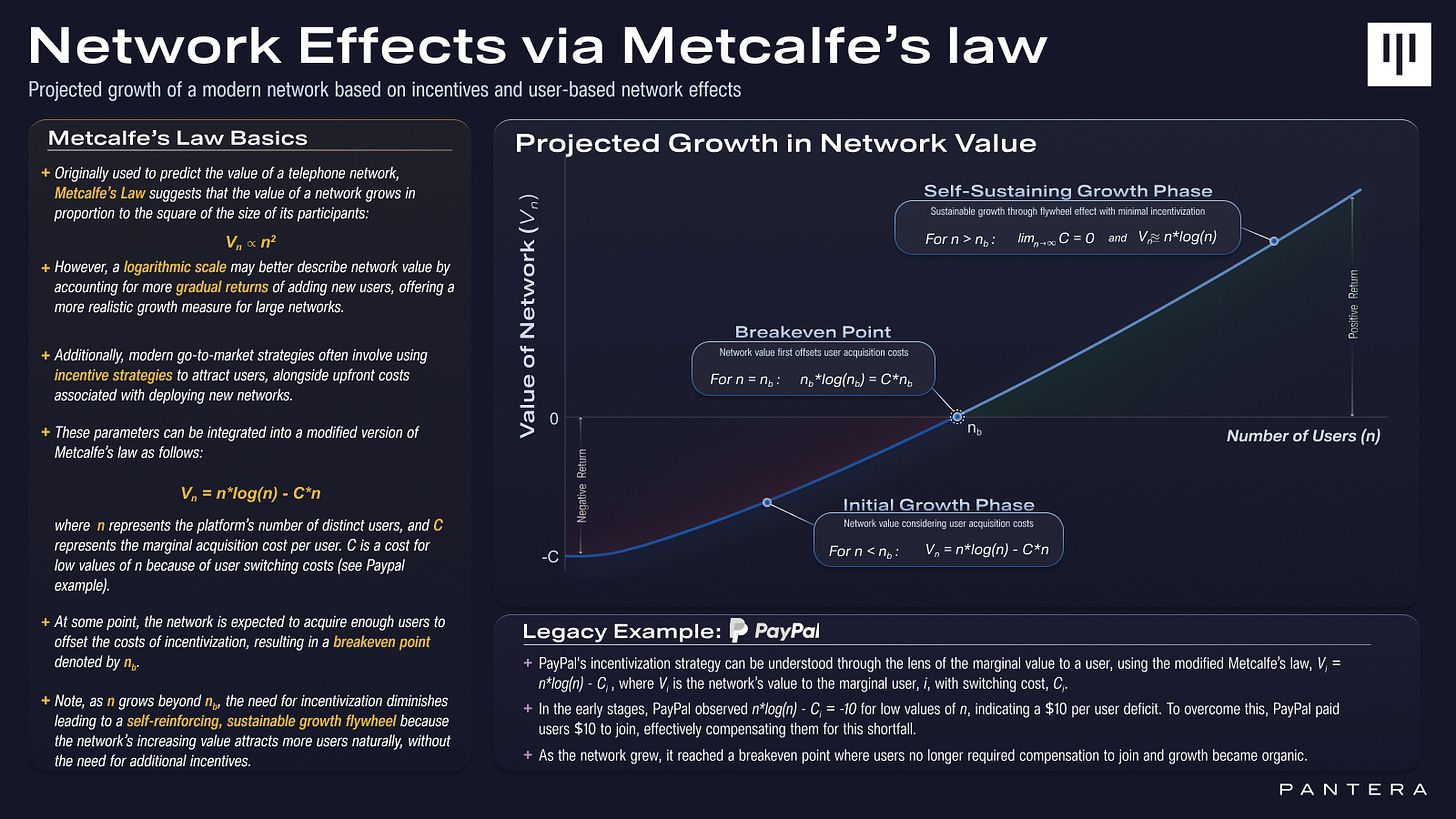

A classic story in Silicon Valley startup lore is Paypal’s decision to pay people $10 to use their product. The reasoning was that if you could pay people to join eventually the network value would be sufficiently high that new people would join for free, and you could stop paying. It certainly seemed to work, as PayPal was able to stop paying and continue growing, thereby bootstrapping its network effects.

In crypto, we have adopted and extended this approach with airdrops, paying people not just to join but typically to use our products for some period.

Quasi-Hyperbolic Discounting Model

Airdrops have become a multifaceted tool used to reward early users, decentralize protocol governance, and, frankly, to market something new. Formalizing the distribution criteria has become an art, particularly when determining who should be rewarded and the value attributed to their efforts. In this context, both the quantity of tokens distributed and the timing of their release, often through mechanisms like vesting or gradual release, play significant roles. These decisions should be grounded in systematic analysis rather than relying on guesswork, sentiment, or precedents. Using a more quantitative framework ensures fairness and strategic alignment with long-term objectives.

The quasi-hyperbolic discounting model provides a mathematical framework to explore how individuals make choices involving trade-offs between rewards at different times. Its application is particularly relevant in areas where impulsivity and inconsistency over time significantly influence decision-making, such as financial decisions and health-related behaviors

The model is driven by two population-specific parameters: present bias, ꞵ, and the discount factor, 𝛿.

Present Bias (ꞵ):

This parameter measures the tendency of individuals to prioritize immediate rewards over those that are further away disproportionately. It varies between 0 and 1, where a value of 1 indicates no present bias, reflecting a balanced, time-consistent evaluation of future rewards. As values approach 0, they signify an increasingly strong present bias, indicating a heightened preference for immediate rewards.

For instance, given the choice between 50 today or 100 in a year, a person with a high present bias (closer to 0) will prefer the $50 immediately rather than waiting for the larger sum.

Discount Factor (𝛿):

This parameter describes the rate at which the value of future rewards diminishes as the time until their realization increases, accounting for the natural decline in their perceived value with delay. The discount factor is more accurately quantified over longer, multi-year intervals. When assessing two options in the short term (less than one year), this factor exhibits considerable variability as immediate circumstances can disproportionately influence perception.

For generalized populations, studies show the discount rate is usually around 0.9. However, this value is often substantially lower among groups with gambling tendencies. Research indicates that habitual gamblers typically exhibit a mean discount factor slightly below 0.8, whereas problem gamblers tend to have a discount factor closer to 0.5.

Using the above terms, we can express the utility U of receiving a reward x at time t through the following formula:

U(t) = tU(x)

This model captures how the value of rewards varies depending on their timing: immediate rewards are evaluated at full utility, while future rewards are adjusted downward in value, factoring in both the present bias and the exponential decay.

The Experiment

Last year, Pantera Research Lab conducted a study to quantify the behavioral tendencies of crypto users. We surveyed participants with two straightforward questions designed to gauge their preference for immediate payment versus receiving some future value.

This approach helped us ascertain representative values for both ꞵ and 𝛿. Our findings revealed that the representative sample of crypto users exhibits a present bias just above 0.4 and a notably low discount factor.

The study revealed an above-average present bias and a low discount factor among crypto users, suggesting a tendency towards impatience and a preference for immediate gratification over future gains.

This can be attributed to several interconnected factors within the crypto landscape:

- Cyclical Market Behavior: The crypto market is known for its volatility and cyclical nature, with tokens often experiencing rapid value fluctuations. This periodicity influences user behavior, as many are accustomed to navigating through these cycles rather than adopting the long-term investment strategies more common in traditional finance. The frequent ups and downs may lead users to discount future values more steeply, wary of potential downturns that could erase profits.

- Stigma Around Tokens: The survey specifically asked about tokens and their perceived future value, which could have highlighted an ingrained stigma associated with token-specific trading. The stigma, tied to the periodic and often speculative nature of token valuations, reinforces a cautious approach to long-term investments in the crypto space. Additionally, suppose the survey had measured preferences using a fiat currency or another form of reward. In that case, the discount rates of crypto users might align more closely with global averages, suggesting that the nature of the reward could significantly influence the observed discounting behavior.

- Speculative Nature of Crypto Applications: Today's crypto ecosystem is deeply rooted in speculation and trading, traits that are prevalent in its most successful applications. This tendency highlights that current users overwhelmingly favor speculative platforms, a preference reflected in the survey results, which show a strong inclination towards immediate financial gains.

While the study's results may diverge from typical human behavior norms, they reflect the characteristics and tendencies of the current crypto user base. This distinction is especially pertinent for projects designing airdrops and token distributions, as understanding these unique behaviors allows for more strategic planning and reward system structuring.

Take, for example, the approach by Drift , a perps DEX on Solana, which recently launched its native token, DRIFT. The Drift team included a time-delay mechanism in their token distribution strategy, offering to double the rewards for users who wait 6 hours after the token launch to claim their airdrop. The time delay was added to mitigate the congestion typically caused by bots at the outset of airdrops and potentially help stabilize the token's performance by reducing the initial surge of sellers.

In fact, only 7.5k , or 15% (at the time of writing), of potential claimers did not wait the 6 hours for their rewards to double. Based on our presented research, with a doubled value for the reward, Drift could have delayed a few months and statistically should have appeased most of their end users.

Stay up to date with the latest research from Pantera Research Lab by following our Head of Research, Matt Stephenson , and Research Engineer, Ally Zach .

- Paul Veradittakit

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.