Empire Newsletter: Bitcoin’s back to correlating with US equities

And, has Gensler’s SEC gone too far?

Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter .

Retreat, retreat!

Keep calm and hold on.

It might be another rough day in the markets as crypto copes with some macroeconomic data.

Between the Consumer Price Index print and the Federal Reserve’s meeting later today, there might be some more wild moves on the horizon for bitcoin and ether.

Though, as of this morning, bitcoin’s trying to regain some of the ground it lost yesterday.

BTC, which took off thanks to the CPI print, is trying to retake $70,000, marking a 3.6% increase over the past 24 hours — which have been, shall we say, volatile.

ETH was also hit by the selloff yesterday, dropping down to $3,300 at its low point, but has since regained the $3,500 level.

K33 Research analysts pointed out that bitcoin’s back to correlating with US equities, at levels not seen since 2022.

K33’s chart shows the close correlation between the Nasdaq and bitcoin

K33’s chart shows the close correlation between the Nasdaq and bitcoin

Unless the Fed decides to shock everybody — and, as I said on Monday, the chances of this are incredibly low — there won’t be a rate change announced today. Don’t discount Fed Chair Jerome Powell though, because his press conference and the statement released alongside the decision could affect the market.

“At the press conference, we expect Chair Powell will express confidence that the economy is still on the right path and that the FOMC can be patient in gaining confidence that inflation is heading toward two percent,” JPMorgan analysts wrote in a FOMC preview note.

Economists, and apparently crypto analysts, will take a look at the Fed’s dot plot, which shows what the Fed heads (or policymakers if you don’t like my term) are thinking when it comes to rates and when to expect easing or tightening of rates. It’s not a perfect way to gauge what the Fed is thinking, but following the jobs report on Friday, it’s going to be a helpful indicator of what to expect — especially if bitcoin continues to correlate with the stock market.

While bitcoin’s trying to walk hand-in-hand with equities, this isn’t On the Margin — our newest newsletter written by host Felix Jauvin and our very own Casey Wagner and Ben Strack — so if you want more on the macro environment, head here .

Now let’s zoom into crypto, starting with the liquidations over the past 24 hours. CoinGlass data shows that roughly $168 million in liquidations have taken place.

K33 noted on Tuesday that CME traders “de-risked… following negative U.S. spot ETF daily flows, breaking a record 19 days of net inflows. CME’s annualized futures premiums stuck around 12% for both BTC and ETH last week but declined to a low of 6% on Tuesday, levels not seen since May 23.”

But, despite the cautious behavior from institutional traders, the analysts note that “exposure reigns high as open interest sits near all-time highs.”

BitOoda wrote late Tuesday that the outflows seen from the bitcoin ETFs stemmed from traders “reducing risk” ahead of both the Fed decision and CPI. The thesis could track with the outlaws of $200 million recorded yesterday, which tops the outflows of $60 million Monday night.

And, while it’s clear that bitcoin’s establishing a pattern of following equities right now, I’d be remiss to not remind you that we’re only a few months post-halving. It’s not historically unusual for bitcoin to have a bit of a sideways moment before it regains momentum.

K33 aptly referred to today as “wild Wednesday” so stay on your toes, though the CPI data may have just saved us from an otherwise volatile day but it’s early yet.

P.S. David and I need your help. No, we’re not soliciting you for donations. Phew. We just want to get to know you better. Fill out this survey and help us produce journalism tailored to you and your crypto interests.

— Katherine Ross

Data Center

- Bitcoin is trading above $69,000 as the market waits for today’s FOMC meeting results.

- Ether is similarly flat, hovering above $3,600 during the morning trade.

- American equities are just as steady in pre-market trading ahead of the FOMC results, per CNN.

- US spot bitcoin ETFs posted $200 million in net outflows on Tuesday.

- Consumer Price Index (CPI) core consumer prices rose 3.4% year over year in May, slightly lower than expectations.

Haters gonna hate

“Snake oil salesmen.”

That’s the term Kerrisdale Capital used last week when explaining why they’re shorting bitcoin miner Riot. And, while they’re only taking one short position currently, they didn’t exactly seem bullish on the industry.

In a thread on X, the firm said they planned to “launch a war against bitcoin miners, an industry of snake oil salesmen that are incinerating both investor capital and the environment and should be banished from America much like the Chinese RTO frauds that we helped kick out a decade ago.”

So what’s the beef?

Kerrisdale thinks that Riot isn’t very good at returning shareholder value, and that they’re more focused on “issuing stock” and “energy arbitrage games.”

Riot didn’t return my request for comment on these allegations.

The short-seller pointed out that Riot has never generated positive cash flow.

“Bitcoin mining is easily among the worst business models for a public company we have ever encountered: unpredictable revenue, capital intensive, extremely competitive, a pure commodity product, and lately drawing intense regulatory scrutiny even in crypto-friendly places like Texas where Riot has 100% of its bitcoin production,” the report said.

Kerrisdale noted that investors no longer have to rely on bitcoin miners as a proxy to the digital asset thanks to the newly approved bitcoin ETFs. The argument itself isn’t new — MicroStrategy’s Michael Saylor has been batting it down since the ETFs inched toward the finish line last year — but the timing is. We’re now post-halving, and in a weird sideways moment (as I mentioned above).

(Though Bernstein notably had a different take back in March, arguing that miners do remain a good equity proxy.)

But whether that’s the case or not, Riot hasn’t exactly had a top-notch year in the traditional markets.

Stock-wise, the company is down 35% year to date and it’s faced several headwinds including the halving (obviously) and it’s now locked in a battle with Bitfarms.

In case you haven’t been keeping up on the MA front: Riot acquired a sizable position in Bitfarms and privately proposed to buy the company. Bitfarms said no, thanks. Riot didn’t love that and acquired a roughly 12% stake. In return, Bitfarms adopted a poison pill strategy, which essentially just means that the company would dilute Riot’s shares if it tries to amass a position over 15%. It’s fair to say that this isn’t the best-case scenario for the miner.

In a statement released early Wednesday, Riot CEO Jason Les said that the Bitfarms strategy showed “disregard for the perspectives of its shareholders.”

While Kerrisdale may be drinking the hatorade, JPMorgan analysts think there’s a runway for the stock. The firm, in a May 28 note, reiterated its overweight rating with a price target of $15 a share.

We’ll just have to see how the miners weather the next few months as the post-halving slump sets in.

— Katherine Ross

The Works

- A group of bitcoin mining execs held a meeting with former US President Donald Trump as the Republican seeks a second term in the White House, per Bloomberg .

- It’s yet another FOMC meeting results day, with Fed officials expected to hold interest rates steady once again.

- UK crypto firms are said to be trying to cultivate stronger ties with the Labour Party ahead of an election next month.

- PleasrDAO is suing Martin Shkreli after Shkreli allegedly played recordings of a one-of-a-kind Wu-Tang Clan record on social media.

- Apple became the latest tech giant to enter the generative AI business (albeit a tad late), per the New York Times.

The Morning Riff

Q: Has Gensler’s SEC gone too far?

When you have the Wall Street Journal’s editorial board chastising your approach in an opinion piece, then you’ve probably taken it a step too far, especially when they bring up a crypto enforcement case to close out their point. (The SEC can close the Salt Lake office, but the DEBT Box sanctions won’t be forgotten any time soon.)

My point being that Gensler’s SEC is really relying on this regulation-by-enforcement approach, which opens up a Pandora’s box of sorts because it relies on various courts and judges to weigh in on regulatory matters (most of which are unclear to begin with). It also creates confusion when different courts say different things.

It’s tough to quantify “too far,” but the lack of clarity on a lot of fronts — from SAB 121 to the securities questions to the larger framework — aren’t doing anyone any good.

— Katherine Ross

I’m going to try and play a bit of the devil’s advocate here.

Gensler has “gone too far” in the sense that he’s definitely not winning any popularity contests when it comes to market oversight, crypto or otherwise. Perception-wise, he’s definitely wounded, and that’s notable given Gensler’s sometimes weird public presence on Twitter.

But what to do otherwise? Democrats and Republicans have (very recent partial victories aside) failed to update the rules to account for new technologies and business models, leaving agencies like the SEC to sort of just…figure it out on their own. Because Congress and the White House (and many of their donors) prefer an unchanging but unclear status quo, nothing actually gets done in the end, with half-finished legislation being kicked from one season to the next.

Has the SEC gone too far, at least with respect to crypto? I think it’s fair to say yes. But both US political parties have long come up far, far too short (political posturing aside), and that’s the real problem here.

— Michael McSweeney

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter .

Explore the growing intersection between crypto, macroeconomics, policy and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the On the Margin newsletter .

The Lightspeed newsletter is all things Solana, in your inbox, every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.

- Bitcoin mining

- BTC

- Empire Newsletter

- SEC

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple Agrees to $50M SEC Settlement in Lawsuit Conclusion

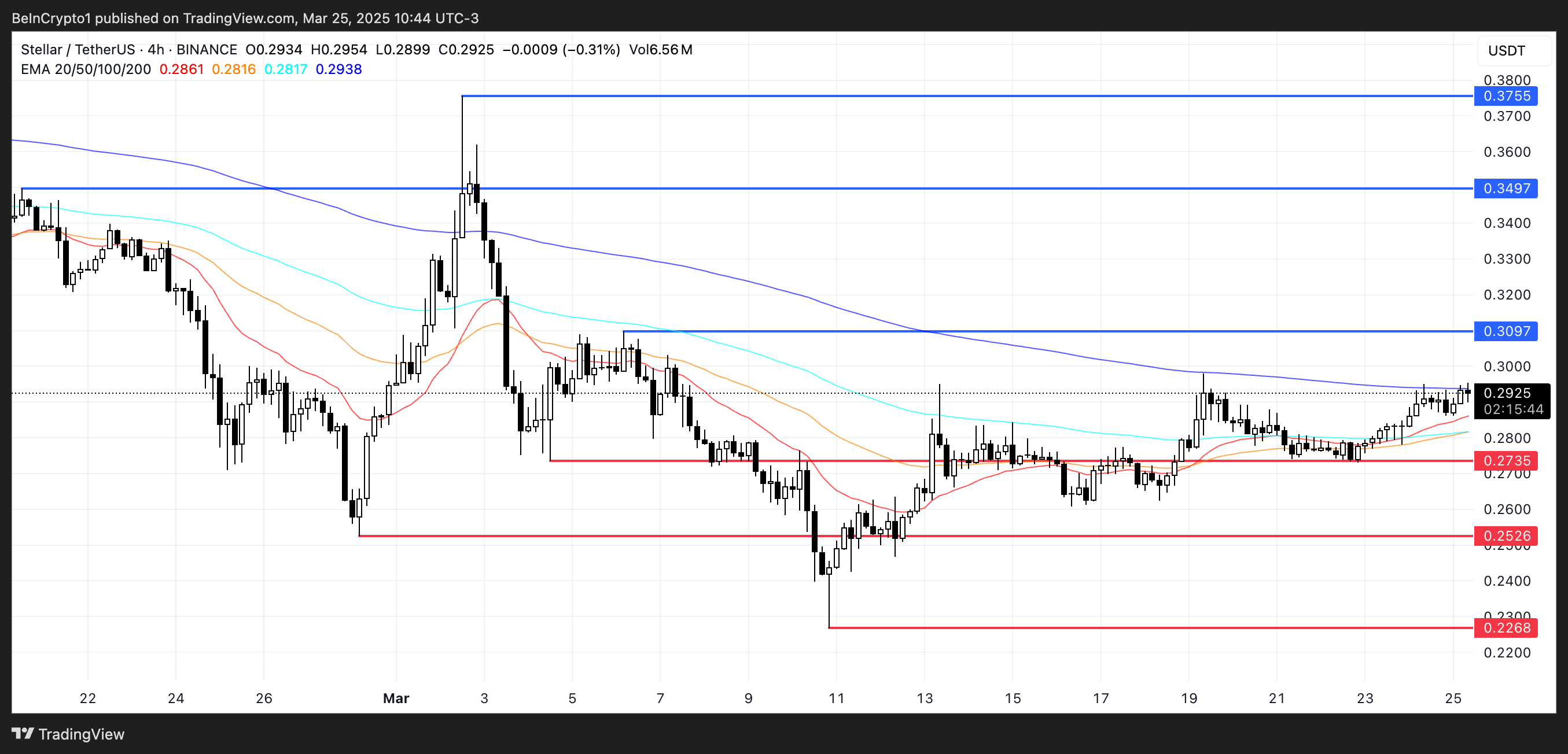

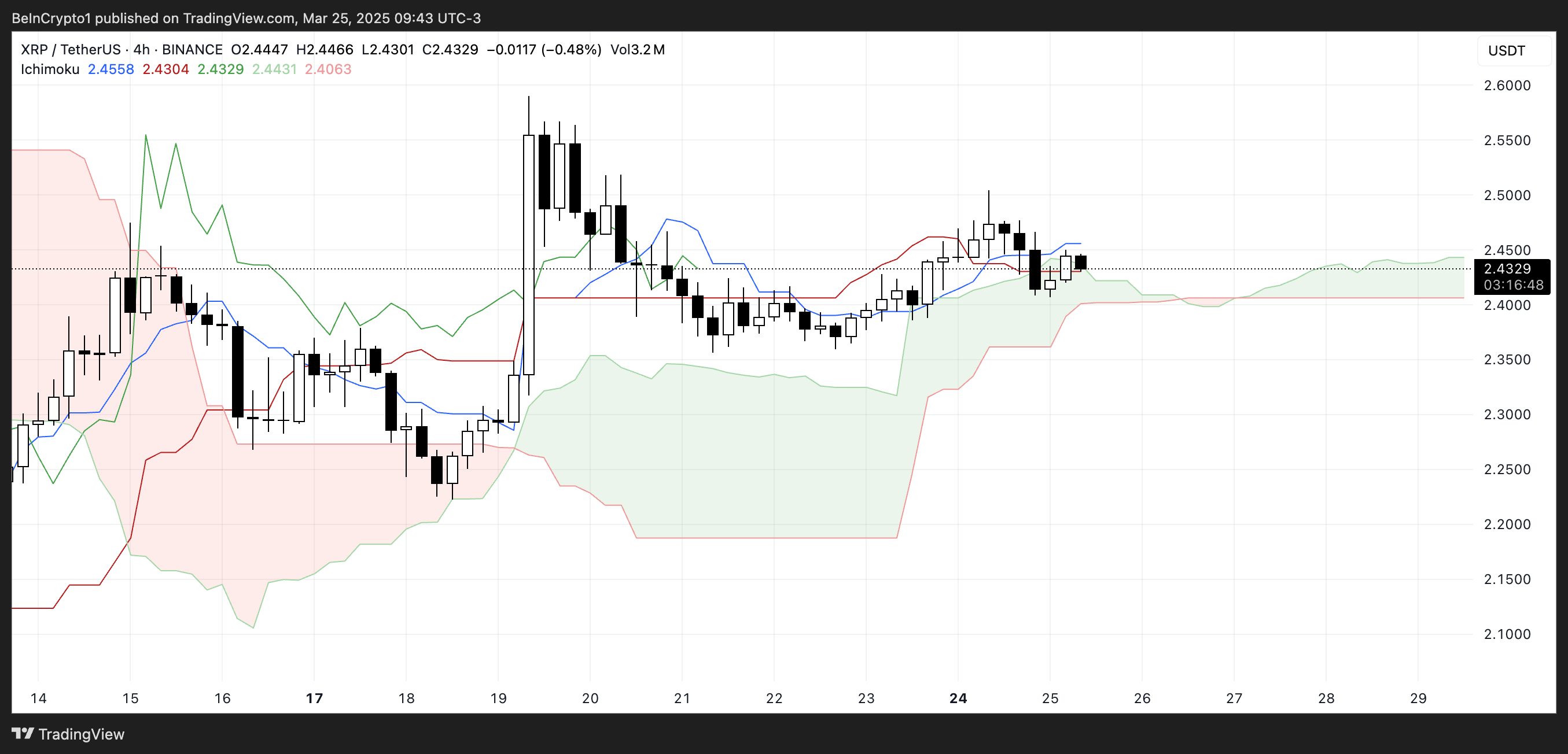

XRP Remains in Consolidation: Analyzing Market Indecision and Potential Price Movements

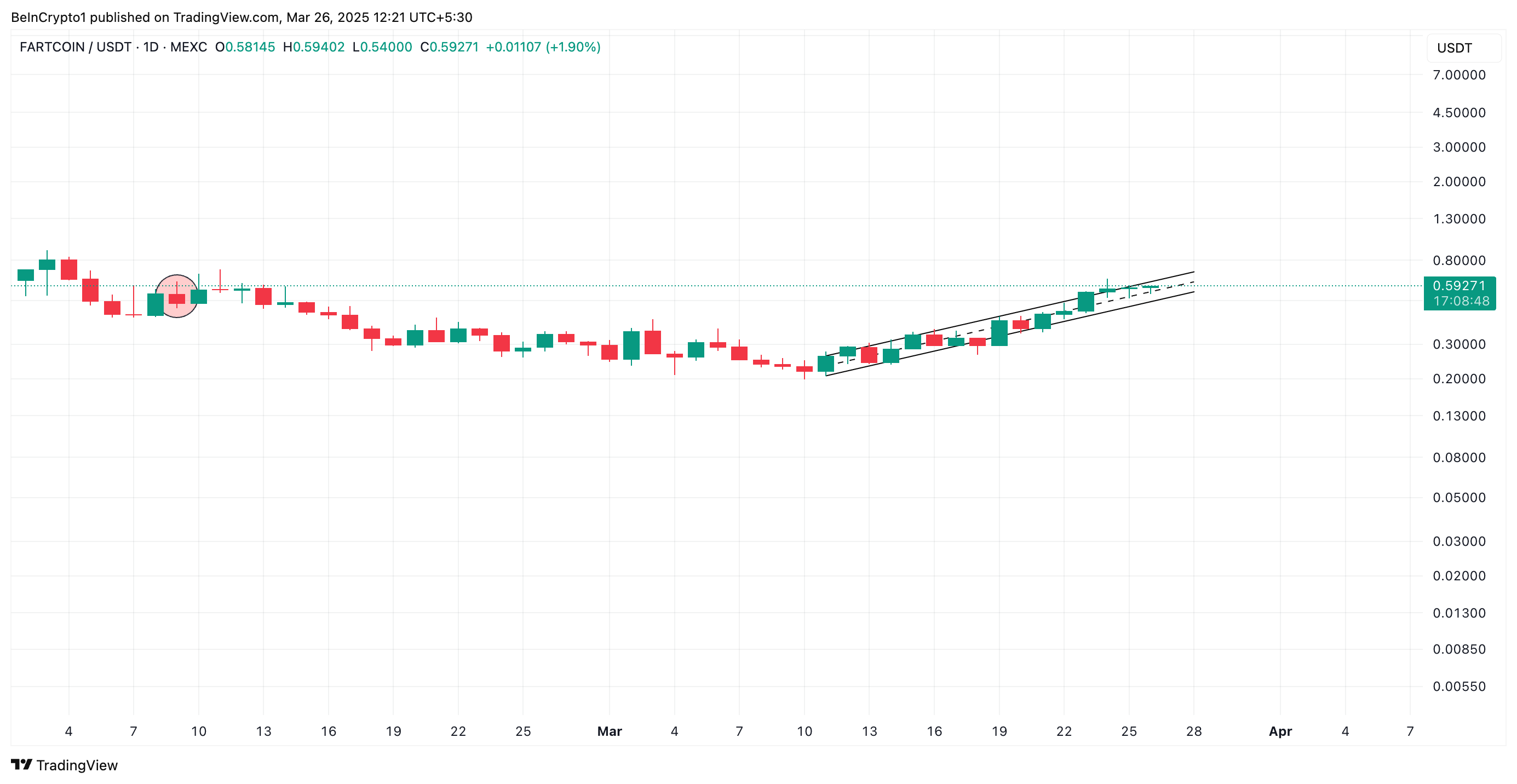

FARTCOIN Sees 11% Surge Amid Meme Coin Frenzy—Could It Target $0.95?