South Korea to treat certain NFTs as regular crypto, new rulebook says: report

South Korea’s Financial Services Commission published a new set of guidelines for regulating NFTs on Monday, according to Yonhap news agency. The country’s regulators will regulate mass-produced NFTs that have become exchangeable per their review as cryptocurrencies.

South Korea's top financial regulator issued new guidelines aimed at non-fungible tokens on Monday to provide regulatory clarity on NFTs, according to Yonhap news agency.

The new guidelines reportedly stated that the Financial Services Commission (FSC) will regulate certain NFTs as regular cryptocurrencies if they are deemed to no longer possess the unique qualities that distinguish them from cryptocurrencies.

The FSC may classify an NFT as crypto in a regulatory context if it is mass-produced, fairly exchangeable, capable of being fractionalized or being used for payments for goods and services, Yonhap reported, citing the guidelines.

On the other hand, digital tokens that are not transferable and have small to no economic value would be classified as regular NFTs. An example of such would be an NFT proof of transaction or an NFT ticket for a concert.

An FSC spokesperson told Yonhap that a collection with around a million NFTs issued may be traded and used as payment measures like cryptocurrencies. However, the FSC said it would make the distinction through a case-by-case review and that there would not be one absolute standard used to interpret NFTs as crypto in the regulatory context.

The FSC’s new rule book also suggested that an NFT can be classified as a financial security, if it has corresponding characteristics stated in the country’s Capital Markets Act.

South Korea’s new crypto law

The new guidelines precede South Korea’s first crypto-focused regulatory framework, which will be in full effect from July 19. The law, named the Virtual Asset User Protection Act, aims to eradicate illicit market acts, such as using undisclosed information for crypto investments, manipulating market prices and engaging in fraudulent transactions.

The act also requires cryptocurrency service providers to safeguard over 80% of deposits in cold storage to protect user funds and enroll in insurance programs for potential user compensation in the event of security breaches.

The new law is part of South Korea’s two-part legislation that seeks to establish a regulatory framework for the crypto industry. The second half of the regulation, currently under development, focuses on standardizing crypto token issuance and information disclosure for investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News: With the Latest XRP ETF Updates, Will XRP Price Surge to NEW ATH?

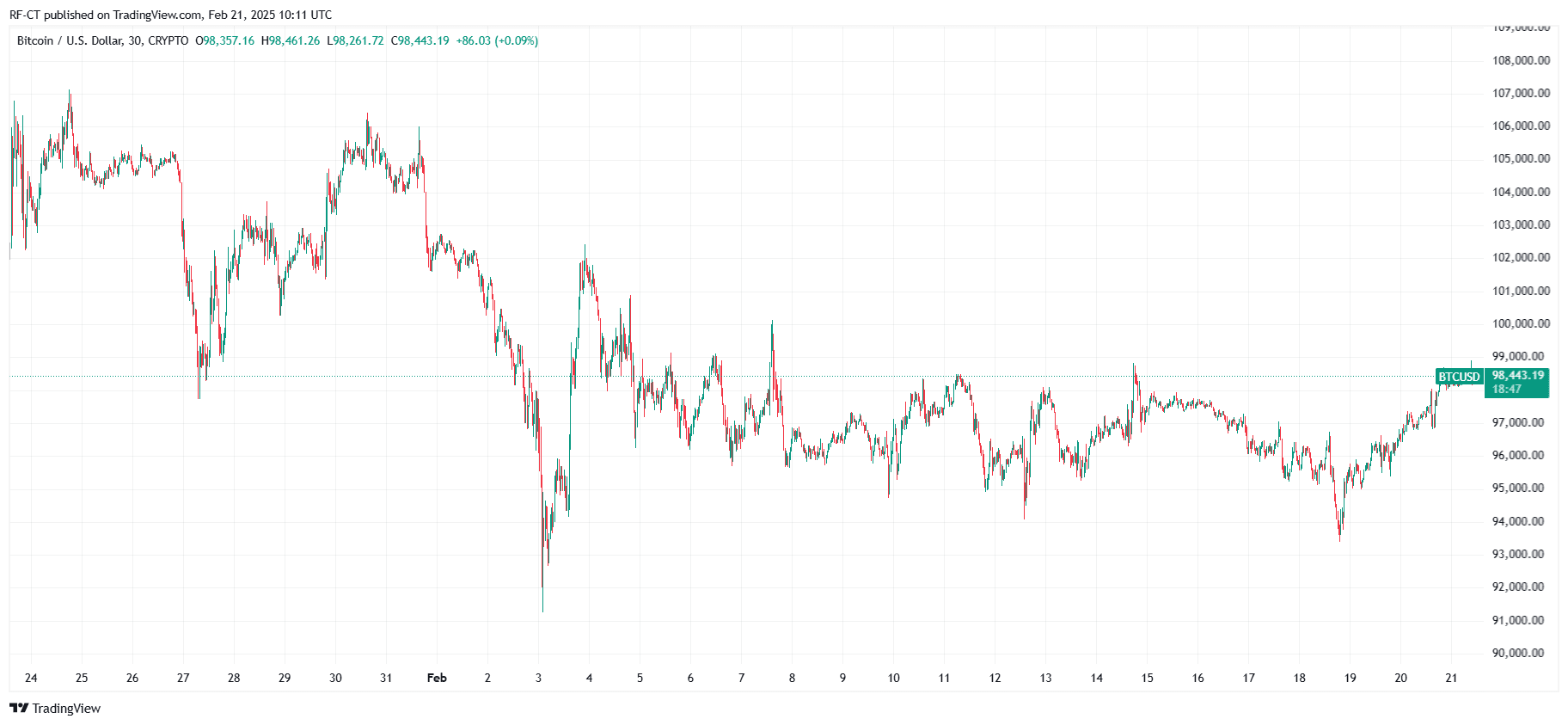

Bitcoin Price Prediction: BTC Price Over $100,000 AGAIN Soon?

With XRP Under Pressure, Major Investors Shift Focus to this Rising Altcoin

Is Trump Pro-Crypto? Only One-Third of Australians Think So