Linea reaffirms decentralization plan after deliberately pausing block production amid Velocore hack

Quick Take Linea halted its block production in response to an exploit involving Velocore. The project later clarified it plans to fully decentralize the network.

Ethereum Layer 2 blockchain Linea said it plans to decentralize the network following its deliberate block-production halt.

Linea did so in response to a security exploit on Velocore, a decentralized exchange on the network, which led to an unauthorized withdrawal of over $7 million in ether on June 2.

To prevent the hacker from converting a portion of stolen tokens into ether, Linea took necessary actions that it believed would protect the broader ecosystem. "Linea's team made a decision to halt block production by pausing the sequencer and censor attacker addresses to protect the users and builders in our ecosystem," it said . "One of the key drivers in our decision to pause the sequencer was that the hacker had acquired and was beginning to sell a large sum of tokens into ether."

The sequencer was paused from block 5081800 and 5081801, according to Linea. The incident and Linea’s response to the hack triggered comments from industry figures, including Matter Labs’ CEO Alex Gluchowski, who emphasized the urgency for Layer 2 networks to prioritize decentralization.

“Decentralizing the sequencer isn’t optional. Every serious L2 stack must make it a priority,” said Gluchowski, who leads the development of zkSync — a competitor to Linea.

A sequencer is a component that organizes and batches multiple off-chain transactions on a Layer 2 rollup before they are submitted to the Ethereum mainnet.

Linea, which is a ZK Rollup backed by Consensys, acknowledged that the network is in “training wheels” phase, indicating that the network is still centralized. However, the project added it plans to actively moving towards a decentralized model where unilateral actions by core developers cannot halt the chain.

“Linea’s goal is to decentralize our network — including the sequencer. When our network matures to a decentralized, censorship-resistant environment, Linea’s team will no longer have the ability to halt block production and censor addresses - this is a primary goal of our network,” it noted on X.

Linea’s product lead, Declan Fox, responded to Gluchowski’s post and reiterated the project’s commitment to quickly decentralizing the network. “Linea is on a solid path to decentralising all aspects of the network in a very aggressive time window,” Fox said .

Moving towards decentralization

While rollups offer a promising solution for scaling Ethereum dApps, they inherently introduce centralization risks due to reliance on sequencers controlled by project teams. This setup presents single points of failure and potential censorship issues.

Decentralizing this infrastructure would enable sequencer nodes from several parties to order and batch transactions on Layer 2 and submit them to the Ethereum base chain. The distributed nodes would then avoid the central point of failure and ensure fairness in block sequencing. Most Layer 2 chains do not yet possess decentralized sequencers but plan to do so in the future.

Despite a move towards such decentralization, the practice of halting entire blockchains to prevent hackers from transferring funds remains widespread across the industry — even among Layer 1 networks considered to be relatively more decentralized than Layer 2s. Historically, there have been several instances where teams at BNB Chain , Osmosis , and Acala halted their respective chains and censored perpetrators' accounts — working with validators — following large security exploits.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

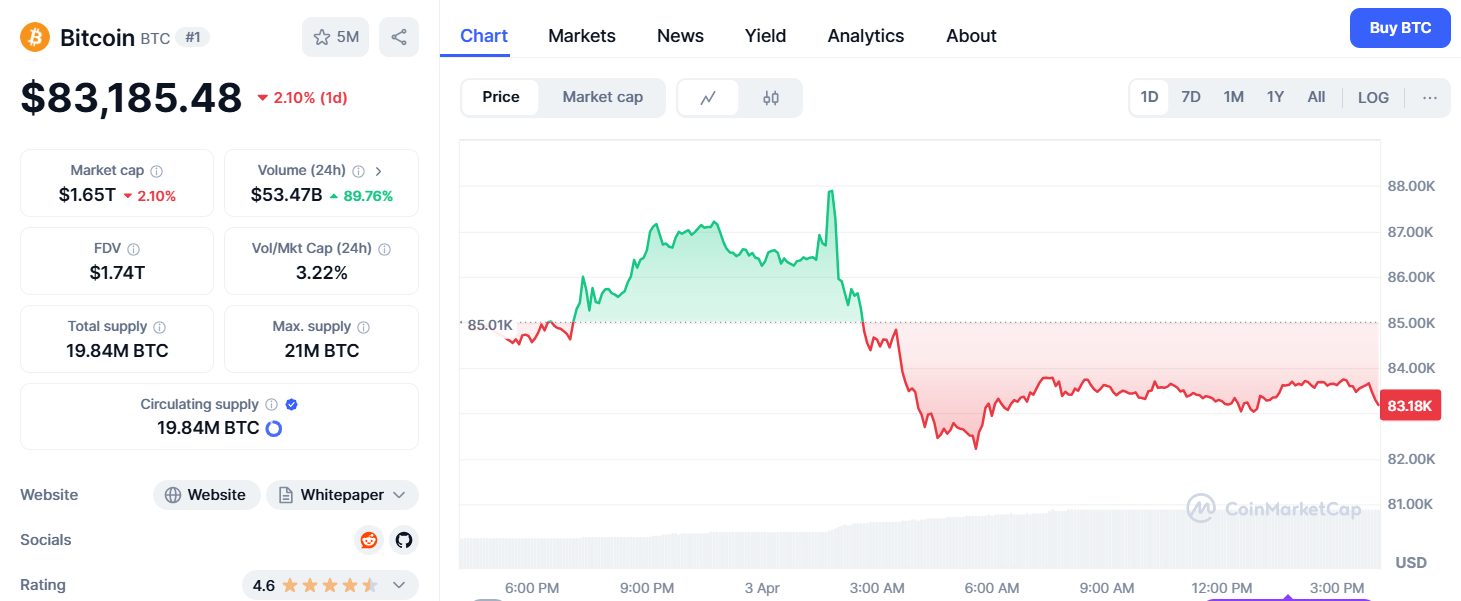

Crypto Market Becomes Casualty to Trump’s Tariff Announcements

Crypto Price Today (April 3, 2025): Bitcoin Falls After US Tariffs; ETH, XRP, SOL Fumbles

Analyst Expects BTC to Pump in April and Highlights Top 10 Hidden Gems with 200x Pump Potential

BIGTIME Surges Over 60% Within an Hour, Despite the $300 Million Liquidation in Crypto Under 4 Hours