USDC stablecoin issuer Circle plans to redomicile to the US ahead of possible IPO

Stablecoin issuer Circle is planning to redomicile from Ireland to the U.S. Circle confidentially filed for an initial public offering of its equity securities in January.

USDC +0.016% stablecoin issuer Circle plans to shift its legal base from Ireland to the United States.

Circle's parent company recently filed required paperwork with the High Court of the Republic of Ireland to redomicile the firm, a spokesperson confirmed to The Block. However, the reason for the move remains unclear. Bloomberg first reported the news on Wednesday.

A potential initial public offering for Circle could be among the reasons, especially given the U.S.’s higher tax burden compared to Ireland’s relatively low corporate tax rates, which makes the move otherwise unattractive.

In January, Circle confidentially filed for an IPO of its equity securities under plans to become a publicly traded company. The firm confidentially submitted a draft registration statement S-1 form to the U.S. Securities and Exchange Commission — a common approach for companies seeking to go public, offering them the flexibility to finalize their plans away from the public eye.

The firm previously said details on share quantity and pricing are yet to be determined, and that the launch is pending SEC review and subject to market and other conditions.

Circle’s USDC is the second-largest stablecoin behind Tether’s USDT, with a market capitalization of $32.9 billion, according to The Block’s price page .

In 2021, Circle agreed to go public through a merger with a Special Purpose Acquisition Company named Concord Acquisition Corp., but that arrangement later fizzled out.

Circle's investors include financial heavyweights like Goldman Sachs, Fidelity and BlackRock.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Stalls Below $90K as Traders Eye $86K Support, Says Michaël van de Poppe

Amazon’s AI assistant Alexa+ now works with Angi, Expedia, Square, and Yelp

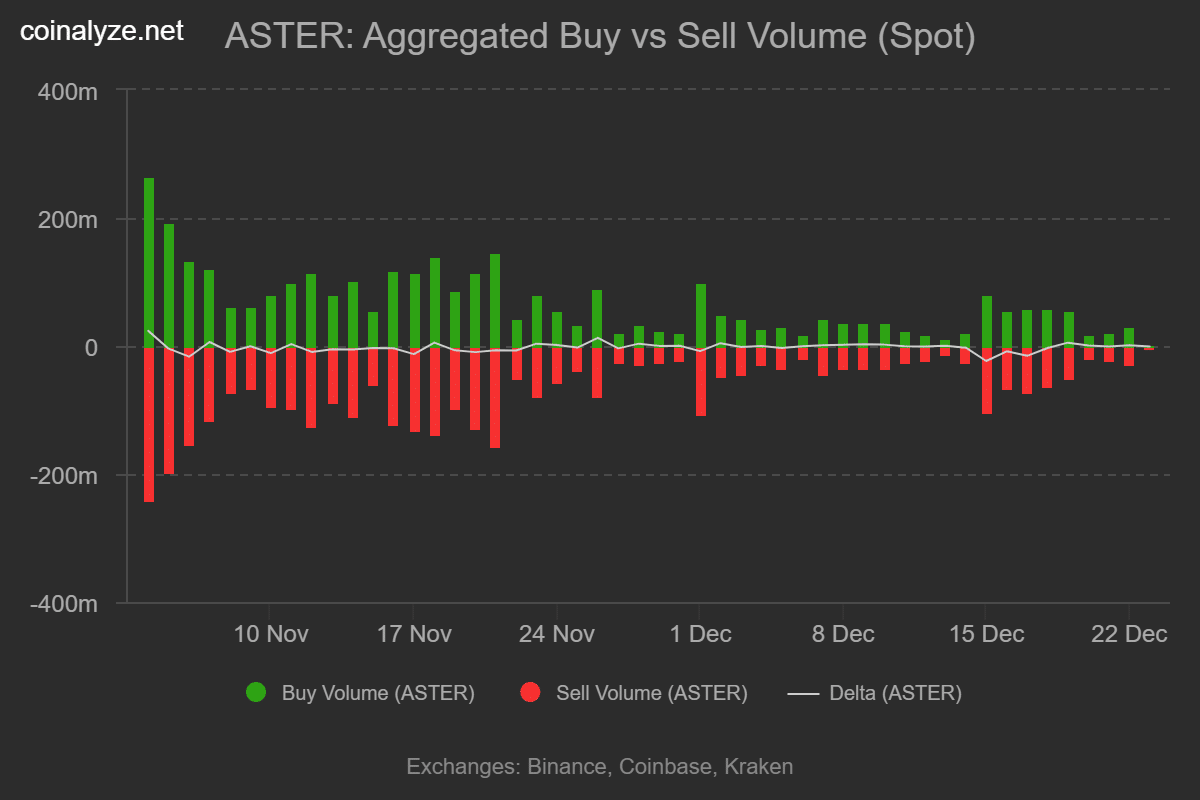

Aster DEX buys back $140M in tokens, yet prices stall – Why?

ETF data shows Bitcoin dominance held firm in 2025 as Ethereum gradually gained share