IBIT and FBTC ETFs hit $10 Billion AUM in weeks, smashing previous record of three years: analyst

JEPQ previously held the record for the fastest exchange-traded fund, reaching $10 billion in assets under management (AUM) in 647 trading days, taking around three years.BlackRock’s IBIT and Fidelity’s FBTC passed $10 billion AUM in 49 and 77 trading days, respectively.

"Prior to the bitcoin ETFs, the record speed for an ETF to reach $10 billion in assets was held by JEPQ who did it in 647 trading days (nearly three years). IBIT got there in 49 days, FBTC in 77 days," Balchunas wrote .

JEPQ is the JPMorgan Nasdaq Equity Premium Income ETF. It is an actively managed fund that uses the Nasdaq-100 Index as a benchmark, trades equity-linked notes and sells call options to provide income to its holders, according to Yahoo Finance. JEPQ shares trade at $53.42 as of 10:30 a.m. ET (14:30 UTC) on May 10, seeing year-to-date returns of 10.14%. Its net assets are $12.37 billion after launching on May 3, 2022.

BlackRock's iShares Bitcoin Trust IBIT and the Fidelity Wise Origin Bitcoin Fund FBTC launched on Jan. 11, 2024. Both funds give investors exposure to bitcoin's price movements while omitting the need to hold the asset itself.

IBIT crossed $10 billion in total inflows on March 11, 2024, and $15 billion in total inflows on April 12.

IBIT maintained $17.28 billion in assets under management as of May 6, according to The Block's Data Dashboard.

FBTC became the second bitcoin ETF behind IBIT to reach $1 billion inflows on Jan. 19, The Block previously reported. FBTC crossed $10 billion in assets under management on March 28. The fund saw its record inflow of $473 million on March 8. The Block's Data Dashboard shows FBTC's inflows reached nearly $100 million on May 6.

Both IBIT and FBTC are among the largest spot bitcoin ETFs by market share. IBIT holds 43.98%, and FBTC comes third with 18.34% behind Grayscale's GBTC.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pumpdotfun Surpasses Hyperliquid in 24H Revenue

Pumpdotfun beats Hyperliquid in 24-hour revenue, marking a major shift in the DeFi trading race, according to DefiLlama.What’s Driving Pumpdotfun’s Revenue Surge?What It Means for DeFi

XRP ETF Set to Launch This Week in Major Milestone

Rex-Osprey’s $XRPR to become the first U.S. spot XRP ETF, launching this week amid rising investor excitement.What is the $XRPR ETF and Why Does it Matter?A New Era for XRP and Crypto ETFs in the U.S.

First XRP and Dogecoin ETFs Set for US Unveiling This Week—Here's How

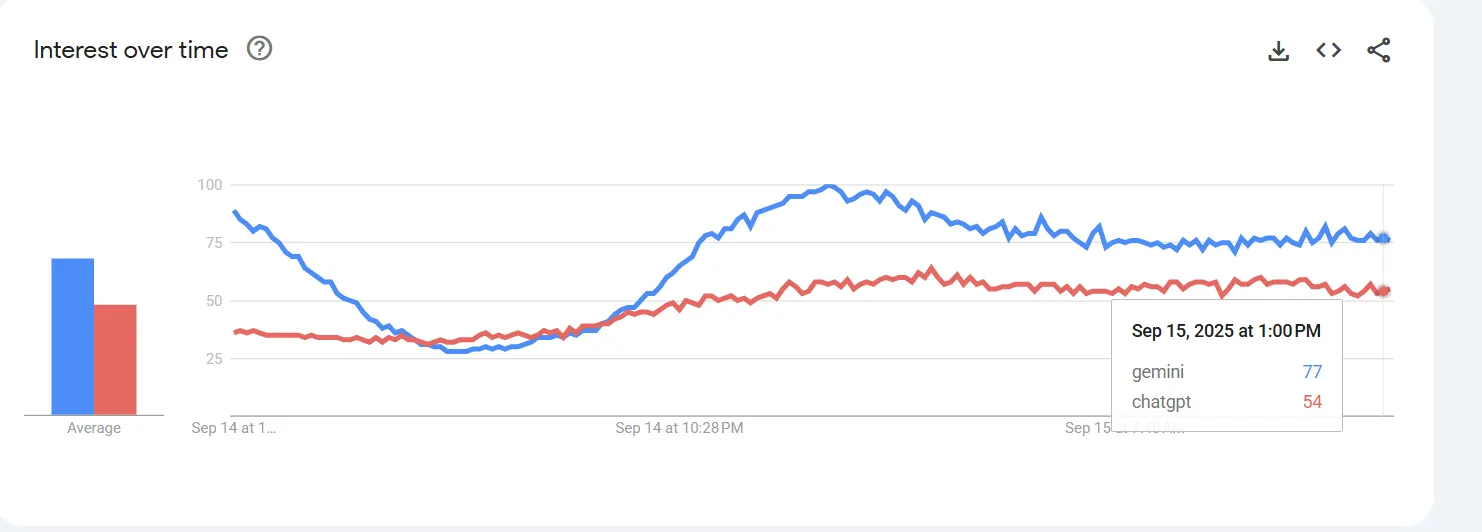

Nano Banana Saves Google: Gemini Dethrones ChatGPT as GOOG Hits $3 Trillion