This Bullish BTC Indicator Suggests Upside Above $70K: Bitcoin Price Analysis

Bitcoin’s price is yet to break above its recent high and create a new ATH. However, looking at the technical and fundamental signs, it might only be a matter of time.

Bitcoin Price Analysis: Technicals

By TradingRage

The Daily BTC Chart

Over the last month, the Bitcoin price has been trapped inside a large symmetrical triangle pattern on the daily timeframe.

Yet, it is currently testing the higher boundary of the pattern, trying to push above the $70K level. If a bullish breakout from the triangle occurs, a positive continuation and, subsequently, a new all-time high would be highly probable.

The 4-Hour BTC Chart

Looking at the 4-hour chart, it is evident that the BTC price has been bouncing around the higher trendline of the triangle and the $70K level recently. Yet, the $68K support zone has seemingly held strong, preventing the price from falling deeper inside the pattern.

Moreover, the Relative Strength Index is showing values above 50%, indicating that the market momentum is bullish at the moment. Therefore, a rally toward the $75K zone and even higher seems likely in the short term if the price does not fall back inside the pattern.

Sentiment Analysis

By TradingRage

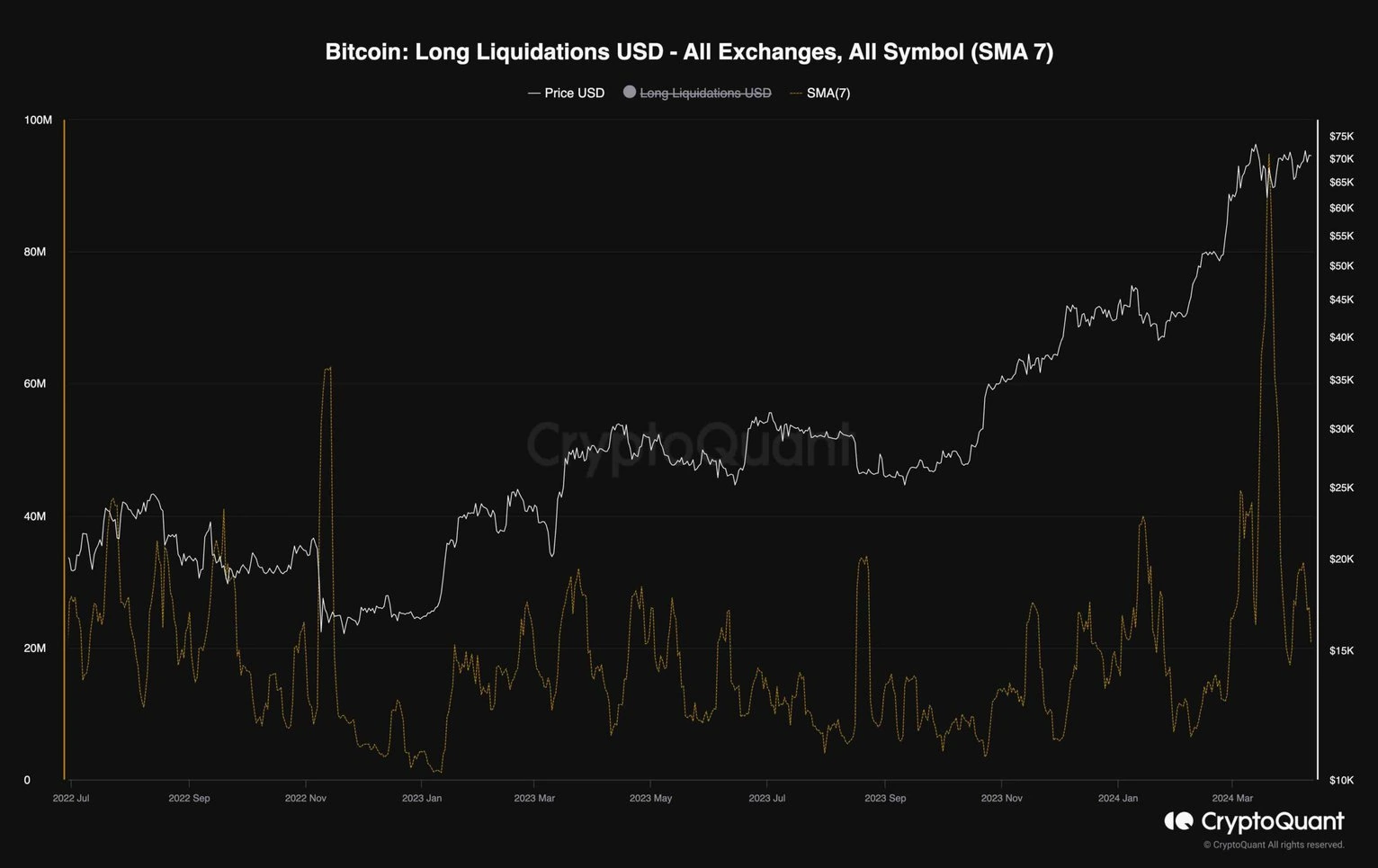

Bitcoin Long Liquidations

Bitcoin’s recent consolidation around the $70K mark is still going on, with the price showing no willingness to break to either side. Yet, things might be about to change, as the futures market sentiment suggests.

This chart demonstrates the long Bitcoin liquidations. It measures the amount of liquidations of long contracts. As the chart shows, during the recent consolidation, a significant amount of long positions were liquidated. Therefore, the futures market has seemingly cooled down, and BTC might be able to continue its rally soon and make a new all-time high.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin Is Sliding: How Low Can DOGE Price Go?

Hyperliquid (HYPE) Price Prediction 2026: Will Rising Adoption Propel It to $90? While Qubetics Presale Smashes Past $18 Million

Explore Hyperliquid's HYPE price prediction for 2026, with projections as high as $90. Discover Qubetics' $18M presale and how its Layer 1 wallet is redefining decentralized autonomy.The Rise of Hyperliquid: A Quiet Revolution in DeFiQubetics: Enabling Secure Digital Autonomy Through a Non-Custodial Multi-Chain WalletConclusion: Hyperliquid and Qubetics Define DeFi’s Next Frontier

Bitcoin Cycle Predicts $205K Peak in 2025

Bitcoin may hit $205K in 2025 if its 3-year growth, 1-year consolidation cycle holds true, signaling a potential 120% rally ahead.BTC’s Proven 4-Year Pattern Returns$205K in Sight: Can BTC Double Again?Why This Matters for Investors

Price predictions 6/18: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, SUI, BCH