The Bitcoin spot ETF had a total net inflow of $132 million yesterday, with the ETF net asset ratio reaching 4.16%

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Central African Republic launches memecoin as experiment, according to president's X account

The President of Central Africa Republic’s official X account announced a memecoin named CAR.The memecoin launch is said to be an experiment to see if a meme can “unite people” and support the “national development” of the Central African Republic.

The Funding: Why 'VC coins' like BERA are facing backlash

This is an excerpt from the 21st edition of The Funding sent to our subscribers on Feb. 9.The Funding is a fortnightly newsletter written by Yogita Khatri, The Block’s longest-serving editorial member.To subscribe to the free newsletter, click here.

Is Arweave's Computing Platform AO the Future? Mainnet Launch Explained

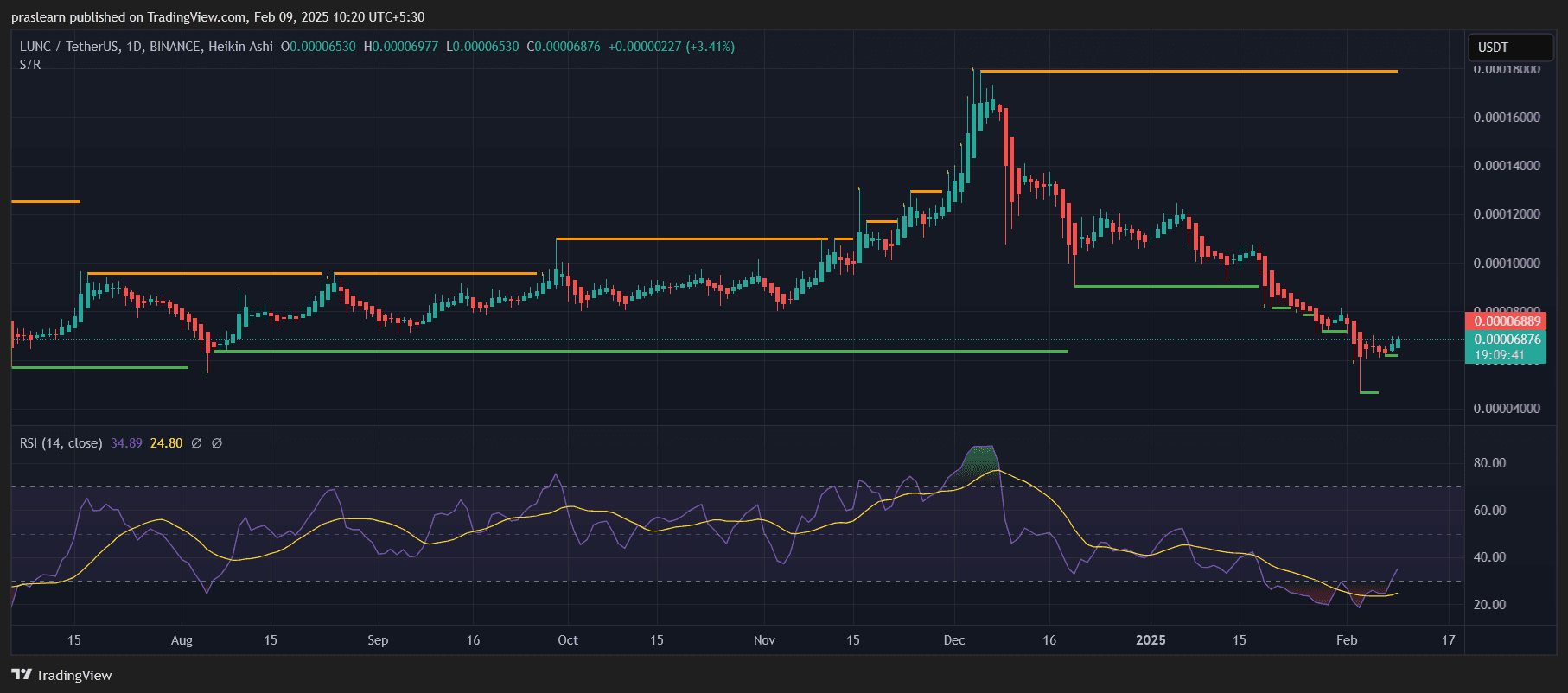

Is Terra Classic (LUNC) Gearing Up for a Comeback or Facing More Downside?