Bitcoin spot ETF had a total net inflow of 683 million US dollars yesterday, with an ETF net asset ratio of 4.24%

According to SoSoValue data, the total net inflow of Bitcoin spot ETF on March 13th (US Eastern Time) was $683 million.

Grayscale's GBTC ETF had a net outflow of $276 million in a single day yesterday.

The Bitcoin spot ETF with the highest single-day net inflow yesterday was BlackRock's IBIT ETF, with a net inflow of $586 million. The total historical net inflow of IBIT has reached $12.03 billion.

Next is Fidelity's FBTC ETF, with a single-day net inflow of approximately $281 million yesterday. The total historical net inflow of FBTC has reached $6.7 billion.

As of press time, the total asset value of Bitcoin spot ETF is $60.96 billion, and the ETF's net asset ratio (market value as a percentage of total market value) is 4.24%. The cumulative historical net inflow has reached $11.82 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Funding: Why 'VC coins' like BERA are facing backlash

This is an excerpt from the 21st edition of The Funding sent to our subscribers on Feb. 9.The Funding is a fortnightly newsletter written by Yogita Khatri, The Block’s longest-serving editorial member.To subscribe to the free newsletter, click here.

Is Arweave's Computing Platform AO the Future? Mainnet Launch Explained

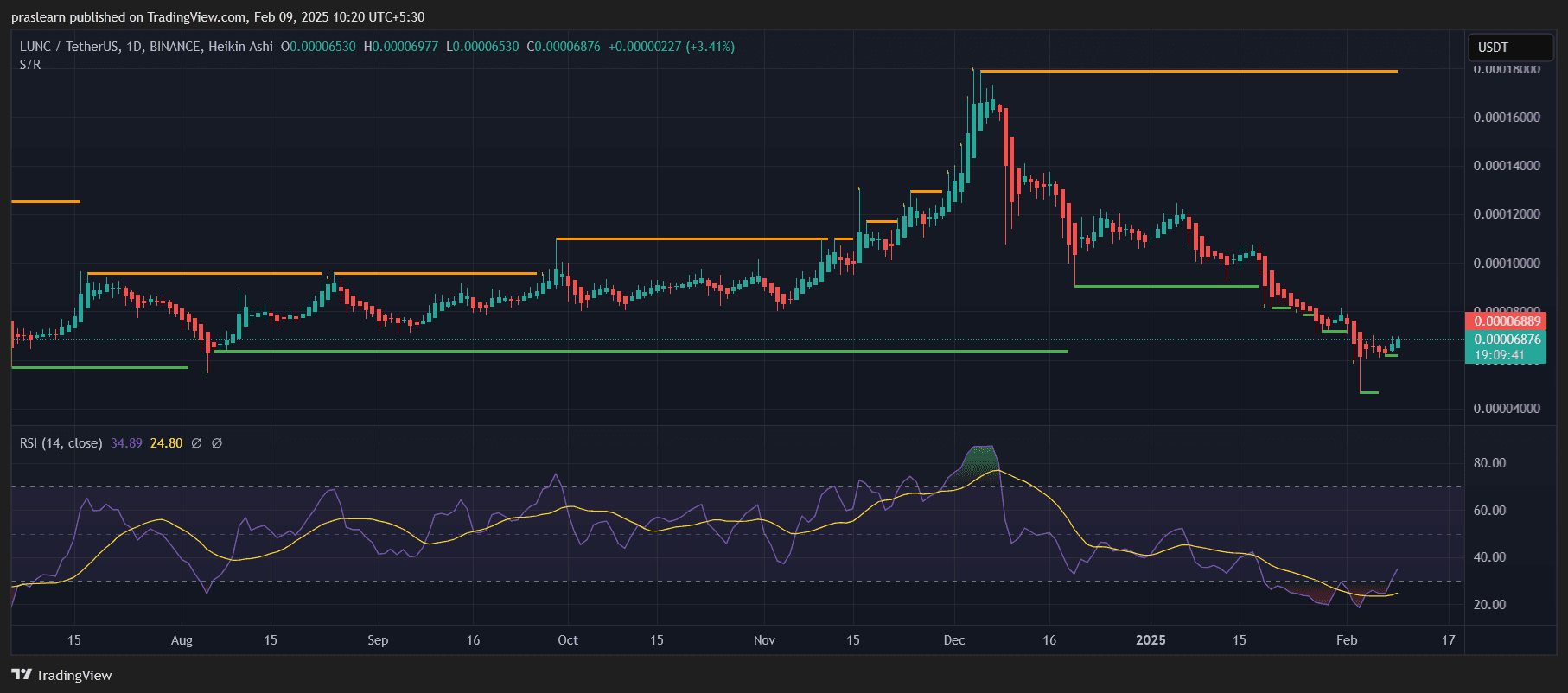

Is Terra Classic (LUNC) Gearing Up for a Comeback or Facing More Downside?

ETH Price Down 19.1% This Week: Is It Time to Invest?