News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

PENGU Holds $0.009 Support as Bear Pressure Builds: Consolidation Ahead?

Cryptotale·2025/12/26 12:45

Bitcoin’s Path Ahead: Market Conditions Signal Cautious Sentiments

Cointurk·2025/12/26 12:42

Trust Wallet Extension Bug Triggers $6M+ Crypto Losses, Forces Emergency Upgrade to Version 2.69

Crypto Ninjas·2025/12/26 12:12

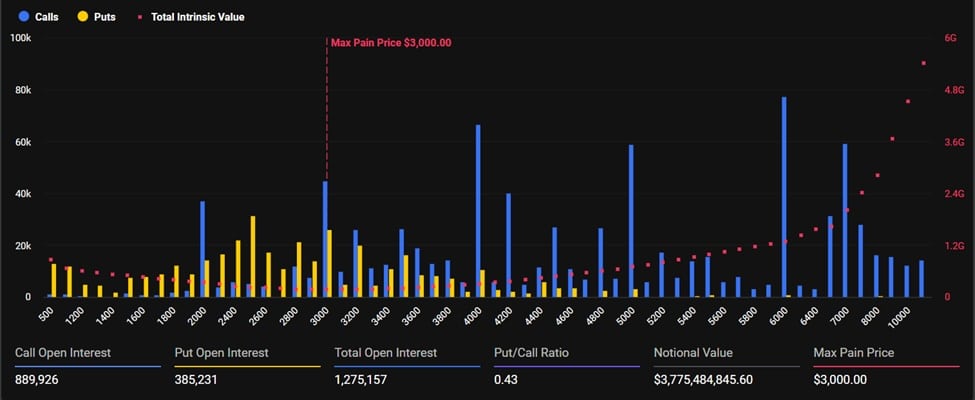

Bitcoin (BTC) Options Expiry Fuels Volatility Spike

Coinspeaker·2025/12/26 12:12

From Vision to Void: The Story of Sam Bankman-Fried

Cryptotale·2025/12/26 12:00

Dive into Solana and Cardano’s Quest for Future Growth

Cointurk·2025/12/26 11:33

Midnight Blockchain: The Revolutionary Manhattan Project for Privacy Tech

Bitcoinworld·2025/12/26 11:21

Critical Bitcoin Exit Opportunity: Peter Schiff’s Stark 2025 Warning for Crypto Holders

Bitcoinworld·2025/12/26 11:21

Revolutionary: How Lugano Embraces Bitcoin Payments for Everything from Taxes to Burgers

Bitcoinworld·2025/12/26 11:21

Trust Wallet’s Decisive Move: Full Compensation for $7M Hack Victims

Bitcoinworld·2025/12/26 11:21

Flash

12:45

Meme coins plunge from "Christmas frenzy" to harsh reality: market cap evaporates by 65% in one yearBlockBeats News, December 26 — The Meme coin sector approached its annual low in 2025, experiencing a significant pullback from the speculative peak seen during Christmas 2024. As of December 19, the total market capitalization of Meme coins dropped to $35 billion, marking the lowest level in 2025 and a decline of approximately 65% from the peak at the beginning of the year, before rebounding slightly to around $36 billion. In comparison, on Christmas Day 2024, the Meme coin market capitalization once approached $100 billion. At the same time, trading activity in the sector also declined, with annual trading volume dropping 72% to $3.05 trillion, indicating that retail funds are moving away from highly speculative assets. The market generally believes that Meme coins have always served as a "thermometer" for retail risk appetite. This sharp contraction in market capitalization reflects a more cautious environment in the current crypto market, with a clear decline in capital attraction.CoinGecko pointed out that the Meme coin boom in 2024 was closely related to the U.S. presidential election, with election-themed tokens quickly gaining popularity on social media, on-chain activities, and launch platforms. However, this political narrative backfired on market sentiment in 2025.

12:44

Meme Coin Goes From "Christmas Frenzy" to Harsh Reality: One-Year Market Cap Down 65%BlockBeats News, December 26th. The Meme coin sector approached its annual low in 2025, experiencing a sharp decline from the speculative peak around Christmas 2024. As of December 19th, the total market capitalization of Meme coins dropped to $35 billion, marking the lowest point in 2025, a decrease of approximately 65% from the year's high, followed by a slight rebound to around $36 billion.

By contrast, on Christmas Day 2024, the market cap of Meme coins once approached $100 billion. Meanwhile, sector trading activity has also declined synchronously, with the annual trading volume dropping by 72% to $3.05 trillion, indicating that retail funds are moving away from high-speculative assets.

The market generally believes that Meme coins have always been a "thermometer" of retail risk appetite. The significant contraction in market capitalization this time reflects a growing cautiousness in the current crypto market environment, with a noticeable decline in fund attractiveness.CoinGecko pointed out that the 2024 Meme coin boom was highly related to the U.S. presidential election, as election-themed tokens quickly gained popularity on social media, on-chain activities, and launch platforms. However, this political narrative has backfired on market sentiment in 2025.

12:43

Ukraine says Trump and Zelensky plan to meet on Sunday to seek a peace agreementAccording to TechFlow, on December 26, Ukrainian officials revealed that Trump is expected to host Ukrainian President Zelensky at Mar-a-Lago this Sunday in an attempt to reach an agreement on the U.S.-proposed peace plan. This meeting marks significant progress in the negotiations. Trump had previously stated that he would only meet with Zelensky if he believed an agreement was close to being reached. On Friday morning, after being briefed by chief negotiator Umerov, Zelensky posted on social media platform X: "We have not wasted a single day. We have agreed to hold a top-level meeting with President Trump in the near future. Several matters may be finalized before the New Year." The White House did not immediately respond to the matter.

News