News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.24)|Bitmine Buys Over $200M Worth of ETH Again; U.S. Q3 Real GDP (Annualized) at 4.3%; $200M in Long Liquidations Across the Crypto Market2Bitget US Stock Daily Report | S&P Hits Closing Record High; Gold Breaks $4500 for the First Time; US Q3 GDP Grows 4.3% (December 24, 2025)3Solana: Short-term pain, long-term hope? SOL faces liquidation test

Top Crypto Market News Today: Gnosis Executes Hard Fork While DeepSnitch AI Rallies 96%

BlockchainReporter·2025/12/24 21:45

Experienced Analyst Predicts When Bitcoin’s Decline Will Stop

BitcoinSistemi·2025/12/24 21:09

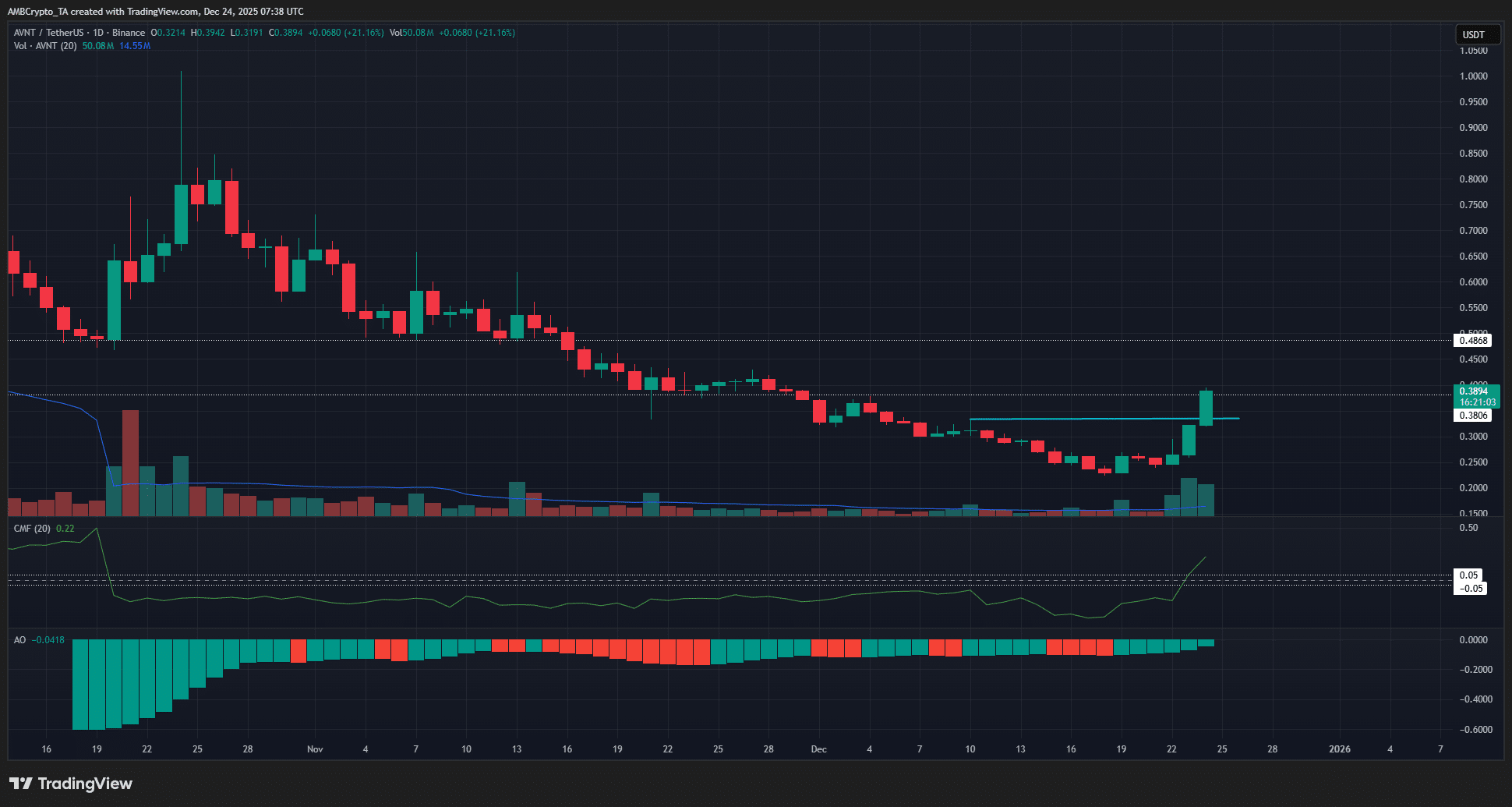

Avantis rallies 24% in a day – Can AVNT squeeze toward $0.40?

AMBCrypto·2025/12/24 21:03

Mt. Gox–Linked Wallets Move 1,300 BTC to Exchanges as Analyst Flags New Outflows

BlockchainReporter·2025/12/24 21:00

Bitcoin Metrics Have Changed: Analyst Reveals the Critical Level Where BTC Must Not Fall Below

BitcoinSistemi·2025/12/24 20:54

SEI Network Holds $0.10 Support as Traders Eyes $0.115 Breakout

BlockchainReporter·2025/12/24 20:00

Watch Cryptocurrency Titans Clash in 2025: TRON Vs. Zcash Showdown

Cointurk·2025/12/24 19:42

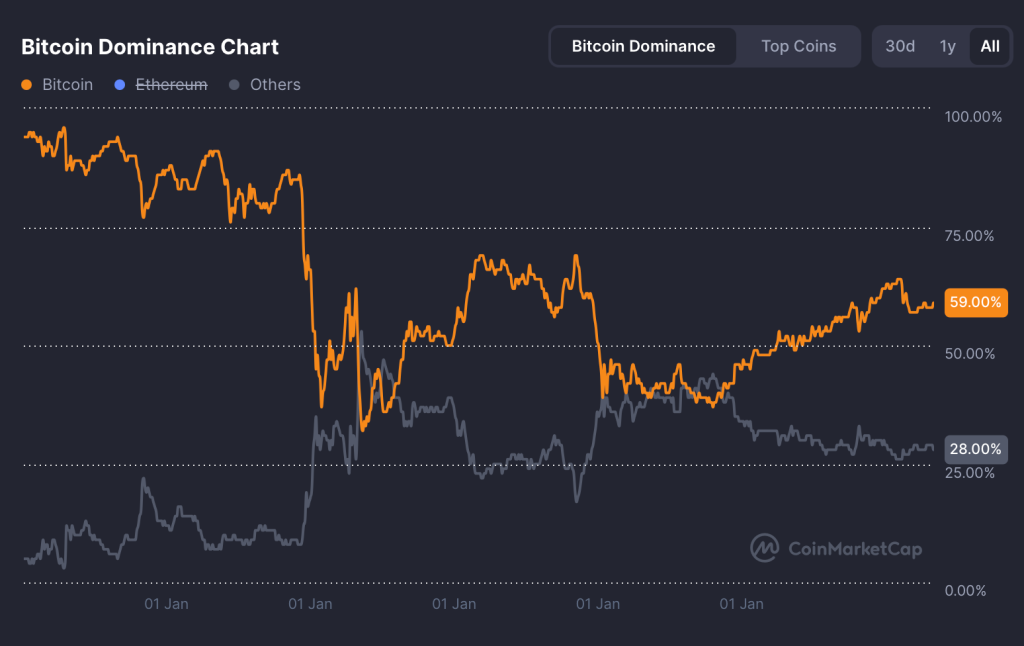

BTC Price Holds Firm as Altcoins Bleed—Is the Capital Rotating Back to Bitcoin?

Coinpedia·2025/12/24 19:30

Grayscale Sees Chainlink as Key Infrastructure for RWA Tokenization

Coinpedia·2025/12/24 19:30

U.S. Economy Beats Expectations, But Peter Schiff Warns of a Deeper Financial Crack

Coinpedia·2025/12/24 19:30

Flash

20:55

The US Dollar Index closed nearly flat on the 24th, ending at 97.941.ChainCatcher News, according to Golden Ten Data, the US Dollar Index, which measures the dollar against six major currencies, was basically flat on December 24, closing at 97.941. 1 euro exchanged for 1.1775 US dollars, lower than the previous trading day's 1.179 US dollars; 1 pound exchanged for 1.3496 US dollars, lower than the previous trading day's 1.3497 US dollars; 1 US dollar exchanged for 156.02 yen, lower than the previous trading day's 156.2 yen; 1 US dollar exchanged for 0.7886 Swiss francs, higher than the previous trading day's 0.7877 Swiss francs; 1 US dollar exchanged for 1.3676 Canadian dollars, lower than the previous trading day's 1.3694 Canadian dollars; 1 US dollar exchanged for 9.1713 Swedish kronor, higher than the previous trading day's 9.1684 Swedish kronor.

17:27

Charles Schwab to launch bitcoin trading servicesCharles Schwab, with assets under management reaching $138 billions, plans to launch bitcoin buying and trading services this year. (The Bitcoin Historian)

17:06

The U.S. trading session is shortened today, and the stock market will be closed tomorrow for Christmas.The U.S. trading session will close early today, with the market closing at 1:00 PM (EST). The stock market will be closed tomorrow for Christmas.

News