News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (April 3) | Trump's tariff orders spark market declines; Fidelity adds crypto to retirement plans2On-Chain Data School (Part 2): The Evergreen Profitable Hodlers, What Was Their Cost Basis for Buying BTC?3PayPal Activates Support for Solana and Chainlink, Will SOL and LINK Price Recover?

Bitcoin ETFs Sees Nearly $100M Outflow After Trump’s Tariff News

Cryptotimes·2025/04/04 20:55

Crypto Price Today (April 4, 2025): Bitcoin Visits $81k Low, Altcoins See Drastic Drop

Cryptotimes·2025/04/04 20:55

Cardano Surpasses Bitcoin and Ethereum in Institutional Inflows

Cryptotimes·2025/04/04 20:55

Bitcoin Power, $MSTR Rises While U.S. Stock Market Crash!

Cryptotimes·2025/04/04 20:55

ATOM at a Crossroads: Will Breaking $5.20 Trigger a 50% Rally or Another Rejection?

Cryptonewsland·2025/04/04 20:33

Over 170 Million LINK Tokens Sold by Whales: What This Means for You

Cryptonewsland·2025/04/04 20:33

Crypto News: Bitcoin Dips Below $85K, Ethereum Slides, XRP Shows Volatility

Cryptoticker·2025/04/04 18:22

XRP Sees Downward Pressure Amid $1.02B Token Unlock and Significant Decline in Network Activity

Coinotag·2025/04/04 09:55

Wormhole Faces Market Indecision as Breakout Attempts Near Key Resistance Level

Coinotag·2025/04/04 09:55

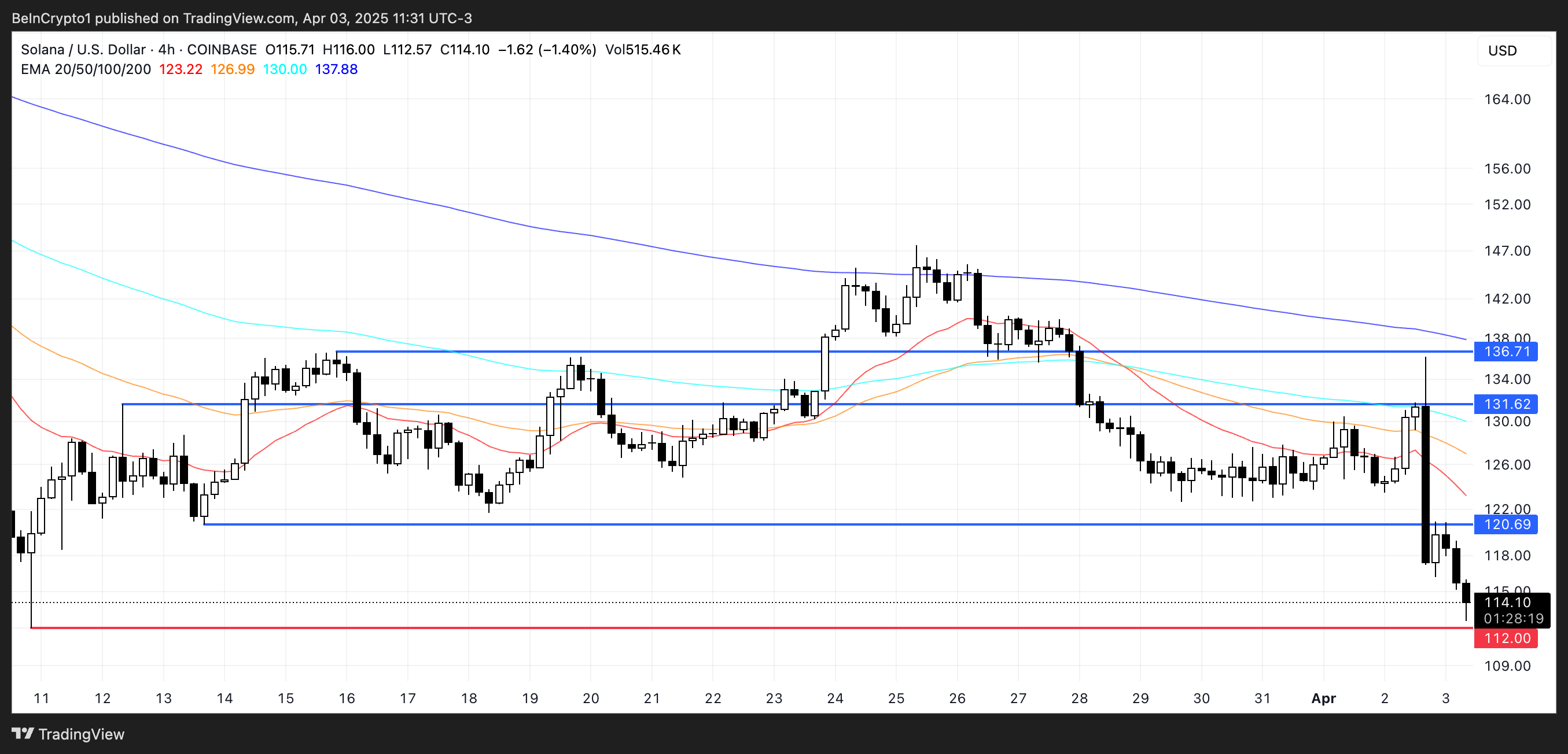

Solana Faces Continued Bearish Pressure, Eyes $112 Support as Selling Intensifies

Coinotag·2025/04/04 09:55

Flash

- 03:45According to: Hut 8, a listed mining company, produced 88 BTC in March, and the reserve increased to 10,264According to ChainCatcher, Nasdaq-listed Bitcoin mining company Hut 8 released its March operations update report. Mining output in March was 88 BTC, and Bitcoin reserves increased to 10,264. The deployed hash rate increased by 102% from an average of 4.6 EH/s in February to 9.3 EH/s at the end of March. Hut 8 CEO Asher Genoot said the company has spun off almost all of its ASIC miners to American Bitcoin, an independent mining entity and a majority-owned subsidiary of Hut 8, focusing on Bitcoin mining and strategic reserve construction.

- 03:43Yesterday, the market value of U.S. stocks decreased by $3.25 trillion, and the market value of cryptocurrencies increased by $5.4 billionGolden Finance reported that according to the crypto media Watcher.Guru, on April 4 local time, the market value of the U.S. stock market evaporated by 3.25 trillion U.S. dollars, and the total market value of the cryptocurrency market increased by 5.4 billion U.S. dollars.

- 03:34US spot Bitcoin ETF had a net outflow of $64.88 million yesterdayGolden Finance reported that according to FarsideInvestors monitoring data, the U.S. spot Bitcoin ETF had a net outflow of US$64.88 million yesterday.