News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Ethereum’s Layer 1 scaling could improve censorship resistance, streamline Layer 2 mass exits, and ensure long-term network stability.

Tether’s acquisition of a minority stake in Juventus has broadened its investment portfolio by incorporating digital assets, AI, and biotech into the sport of football, reflecting a wider shift toward blockchain integration in sports.

Barclays Bank’s $131 million stake in BlackRock’s Bitcoin ETF highlights the accelerating institutional shift toward cryptocurrency investments. As traditional financial giants increase their exposure to Bitcoin, the market is witnessing a deeper integration of digital assets into regulated investment strategies.

As regulatory scrutiny in crypto intensifies, Hex Trust’s move to acquire Byte Trading highlights its push to provide institutional-grade financial services. With new capital from Morgan Creek Digital, the firm is doubling down on its expansion strategy.

While many have viewed Bitcoin as an asset to stash away, emerging Layer-2 solutions are beginning to unlock its hidden potential. By merging advanced programmability with Bitcoin’s robust security, these networks could steer the largest cryptocurrency toward a new era of decentralized finance.

- 19:03Digital asset management company Metalpha announces a $5 million stock buyback plan to be carried out over the next 36 monthsAccording to PRNewswire, the digital asset management company Metalpha has released its latest unaudited financial results. The report reveals that the total revenue for the six months ending September 30, 2024 was $19,720,654, nearly four times higher than the $5,085,150 in the same period of fiscal year 2024. In addition, its board of directors has approved a stock repurchase plan of up to $5 million. The related repurchase transactions will be carried out within the next 36 months.

- 19:02Jupiter responds to LIBRA event: Did not participate in the issuance of LIBRA in any formJupiter responds to the LIBRA controversy: Several members of the Jupiter team learned directly from Kelsier Ventures about two weeks ago that there would be a token project related to Argentine President Javier Milei. Initially, we were not sure of its authenticity, but then saw credible evidence in public tweets from Milei's personal account proving he was serious. This is all the information known by Jupiter. We are completely unaware of any transactions between Milei himself and market makers, nor have we participated in any form. In the memecoin circle, rumors about some kind of "Argentine coin" being issued have long been an open secret with many related tweets already made public. However, out of adherence to confidentiality principles, Jupiter has not discussed this matter at any online or offline occasion. Furthermore, no member of the Jupiter team has ever received any LIBRA tokens or related compensation. The product developers on the Jupiter team did not know in advance about LIBRA's release date, time or contract address (CA). Only Meow knew it was going to launch on release day but he didn't know either contract address or specific time and did not participate in it either. He was even in Tokyo at that time and missed the release.

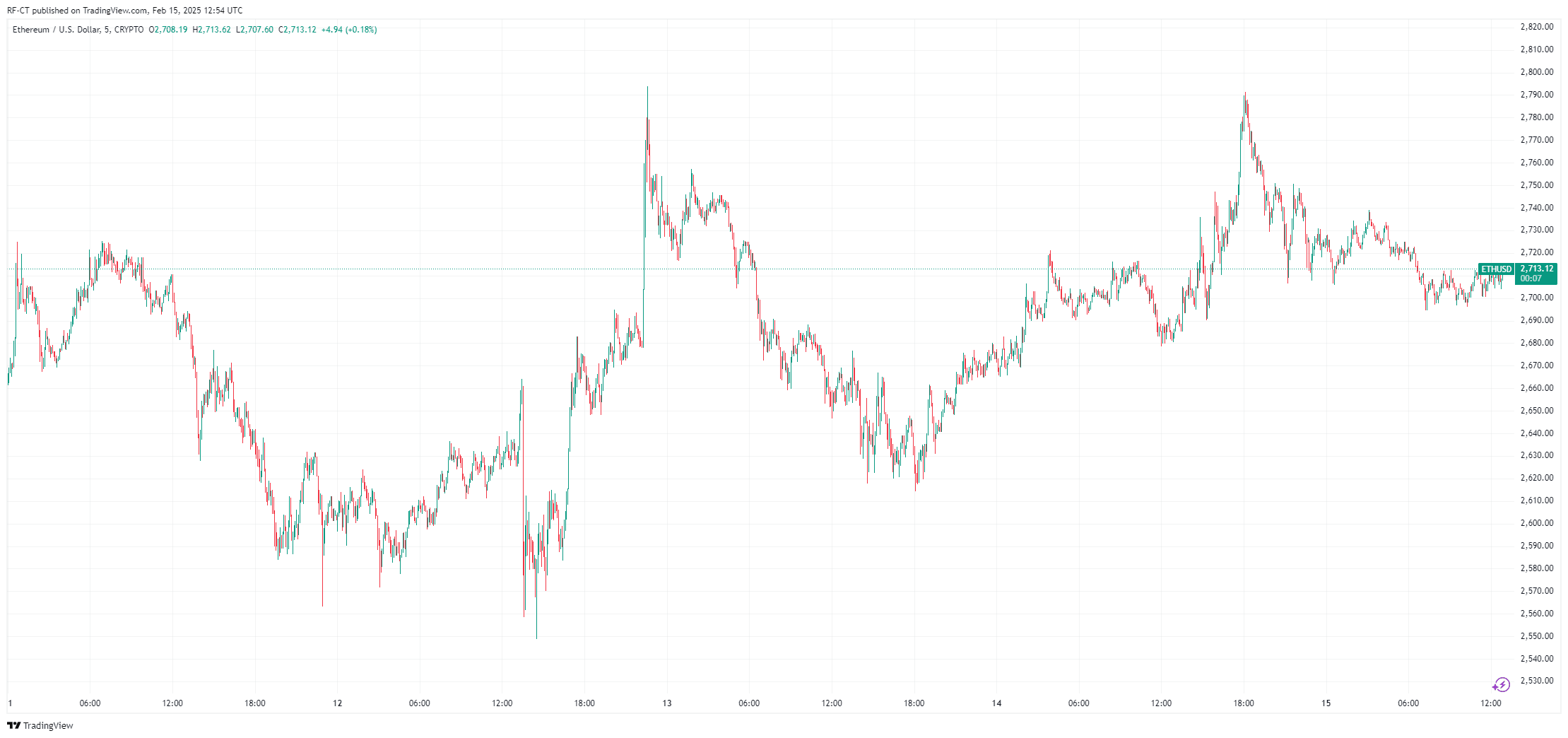

- 17:21The U.S. Ethereum spot ETF has a net outflow of $26.3 million this weekAccording to farside monitoring data, the United States Ethereum spot ETF has a net outflow of 26.3 million US dollars this week.