News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Oil Prices Briefly Break 110 USD; US Stock Futures Fall Across the Board; Iran's New Leader Takes Office (March 09, 2026)2Oracle Q3 Earnings Preview: Limited Performance Boost, Market Seeks Long-Term Optimistic Outlook3On the Eve of the Oil Crisis

Zcash Surpasses Bitcoin in Growth After Leading Developer Group Secures $25 Million

101 finance·2026/03/09 20:27

Many Investment Opportunities Emerge in the Stock Market During Times of Turmoil

101 finance·2026/03/09 20:21

ARIA (Aria.AI) fluctuated by 49.4% in 24 hours: Trading volume surged by 796%, driving intense price volatility

Bitget Pulse·2026/03/09 20:06

DeFi Withdrawals Underscore Changing Investor Attitudes and Infrastructure Issues

101 finance·2026/03/09 20:01

Dogecoin eyes $0.111 after $0.0872 retest – But DOGE’s move holds IF…

AMBCrypto·2026/03/09 20:00

Workers Cling to Their Positions Amid Sluggish Hiring and Increasing Layoffs

101 finance·2026/03/09 19:57

2 Expanding Stocks Poised for Success and 1 Encountering Difficulties

101 finance·2026/03/09 19:57

Can Oracle Finally Silence the AI Doubters?

101 finance·2026/03/09 19:54

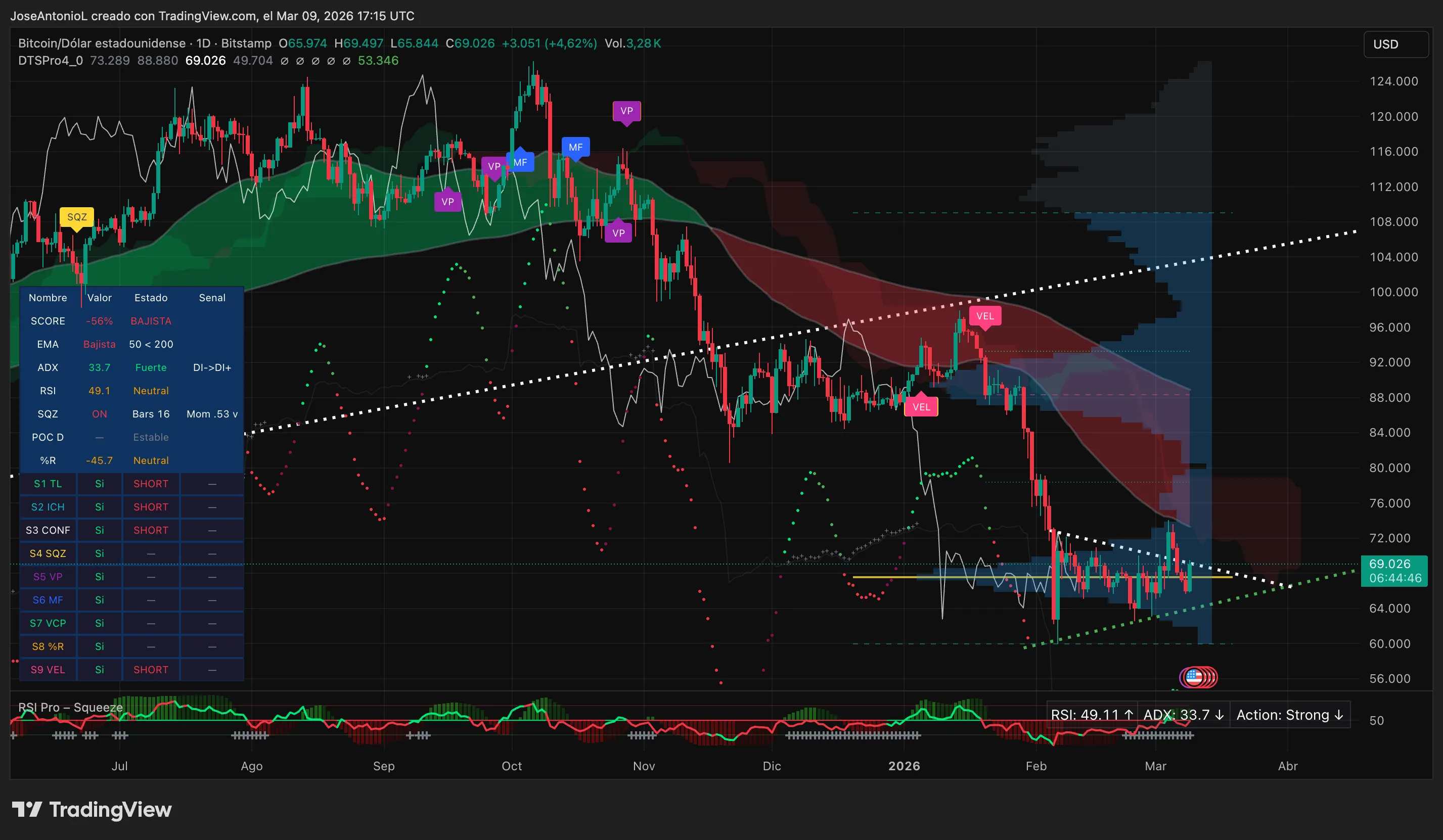

Bitcoin Price Bounces, But Bears Are Still in Control: Analysis

Decrypt·2026/03/09 19:49

Flash

20:30

US Stock Market Magnificent Seven Closing Report | Nvidia, Google A both closed up at least 2.7%Component stock Nvidia closed up 2.72%, Google A rose 2.70%, Apple, Tesla, Meta, and Microsoft all gained at least 0.11%. In addition, AMD closed up 5.33%, TSMC rose 2.89%, Eli Lilly gained 1.82%, while Berkshire Hathaway Class B shares closed down 0.36%. The "mega-cap" technology stock index rose 1.40% to 372.45 points. Besides Tesla, Google A, AMD, Apple, Microsoft, Nvidia, Meta Platforms, and Amazon, Broadcom closed up 4.62%, Qualcomm rose 1.78%, while Adobe closed down 0.42%, Netflix fell 0.71%, Oracle dropped 0.92%, and Salesforce declined 1.64%.

20:26

Prothena announced that its partner Novo Nordisk has paid the company a $50 million clinical milestone payment.The triggering of this payment is related to the progress of the Phase III clinical trial of Coramitug (formerly codenamed Prx004) for the treatment of transthyretin amyloid cardiomyopathy. Currently, this pivotal clinical trial is ongoing.

20:25

The Philadelphia Gold and Silver Index, traded during the US stock market session, closed up 1.12% at 418.01 points. After a gap-down opening, it hit a daily low of 390.39 points early in the session, then gradually recovered lost ground.The NYSE ARCA Gold Miners Index, which trades around the clock in global markets, rose by 0.31% to 2,919.20 points. Before the US stock market opened, it remained slightly down, hovering near 2,885 points, then plunged lower, quickly hitting a new daily low at 2,768.61 points. During US trading hours, the Materials Index closed up 1.05%, while the Metals & Mining Index closed up 1.45%.

News