Ethereum’s Bearish Streak Meets a Possible Bullish Turning Point

- Bullish traders keep buffering selloffs, preventing Ethereum’s market cap from losing its second rank to other crypto competitors.

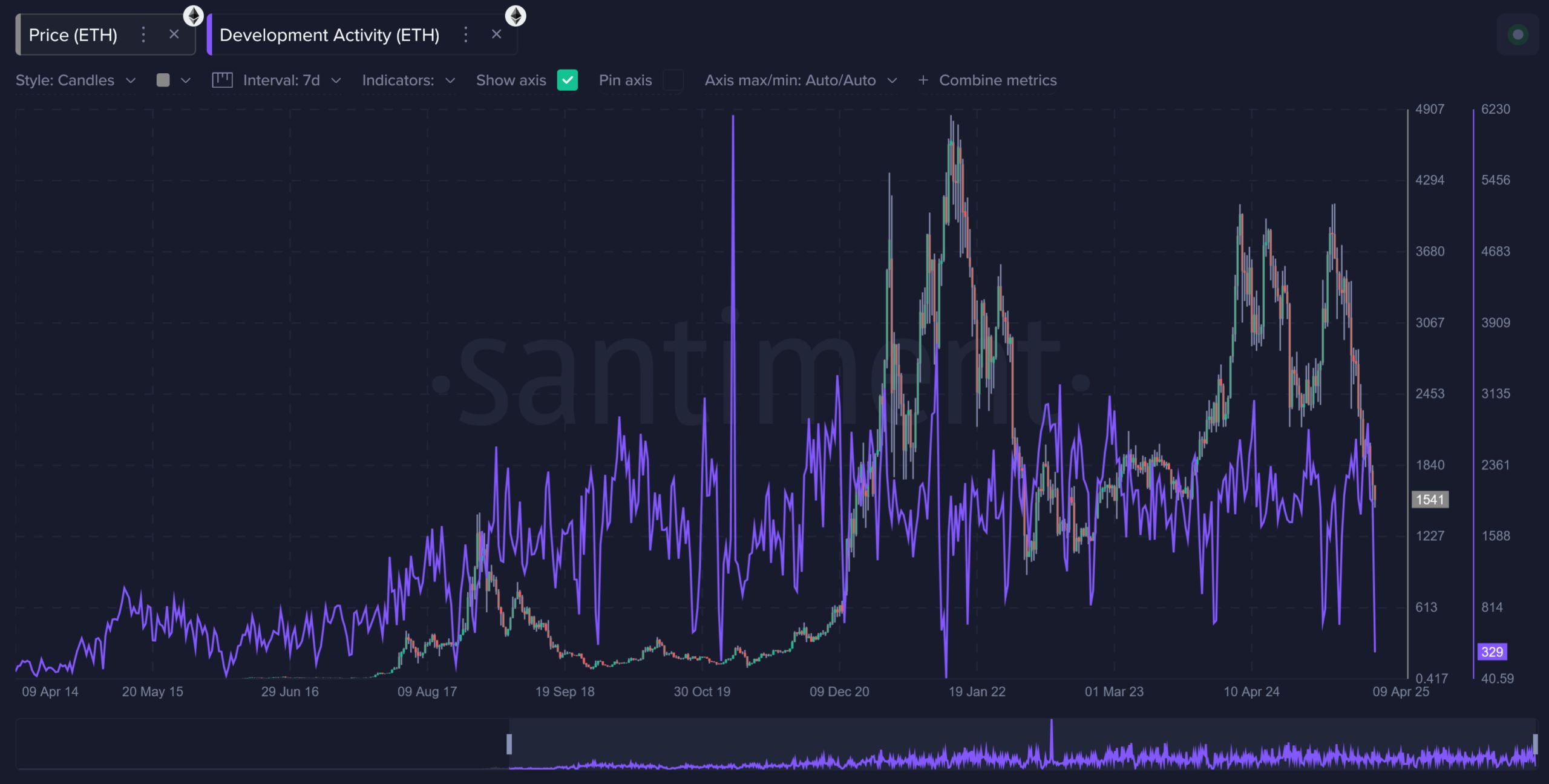

- Even with ongoing struggles versus Bitcoin, Ethereum’s development activity promotes future growth prospects across varying digital asset applications.

The crypto insights platform Santiment reports that Ethereum might see a positive case in 2025, despite the current mood in the market. Their data suggests that many traders expect the asset to underperform, creating what Santiment describes as a setup where the majority’s negative outlook could be overturned.

Ethereum’s role as a top smart contract chain has encouraged devoted teams to keep improving its platform. These contributors address questions about network speed and costs, which remain areas of concern for some traders. However, the ongoing development work indicates that Ethereum will likely stay active for the foreseeable future.

Source: Santiment

Source: Santiment

Santiment’s figures rank Ethereum seventh among the most active digital assets in recent developer contributions. Even though Ethereum’s market price has faced challenges when measured against Bitcoin, bullish traders continue to offset heavy sell volume. According to Santiment, if this buying power vanished, Ethereum would have lost its standing as the second-largest crypto long ago.

At the time of writing, Ethereum trades at around $1,561, up 2.3% over the last day. ETHNews analysts believe that if current growth efforts persist, Ethereum may surprise skeptical market participants in the years ahead.

This broader view emerges as Ethereum builds on its heritage as a platform with consistent engagement, while bearing in mind that crypto prices often behave contrary to popular opinion.

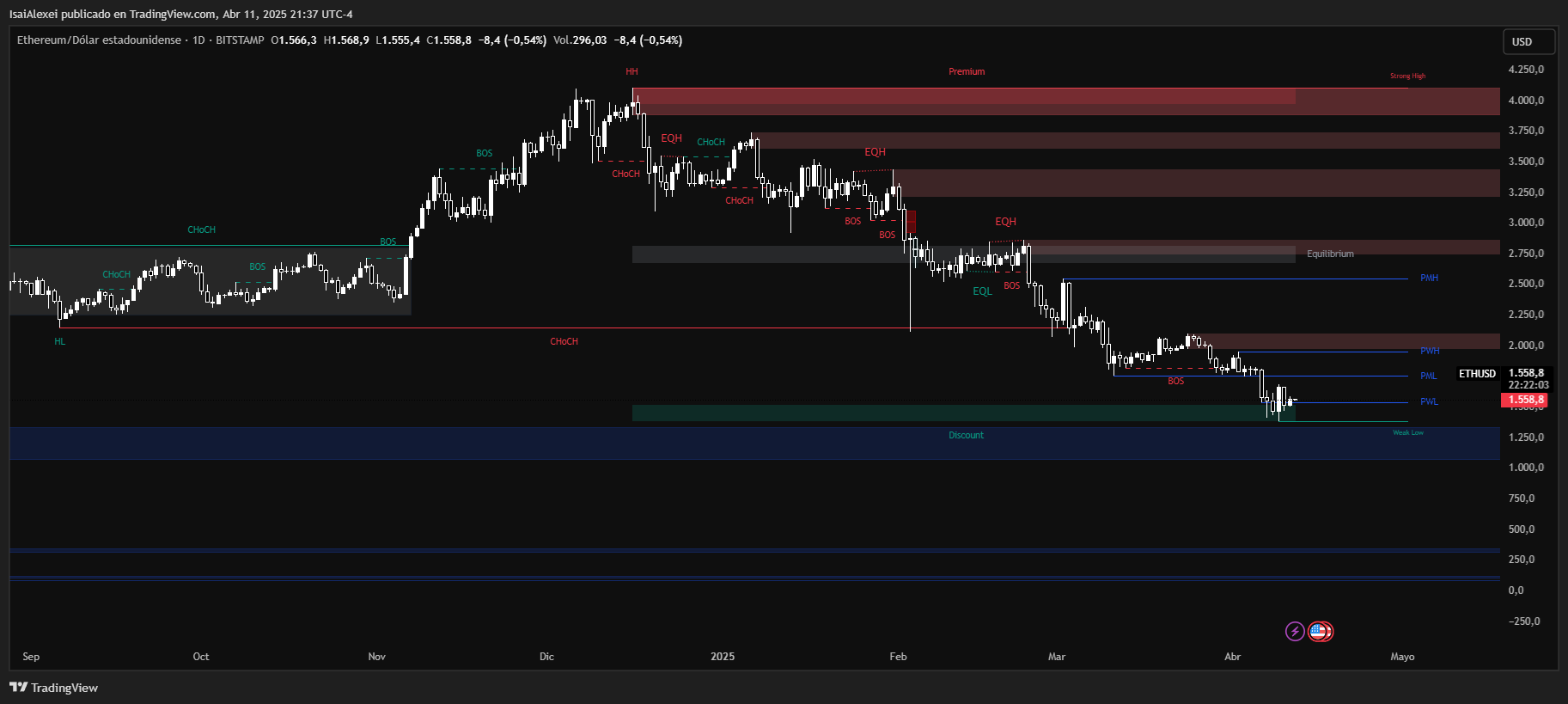

Source: Tradingview

Source: Tradingview

Ethereum (ETH) is currently trading at $1,559.22, showing a slight daily dip of -0.45%, continuing a broader downtrend that has seen a 14.19% drop over the past week and over 53% year-to-date decline. This sustained bearish pressure has pushed ETH close to a critical support zone around $1,425, which could act as a springboard for a rebound if demand increases.

Source: Tradingview

Source: Tradingview

Market volume sits at $13.79 billion in 24 hours, reflecting moderate activity, with no major breakout triggers yet.

Descargo de responsabilidad: El contenido de este artículo refleja únicamente la opinión del autor y no representa en modo alguno a la plataforma. Este artículo no se pretende servir de referencia para tomar decisiones de inversión.

También te puede gustar

OpenAI Lanza nuevo ChatGPT Funciones, ampliación de las capacidades de búsqueda y compra

En Resumen OpenAI ha actualizado ChatGPTBúsqueda de 's con una experiencia de compra optimizada, citas mejoradas, tendencias y sugerencias de autocompletar, y la capacidad de buscar a través de WhatsApp.

Hyperliquid actualiza la estructura de tarifas y los niveles de participación para mejorar la flexibilidad comercial.

En Resumen Hyperliquid anunció que lanzará una estructura de tarifas actualizada y nuevos niveles de participación el 5 de mayo a las 03:00 UTC.

Space And Time crea una fundación para acelerar la adopción de datos probados por ZK en aplicaciones blockchain

En Resumen Space and Time anunció la formación de su Fundación, establecida para apoyar el crecimiento del ecosistema a través de iniciativas de investigación, participación comunitaria y el desarrollo de aplicaciones impulsadas por datos de ZK.

Caída histórica en la confianza económica de los británicos