Goals focus on economic growth and integrating crypto into finance, but there’s controversy over conflicts of interest.

Positives include industry support and potential innovation, while negatives involve ethical concerns and regulatory risks.

Reactions are mixed, with the crypto industry largely positive, but critics raise corruption and security issues.

Market trends show increased bitcoin focus, with potential for broader adoption, though debates continue.

Overview

The Trump administration’s cryptocurrency policies, as of May 27, 2025, reflect a significant shift toward embracing digital assets, aiming to position the United States as a global leader in this space. Here’s a breakdown for a clearer understanding:

Background and Context

President Trump has taken steps to integrate cryptocurrencies into national policy, contrasting with previous regulatory approaches. This includes creating a Strategic Bitcoin Reserve, treating bitcoin as a reserve asset like gold, and easing regulations to foster industry growth.

Key Policies and Actions

Established a Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile on March 6, 2025, to centralize digital asset management.

Rolled back SEC enforcement tactics, dropped lawsuits like against Ripple, and hosted crypto roundtables.

Issued new bank charters to crypto firms and repealed the SAB 121 accounting rule, making it easier for banks to engage with crypto.

Appointed pro-crypto leaders, like Brian Quintenz to the CFTC, and launched a President’s Council of Advisers on Digital Assets.

Supported bitcoin mining to strengthen the economy and grid, exploring blockchain-based payment systems.

Goals and Intentions

The main goals are to make the U.S. the "crypto capital of the world," integrate cryptocurrencies into the $100 trillion capital markets, and drive technological and economic leadership. This includes tokenizing equities and supporting stablecoins for broader financial inclusion.

Positives and Negatives

Positives include increased industry confidence, potential for economic growth, and resolving past issues with seized crypto management. However, negatives include concerns over Trump’s family profiting from crypto (e.g., a $TRUMP meme coin), raising ethical and conflict-of-interest issues. The Federal Reserve’s restrictive stance on banks also limits full integration.

Reactions and Market Trends

The crypto industry largely welcomes these changes, seeing them as a "180 pivot" from past policies. Critics, like Senator Elizabeth Warren, argue these policies pose national security risks and corruption. Market trends show a focus on bitcoin, with expectations of new crypto-focused banks and blockchain adoption, though debates over regulatory capture persist.

This overview aims to provide a balanced view, acknowledging the complexity and ongoing discussions around these policies.

Survey Note: Detailed Analysis of Trump Administration’s Cryptocurrency Policies

As of 03:56 AM WAT on Tuesday, May 27, 2025, the Trump administration’s approach to cryptocurrency policies marks a significant departure from previous regulatory frameworks, emphasizing innovation, economic integration, and global leadership in digital assets. This detailed analysis expands on the overview, incorporating all relevant information to provide a comprehensive understanding for stakeholders, policymakers, and the public.

The administration has implemented several pivotal actions to reshape the cryptocurrency landscape in the U.S. On March 6, 2025, President Donald J. Trump signed an executive order establishing the Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile, as detailed in the White House fact sheet . This initiative treats bitcoin as a reserve asset, akin to gold, and aims to centralize ownership, control, and management of digital assets within the federal government for proper oversight and strategic positioning.

Additional actions include:

Regulatory rollbacks by the SEC, such as dropping the lawsuit against Ripple and hosting crypto roundtables to engage with industry stakeholders.

The Office of the Comptroller of the Currency (OCC) issuing new bank charters to crypto firms, facilitating greater financial integration.

The FDIC, under Travis Hill, exposing "Choke Point 2.0," a perceived effort to restrict banks from working with crypto companies, as noted in recent reports.

Repeal of SAB 121, an accounting rule that previously restricted banks from crypto custody, seen as an early win for the industry .

Appointment of Brian Quintenz to lead the CFTC, signaling a pro-crypto regulatory approach.

Launch of the President’s Council of Advisers on Digital Assets to guide policy development and exploration of blockchain-based payment systems by bank regulators.

Support for bitcoin mining, aiming to strengthen the U.S. economy and energy grid, with incentives for new power infrastructure.

These actions collectively aim to create a more welcoming environment for cryptocurrencies, contrasting with the enforcement-heavy approach of the previous administration.

Goals and Strategic Objectives

The overarching goals, as articulated in official statements and industry analyses, include positioning the U.S. as the "crypto capital of the world." This involves integrating cryptocurrencies into the $100 trillion capital markets, far beyond the current $3 trillion crypto market, as highlighted in recent CNBC coverage . Specific objectives include:

Treating bitcoin as a strategic reserve asset, leveraging its scarcity and security (often referred to as "digital gold") to enhance the U.S.’s global financial position.

Tokenizing the equities market and supporting stablecoins to facilitate broader financial inclusion and innovation.

Centralizing digital asset management to resolve past issues of disjointed handling of seized cryptocurrencies, scattered across federal agencies.

Supporting bitcoin mining to bolster the economy and grid, with incentives for new power infrastructure to meet energy demands.

These goals reflect a forward-thinking approach, with President Trump consistently advocating for embracing digital assets, stating, "I am very positive and open-minded to cryptocurrency companies, and all things related to this new and burgeoning industry. Our country must be the leader in the field," as noted in White House communications.

Positives and Benefits

The administration’s policies have several potential benefits, as evidenced by industry reactions and economic analyses:

Increased Industry Confidence: The crypto industry feels more welcome in Washington, D.C., with stakeholders like Coinbase CEO Brian Armstrong and Castle Island Ventures’ Nic Carter praising the regulatory shift. Armstrong’s donations to Trump’s campaign are seen as paying off, with Coinbase stock benefiting post-election .

Economic Growth Potential: Integrating crypto into traditional finance could unlock new economic opportunities, with 73% of U.S. crypto holders wanting the U.S. to be a global leader, according to the National Cryptocurrency Association (Stu Alderoty).

Technological Leadership: The focus on blockchain technology and bitcoin mining could position the U.S. at the forefront of innovation, with early wins for companies like MARA Holdings and OBM in the mining sector.

Resolution of Past Issues: The Strategic Bitcoin Reserve addresses the previous lack of clear policy for managing seized cryptocurrencies, which cost taxpayers over $17 billion in premature sales, ensuring a more cohesive approach.

Negatives and Challenges

Despite the positives, several challenges and criticisms have emerged:

Conflicts of Interest: President Trump’s family has profited significantly from crypto ventures, collecting $320 million in fees from a new cryptocurrency and increasing their net worth by $2.9 billion, as reported by The New York Times and CBS News . This has raised ethical concerns, particularly with the launch of a $TRUMP meme coin, criticized for adding billions to their wealth Trump's Memecoin Dinner Contest Earns Insiders $900,000 in Two Days.

Federal Reserve Restrictions: The Federal Reserve remains a "structural holdout," restricting banks from crypto-related activities, which could limit the full potential of these policies, as noted in recent Federal Reserve press releases .

National Security Risks: Critics, including Senator Elizabeth Warren, argue that Trump’s stablecoin and crypto policies pose national security risks, weakening regulatory guardrails, as expressed in an X post .

Appearance of Impropriety: The involvement of a lobbyist with crypto ties, who was later "exiled" from the White House after influencing Trump’s Truth Social post about including XRP, SOL, and ADA in the strategic reserve, has raised concerns about regulatory capture, as discussed in multiple

Political and Economic Context

The political landscape shows a mix of support and resistance. The administration’s policies have garnered bipartisan momentum in Congress for stablecoin and market structure legislation, but some bills, like the GENIUS Act, were rejected due to concerns over Trump’s personal involvement, as noted in an X post by

@Jason

. Economically, the administration is targeting the integration of crypto into the $100 trillion capital markets, with expectations of new banks focusing on crypto and stablecoins, as per industry analyses. However, the Federal Reserve’s stance and Trump’s 43% job approval rating add complexity to the economic context.

Stakeholder Reactions

Reactions from various stakeholders highlight the polarized nature of these policies:

Crypto Industry: Leaders like Paul Grewal (Coinbase), Veronica McGregor (Exodus), and Faryar Shirzad (Coinbase) have celebrated the "180 pivot" from Biden-era policies, as reported in CNBC . Bitcoin maximalists, as seen in an X post by

@BitcoinPierre

, support the focus on bitcoin in the strategic reserve.

Critics: Robert Reich, in an X post, accused the administration of corruption, citing eased regulations while Trump profits . Early blowback on including multiple cryptocurrencies in the reserve caused rifts, later resolved by narrowing to bitcoin, as reported in CNBC Pro-Trump Techies Enraged by Crypto Reserve Plan Causing

Lawmakers: The rejection of the GENIUS Act reflects concerns over Trump’s involvement, with some lawmakers citing the appearance of impropriety, as discussed in X posts.

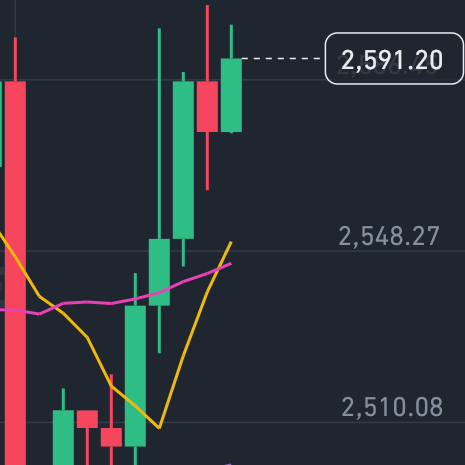

Market Trends and Implications

Market trends indicate a strong focus on bitcoin, with the Strategic Bitcoin Reserve elevating its status as a reserve asset. Industry experts, like Nic Carter, expect new banks focusing on crypto and stablecoins, with support for blockchain technology integration across financial systems. The market has reacted positively, with stakeholders expressing optimism about regulatory clarity, but concerns about ethical issues and regulatory capture, as seen in X discussions, introduce caution. The administration’s target of integrating crypto into the $100 trillion capital markets suggests long-term growth potential, though current debates highlight the need for balanced regulation.

Summary Table: Key Aspects of Cryptocurrency Policies

Aspect

Details

Key Actions

Strategic Bitcoin Reserve, regulatory rollbacks, new bank charters, support for mining.

Goals

Make U.S. crypto capital, integrate into finance, drive economic growth.

Positives

Industry support, economic potential, resolved asset management issues.

Negatives

Conflicts of interest, Federal Reserve restrictions, national security risks.

Reactions

Industry positive, critics raise corruption, lawmakers mixed on legislation.

Market Trends

Bitcoin focus, new crypto banks expected, blockchain integration potential.

This detailed analysis provides a comprehensive view, ensuring all relevant information is considered, from official actions to stakeholder reactions and market implications, as of the current date

Preço mais baixo

Preço mais baixo Preço mais alto

Preço mais alto