XRP Gains 28% Amid Rumors of SWIFT Deal and SEC Decision

- XRP jumped 28 percent, reaching $2.12, fueled by unverified hints about SWIFT integration and the SEC lawsuit’s resolution.

- Traders anticipate Ripple’s final SEC filing on April 16, plus potential SWIFT news on April 21, influencing price.

XRP rose 28% to $2.12, generating discussion across trading platforms. Many observers attribute the surge to possible news involving SWIFT and to speculation about the closing phase of the SEC vs. Ripple lawsuit.

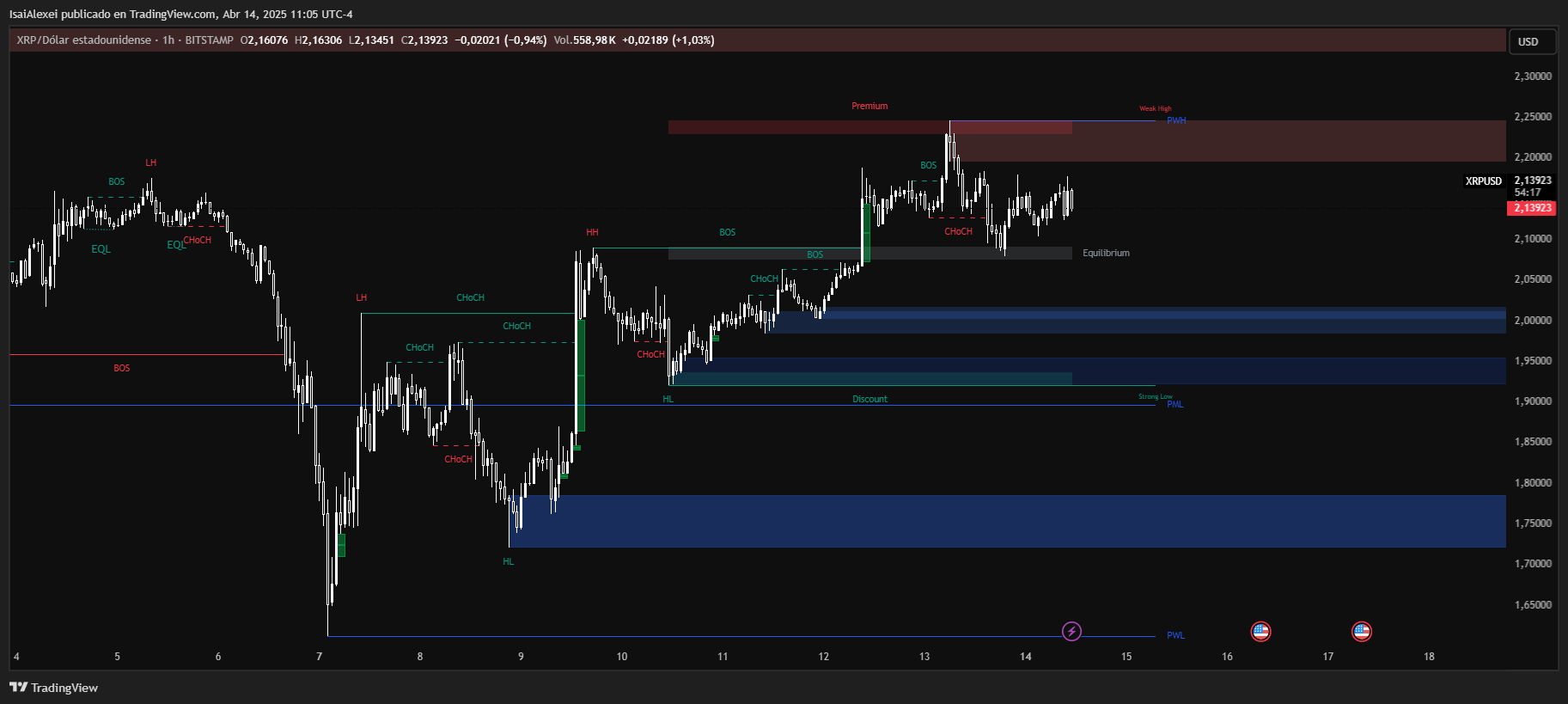

Source: Tradingview

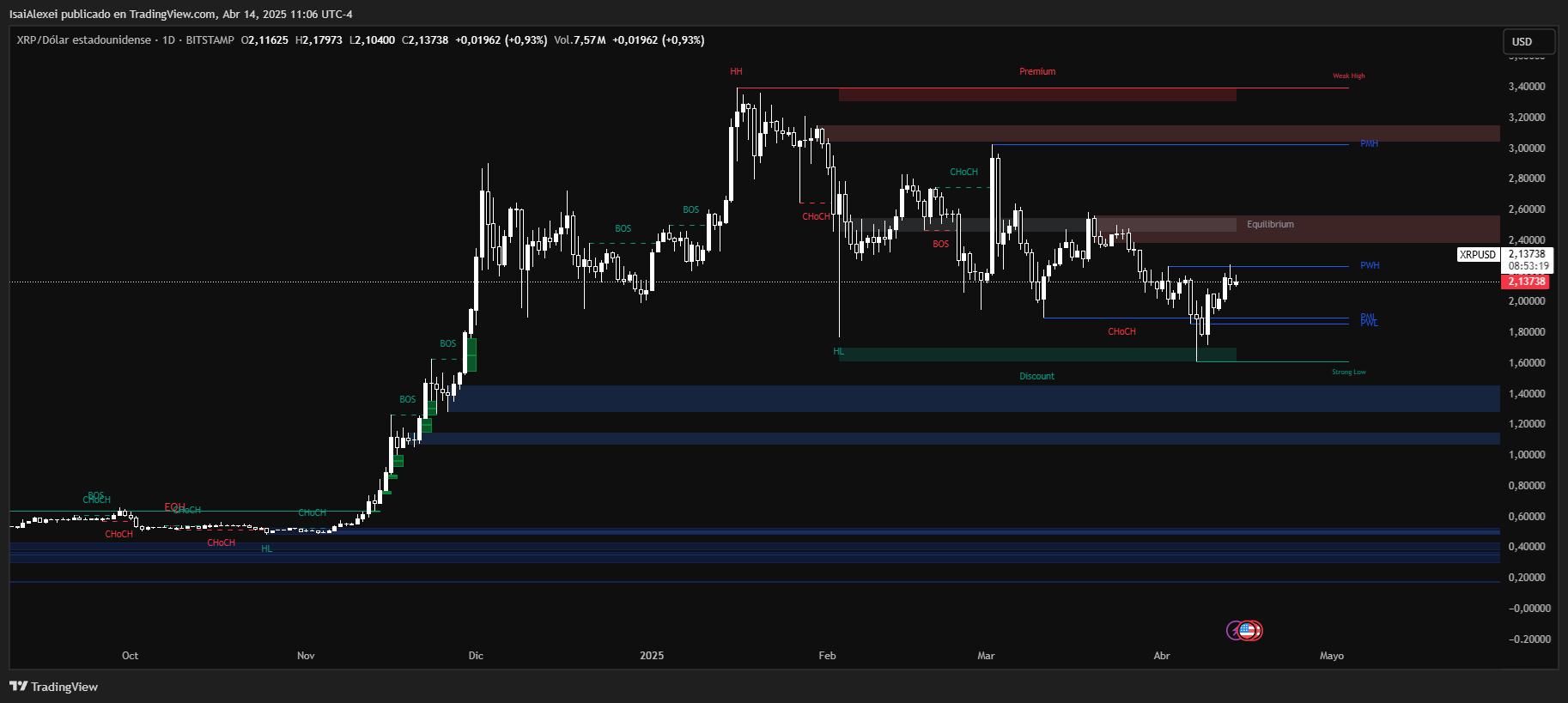

Source: Tradingview

ETHNews analysts predict XRP may reach $3 if it clears upcoming resistance levels. Meanwhile, a smaller group envisions a path to $45, although that view relies on two potential events: a positive result for Ripple in the SEC case, and a formal announcement from SWIFT , the global payments network. Reports hint that such news may surface around April 16 or April 21.

Traders point to a rise in futures open interest as another factor. XRP’s open interest climbed from $2.87 billion to $3.41 billion since April 9, showing that larger funds may be entering the market. However, some warn that rumors can push prices in sudden directions, especially when anticipation grows before confirmed statements.

https://x.com/TheCryptoSquire/status/1911481538287431759

Traders highlight the timing. On April 16, Ripple is expected to file its final response in the long-running legal dispute with the SEC. On April 21, SWIFT might reveal whether it will incorporate Ripple’s infrastructure, potentially allowing XRP to reach more than 11,000 financial institutions worldwide. This twin setup has drawn both optimism and caution.

While Bitcoin remains near $85,000, XRP has gained extra attention. Still, traders advise careful analysis, reminding everyone that official updates often differ from early reports. In the end, Ripple’s legal outcome and any agreement with SWIFT will shape XRP’s direction in the coming weeks.

Ripple (XRP) is currently trading at $2.14, up 0.98% in the past 24 hours, continuing a strong 11.34% weekly uptrend. Despite a 9.24% decline over the past month, XRP has posted a remarkable 346.84% gain year-over-year, reflecting solid recovery and renewed investor confidence.

The token recently bounced from the $1.80 support zone, gaining 20%, and is now approaching a resistance cluster between $2.22–$2.25—a critical level to watch for continuation.

From a technical lens, XRP is hovering just above the 100-day moving average ($2.11), indicating that bulls have managed to reclaim medium-term momentum.

Oscillators remain neutral, but momentum is building, and a clean break above $2.25 could send XRP toward the $2.55–$2.70 range. On the downside, holding above $2.00 is essential to maintain structure; failure to do so could invite a retracement back to $1.87 or even $1.70.

Based on breakout structure and market positioning, XRP is forecast to reach $2.33 within the next 4–5 days, assuming resistance at $2.25 is decisively broken.

Descargo de responsabilidad: El contenido de este artículo refleja únicamente la opinión del autor y no representa en modo alguno a la plataforma. Este artículo no se pretende servir de referencia para tomar decisiones de inversión.

También te puede gustar

RedotPay se une a la red Circle Payments para facilitar las transferencias transfronterizas de criptomonedas a moneda fiduciaria en Brasil.

En Resumen RedotPay se ha asociado con Circle para implementar el CPN para facilitar las transferencias a Brasil, permitiendo a los usuarios de RedotPay enviar criptomonedas que se convierten automáticamente a BRL al llegar a las cuentas bancarias locales.

Cyvers Alerts detecta una vulnerabilidad de $3 millones en el puente de red Nervos; Magickbase suspende contratos en medio de una investigación.

En Resumen Cyvers Alerts identificó una vulnerabilidad de explotación de 3 millones de dólares en el puente de Nervos Network, lo que llevó a Magickbase a suspender los contratos inteligentes y a iniciar una investigación.

Jamie Dimon de JPMorgan dice que el Bitcoin no debería estar en las reservas de EE.UU.

Dimon confirma que JPMorgan pronto permitirá a los clientes comprar Bitcoin, aunque no lo retendrá.