Crash course on Spot Grid

Suitable for volatile markets with upward price fluctuations, spot grids let users sell high and buy low for short-term arbitrage. However, when the market experiences a downward trend, it will bring a corresponding risk of loss.

1. What is spot grid trading?

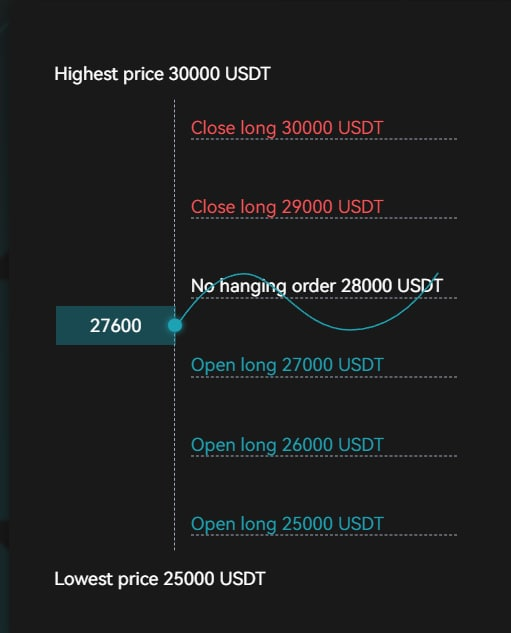

Spot grid is an automated trading bot that buys low and sells high within a specific price range. Users can start running a bot after setting the range of the lowest and highest prices and the number of grids. A trigger can also be set where the bot starts running once the market reaches the trigger price. The bot will calculate the buy low and sell high prices for each grid to place orders. When the bot keeps doing this, users will be able to gain profits from the market volatility.

To begin, select an underlying asset which can be BTC or any other cryptocurrency. Set a reasonable price range for the target, and form a grid by dividing the price range at regular intervals. The bot will buy when the grid decreases, and sell when the grid increases. See the image below (for example, BTC)

As you can see, the spot grid strategy will profit from price fluctuations. Compared to just holding onto an asset, grid trading can generate significantly higher profits in volatile markets. Spot grid trading is profitable when the price fluctuates within a certain price range.

2. Spot grid applications

The core of the spot grid strategy is short-term arbitrage, achieved by buying low and selling high. It is most effective in volatile markets where there are frequent price fluctuations. However, when the market experiences a downward trend, it may result in corresponding losses.

• Spot forward grid: when the price is estimated to rise with market fluctuations. The bot will buy the crypto, then sell them when the price rises, eventually gaining more stablecoins through arbitrage.

• Spot reverse grid: when the price is estimated to drop with market fluctuations. The bot will sell the crypto, then buy them back when the price drops, eventually gaining more coins through arbitrage.

When running a spot grid bot, you may find that the bot will pause if the market price goes beyond the highest or lowest price of your range. It will only resume when the market price falls within the grid range. Profitable opportunities may be missed during the pause.

3. Spot grid features

Advantages of spot grid trading

• The basic principle of spot grid trading is buying low and selling high. By setting appropriate intervals and grid sizes, and matching them with corresponding funds and positions, buy orders can be placed in batches as the price drops, while sell orders can be placed in batches as the price rises. It is a trading strategy that profits from buying low and selling high repetitively due to price fluctuations.

• Spot grid trading is a systematic approach that is independent of human analysis or the need to deeply understand market trends. Thus, no human decision-making is involved. Like a fishing net, this strategy capitalizes on price fluctuations within the grid intervals by buying low and selling high, taking advantage of the price differences through a repetitive circle.

• Spot grid trading yields stable profitability and requires minimal skills or experience, making it ideal for inexperienced traders.

Disadvantages of spot grid trading

• The utilization rate for funds is relatively low, therefore the annual profit is limited.

• Users may be worried about one-sided market conditions. If there is a sudden rise on the market price, the spot grid trading profits will be lower than the profits from a fully invested position, and also there is a risk of slippage. Conversely, if the market drops, there is a risk of being trapped or the grid being broken.

• The high frequency of transactions also leads to an increase in fees.

In conclusion, any trading bots may have their pros and cons. You must fully understand the strategies and instruments to be able to assess the risks independently before trading.

Disclaimer

Spot grid is a transaction tool. The above-mentioned information should not be considered as financial or investment advice from Bitget. Profits from spot grid trading may be impacted by one-sided market conditions or improper price intervals. You can adjust your spot grid trading strategy according to market conditions. Your use of this tool is subject to your unconditional acceptance of all of Bitget's terms and conditions. You should be fully aware of the risks associated with cryptocurrency investments and proceed with caution. You agree that all investments on Bitget.com reflect your true investment intent, and you unconditionally accept the potential risks and gains of your investment decisions.

Share