Federal Reserve Considers Rate Adjustments at Every Meeting

- Federal Reserve shifts to potential rate adjustments at each meeting.

- Leadership includes Chair Powell, Vice Chairs Jefferson, and Barr.

- Impact observed on market dynamics and crypto regulations.

The Federal Reserve’s top leaders, during recent policy reviews, suggested the possibility of interest rate changes at every Federal Open Market Committee meeting, highlighting a shift from previous rigid guidelines.

This change may influence financial markets significantly, easing institutional barriers in the crypto space while potentially affecting major digital assets like Bitcoin and Ethereum.

Lede

The Federal Reserve’s leadership now openly considers interest rate changes at every policy meeting. This marks a shift from the previous forward guidance strategy aiming for more flexibility within the fast-evolving financial and crypto markets .

Nutgraph

Involved leaders include Chair Jerome Powell, Vice Chair Philip Jefferson, and Vice Chair for Supervision Michael Barr. They advocate for dynamic policy considerations, aligning with broader efforts to optimize economic responses and financial oversight.

The Federal Reserve Board…will sunset its novel activities supervision program and return to monitoring banks’ novel activities through the normal supervisory process… — Jerome Powell, Chair, Federal Reserve

Potential Impact on Markets

This adjustment potentially impacts banking operations and crypto market activities . By sunsetting special supervision programs, the Fed reduces compliance burdens, potentially paving the way for greater investment in digital currencies.

The policy change may lead to reduced volatility in interest rates, providing a stabilizing effect on both traditional financial markets and digital asset holdings like Bitcoin and Ethereum.

Market participants are responding with cautious optimism, anticipating regulatory leniency to lead to more efficient capital allocation. The emphasis on each meeting’s discretion hints at a balance of proactive risk management and adaptive economic strategies.

Historical Trends and Future Outlook

Historical data suggests that increased policy flexibility can lead to short-term market fluctuations. However, in the longer term, such adaptability may boost institutional confidence and investment, particularly within the cryptocurrency sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Germany unveils Nvidia supercomputer, says Europe is closing AI gap with US and China

Share link:In this post: Germany launched Jupiter, an Nvidia-powered supercomputer, now the fourth-fastest in the world. Chancellor Friedrich Merz said the machine helps Europe compete with the US and China in AI. The US GAIN AI Act may block future exports of high-end chips like Nvidia’s to foreign countries.

Authors compound Apple’s AI struggles with fresh content use lawsuit

Share link:In this post: Authors Grady Hendrix and Jennifer Roberson sued Apple, alleging their books were used without consent to train its OpenELM AI models. The lawsuit claims the iPhone maker relied on pirated datasets and failed to seek permission, compensate or credit the authors. Microsoft, Meta, OpenAI, and Anthropic also face lawsuits over alleged misuse of copyrighted works for AI training.

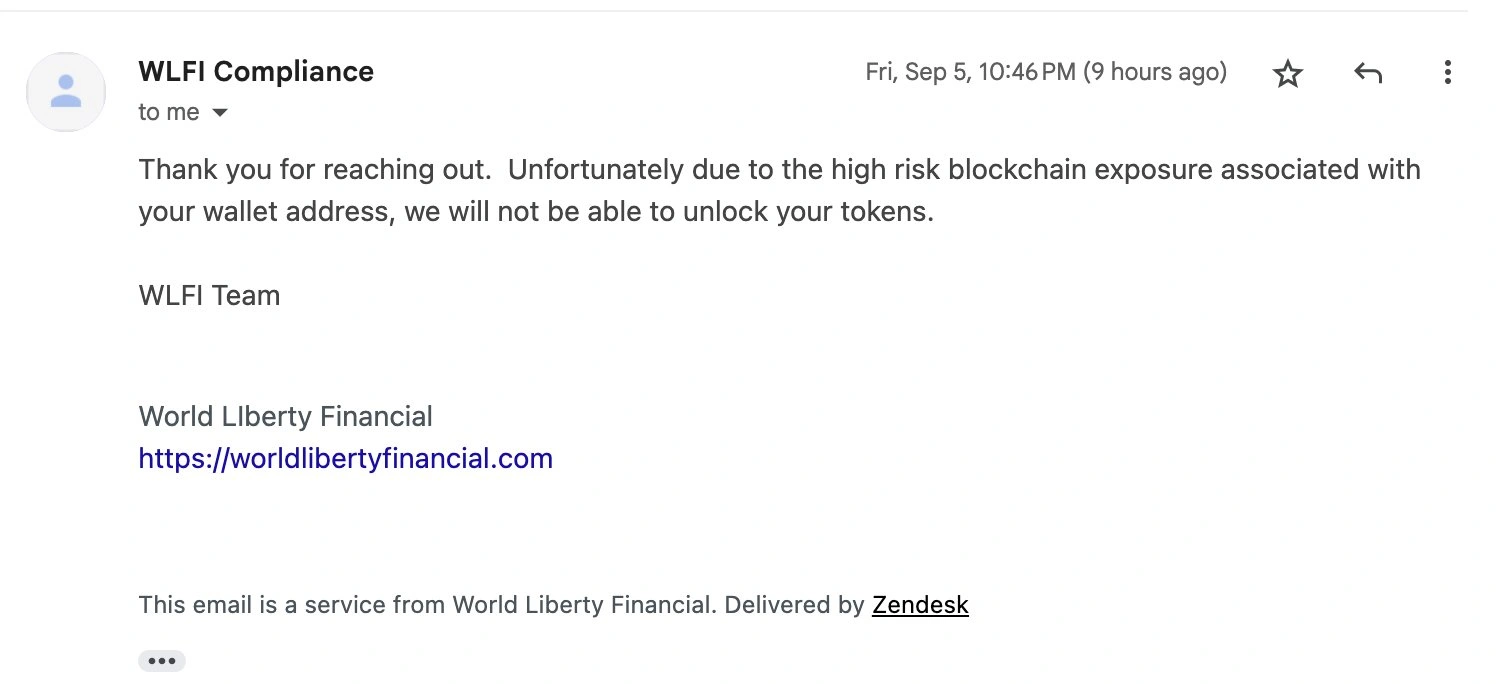

Trump-linked WLFI attracts criticism for ‘debanking users’ with token freezes

Share link:In this post: WLFI is getting some heat as Justin Sun’s frozen WLFI has started to be compared to debanking users. Sun claimed about 600 million tokens on September 1 and has accused WLFI of freezing those tokens after a blacklisting on Thursday. Another investor claims his funds were also locked after a risk assessment that only happened post-distribution.

A Review of Major Market Crashes in Crypto History

The cryptocurrency market often experiences low performance and high volatility in September. Historical crash data shows that the decline rate has gradually slowed, dropping from an early 99% to 50%-80%. Recovery periods vary depending on the type of crash, and there are significant differences between institutional and retail investor behavior. Summary generated by Mars AI. The content generated by the Mars AI model is still being iteratively updated for accuracy and completeness.