Date: Tue, Aug 19, 2025 | 09:20 AM GMT

The cryptocurrency market is experiencing notable selling pressure as Ethereum (ETH) slips back to $4,250 from its recent high of $4,780. This decline has spilled over into the major altcoins , many of which are showing weakness.

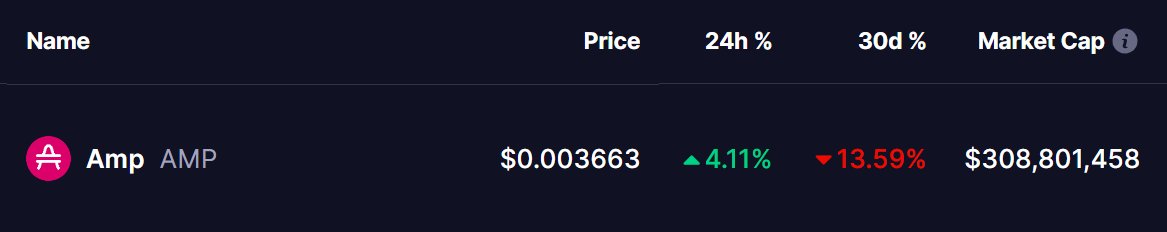

Yet, despite the broader pullback, Amp (AMP) is showing relative strength and flashing a bullish technical setup that looks strikingly similar to the breakout structure recently seen in API3 (API3).

Source: Coinmarketcap

Source: Coinmarketcap

AMP Mirrors API3’s Breakout Structure

Looking at API3’s chart, a clear descending triangle had been forming since the start of the year. After consolidating for months, API3 bounced strongly from the 100-day and 200-day moving averages before decisively breaking out above its resistance trendline (circled on the chart). The move ignited a powerful 132% rally, sending API3 as high as $1.86 today.

API3 and AMP Fractal Chart/Coinsprobe (Source: Tradingview)

API3 and AMP Fractal Chart/Coinsprobe (Source: Tradingview)

Now, AMP appears to be tracing the same path.

The token is currently consolidating in a descending triangle pattern, with price positioned just below a major confluence zone — the 100-day MA ($0.00389), the 200-day MA ($0.00417), and the descending trendline resistance. This setup is nearly identical to API3’s pre-breakout structure.

What’s Next for AMP?

If this fractal plays out, a reclaim of the 100 MA and 200 MA would be the first confirmation signal of strength. From there, a successful breakout above the triangle resistance could ignite a major bullish rally, potentially sending AMP toward $0.0090, echoing API3’s explosive surge.

However, confirmation is key. Until AMP reclaims its moving average resistances, the pattern remains unvalidated and traders should be cautious of potential false breakouts.