Sky Protocol Receives “B-” Credit Rating from S&P Global

- S&P rates Sky Protocol “B-” due to risk factors.

- Centralization and concentrated deposits pose risks.

- Liquidity issues could impact stablecoin and governance.

S&P Global assigned Sky Protocol a ‘B-‘ credit rating due to centralization and liquidity concerns. Founder Rune Christensen’s control and concentrated deposits were highlighted, marking the first stablecoin protocol to receive a formal rating from a major agency.

Points Cover In This Article:

ToggleSky Protocol has been assigned a “ B- ” credit rating by S&P Global, citing centralization and liquidity risks. This evaluation also reflects concentrated deposits and governance control by founder Rune Christensen.

S&P Global’s rating highlights potential vulnerabilities in governance and funding impacting the DeFi and stablecoin sectors.

Evaluation of Sky Protocol

Sky Protocol, under scrutiny for its centralization and deposits, received an unprecedented credit rating from S&P Global . The decision underscores risks associated with liquidity and governance token concentration.

Governance and Stability

Founder Rune Christensen, known for his leadership in DeFi, controls 9% of governance tokens, affecting Sky Protocol’s stability. No direct response from Christensen or his team was noted, but Sky Protocol recognizes and aims to address the identified risks.

“Sky’s rating could be downgraded over the next 12 months if it experiences liquidity shortfalls, excessive losses in crypto lending, or unfavorable regulatory developments.” – S&P Global

Market Reactions and Implications

Market reactions include concerns over Sky Protocol’s capacity to handle liquidity shortfalls, given its risk-adjusted capital ratio. There are broader implications for DeFi and related investments, especially those integrated with Sky Protocol’s USDS stablecoin and governance frameworks.

S&P emphasizes the potential for liquidity issues to affect related DeFi platforms. Cybersecurity and regulatory uncertainties add to these challenges, influencing investor confidence across sectors involved.

Future outcomes may depend on Sky Protocol’s response to S&P’s findings. Historical trends suggest parallels with other DeFi liquidity events, yet none had a formal rating. This analysis may inform upcoming protocols addressing similar governance and liquidity concerns.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump’s Nvidia chip deal with China draws bipartisan security warnings

Share link:In this post: Trump approved a deal letting Nvidia and AMD sell certain AI chips to China if the U.S. gets 15% of the revenue. Lawmakers from both parties warned it could create a “pay-for-play” model for sensitive tech exports. Legal experts questioned whether the payment is effectively an export tax.

Tech giants expect usable quantum computer to arrive this decade

Share link:In this post: IBM and Google say they can build a large-scale quantum computer before 2030. Amazon warns it could take 15–30 years to reach a truly useful system. Qubit instability, high costs, and complex error correction remain major hurdles.

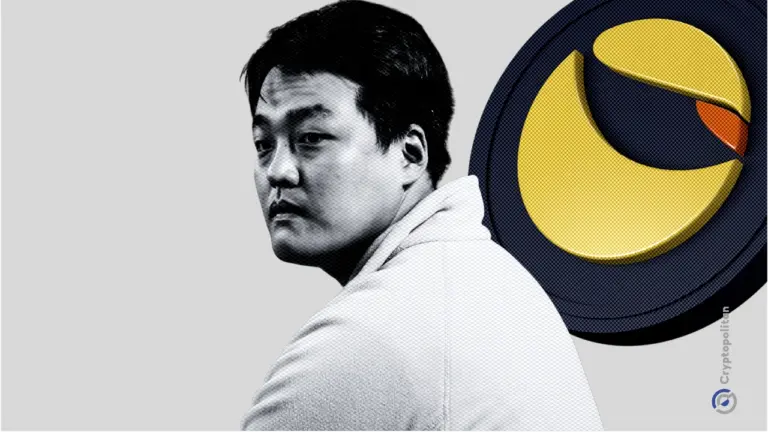

Terraform Labs’ Do Kwon set for guilty plea in $40B TerraUSD fraud case

Share link:In this post: Do Kwon is expected to admit guilt in a U.S. court over the $40B TerraUSD collapse. A judge has set a hearing where Kwon must explain how he broke the law. The 2022 crash of TerraUSD caused major losses and led to other crypto failures.

Wisconsin lawmakers file companion bill to tighten crypto regulations

Share link:In this post: Democrats in the Wisconsin Senate filed a companion bill mirroring last month’s Assembly Bill 384 to tighten the noose on rampant scams linked to crypto kiosks. Senator Kelda Roys filed Senate Bill 386 on August 11 alongside six other Senate members, echoing the Assembly Bill previously filed by Rep. Ryan Spaude. Dileep Kumar, Director at Digital South Trust, said the proposed bills aim to build public trust, despite limiting high-value trades.