NFT Sales Surge to $574 Million in July as Ethereum Collections Lead Market Rally

Non-fungible token (NFT) sales climbed to more than 574 million dollars in July, marking the second-highest monthly volume this year, according to data from CryptoSlam.

Non-fungible token (NFT) sales climbed to more than 574 million dollars in July, marking the second-highest monthly volume this year, according to data from CryptoSlam.

The figure represents a 47.6 percent increase from June’s 388.9 million dollars, though it remains below January’s peak of 678.9 million dollars.

While total transactions fell 9 percent from 5.5 million to five million, the average sale value rose to 113.08 dollars, the highest in six months. This indicates growing demand for higher-value digital assets . The number of unique buyers declined 17 percent to 713,085, while unique sellers increased 9 percent to 405,505, suggesting a market shift toward fewer but larger purchases.

Source

:

NFT Price Floor

.

Source

:

NFT Price Floor

.

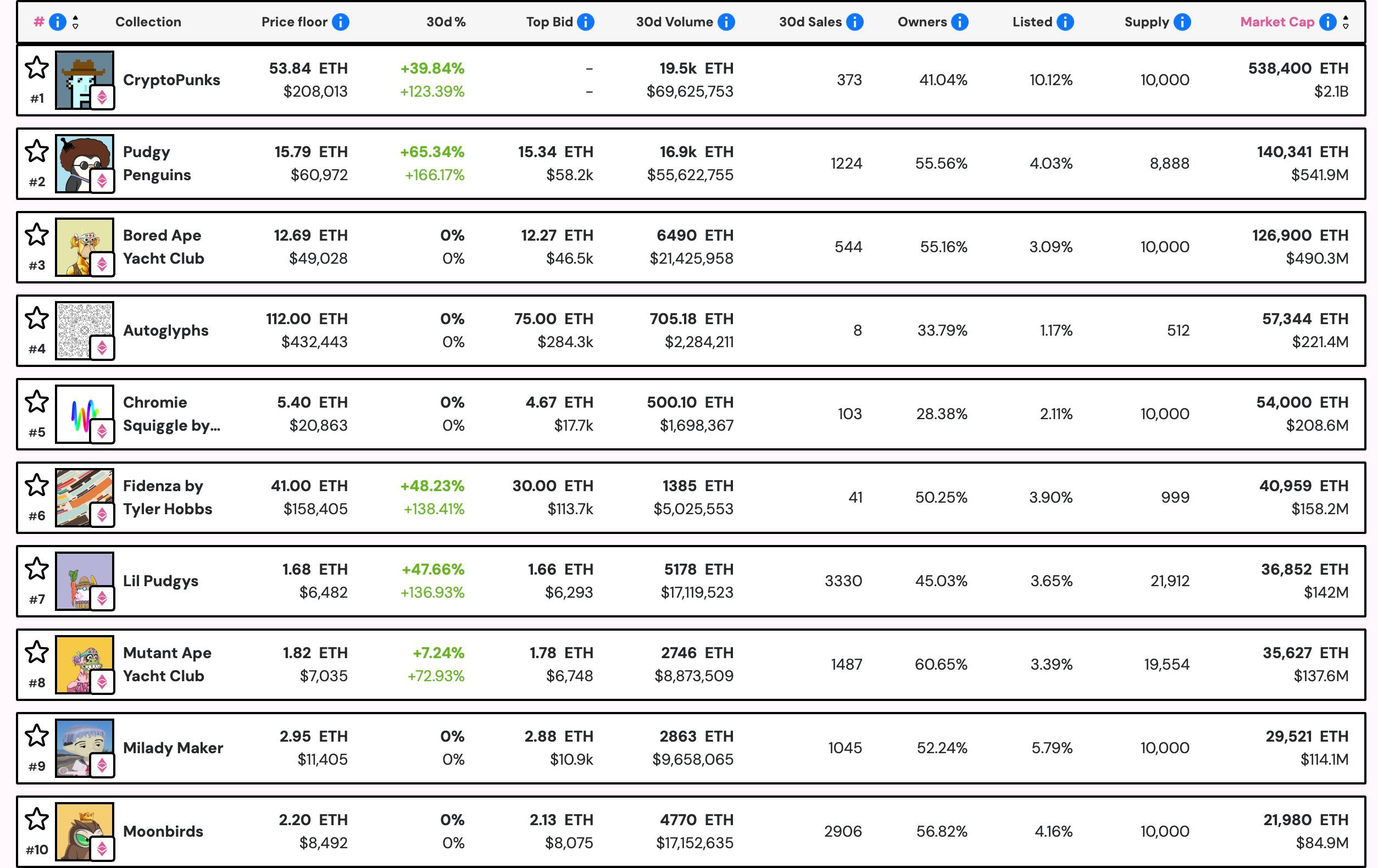

NFT Price Floor data shows the sector’s total market capitalization has surged 21 percent since late July, reaching more than 8 billion dollars. Ethereum’s price rally has played a key role, with the asset trading above 3,800 dollars after jumping 62 percent from early August levels of around 2,400 dollars.

Ethereum-based collections dominated the market in July. CryptoPunks led trading with more than 69.2 million dollars, followed by Pudgy Penguins with 55.5 million dollars. Polygon’s Courtyard NFTs ranked third with 23.8 million dollars. Pudgy Penguins also posted the strongest growth, with floor prices rising 65.44 percent, outpacing other top collections such as Bored Ape Yacht Club and Mutant Ape Yacht Club.

Ethereum maintained its dominance in blockchain-based NFT sales with 275.6 million dollars in July, a 56 percent increase over the previous month. Bitcoin followed with 74.3 million dollars, while Polygon recorded 71.6 million dollars. Polygon’s sales volume dropped by 51.1 percent from June, while BNB Chain recorded a 54 percent decline, reflecting a growing consolidation of activity on Ethereum and a narrowing focus on premium NFT collections. Meanwhile, CoinGecko reported a 20% daily jump in total NFT market cap, from $5.1 billion to $6.3 billion, further signaling renewed interest in the space.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Germany defends economic policy, vows more reforms by year-end

Share link:In this post: Lars Klingbeil said Germany’s coalition will pass major reforms by year-end to boost growth. GDP shrank 0.3% in Q2 2025, worse than the earlier -0.1% estimate. Manufacturing, exports, investment, and consumption all dropped sharply.

Ledn CEO warns Bitcoin Treasury boom is fading

Share link:In this post: Bitcoin treasuries have dropped in value. Ledn’s CEO says big returns are fading. Ledn launched a new wealth program for BTC-backed loans.

Nigeria deports foreign nationals convicted in crypto romance scams

Share link:In this post: Nigeria has announced the deportation of another round of foreign nationals convicted in several crypto-related crimes. According to the EFCC, the current group of departed individuals comprises 102 foreign nationals. The EFCC has promised to step up efforts to curb these crimes, noting that more deportations have been scheduled in the coming months.

Trump’s tariffs will shrink U.S. deficit by $4 trillion over 10 years, CBO projects

Share link:In this post: Trump’s tariffs will cut the U.S. deficit by $4 trillion through 2035, says the CBO. $3.3 trillion will come from primary deficit reduction, and $700 billion from lower interest payments. The tariff revenue nearly offsets the $4.1 trillion debt impact of Trump’s One Big Beautiful Bill Act.