Lorenzo Protocol Ecosystem Roundup — March 2025

Welcome to the March edition of our ecosystem roundup! This is your quick, monthly update on all key happenings across the Lorenzo Protocol ecosystem.

Let’s explore what’s new!

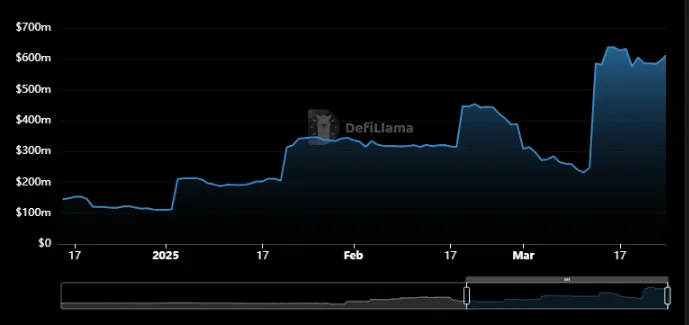

Lorenzo Hits $600M In TVL

We’ve officially crossed a major milestone — Lorenzo has now exceeded $600 million in Total Value Locked, with our latest all-time high reaching $637M, according to DeFiLlama.

This achievement is a testament to the trust our community has placed in us — and the momentum is only building.

Track our growth in real-time: Lorenzo on DeFiLlama

We’re just getting started. Let’s keep climbing!

enzoBTC and stBTC Go Live On Hemi Mainnet

We were excited to support our friends and partners at Hemi for their mainnet launch, with our enzoBTC and stBTC tokens going live on the chain for day 1 of launch.

Please note: The contracts are live, but functionality for the tokens are still to come. Stay tuned for future updates on activating your liquidity with Hemi!

Quietly Building

For team Lorenzo, March has been a month of quiet, intense work across all divisions.

We’re targeting significant expansion, new milestones, and exciting launches.

To everyone supporting us in the Lorenzo Nation, we thank you.

Final preparations are underway…

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETH vs SOL Showdown: Node War and Infrastructure Moat Behind $587 Billion Staked

However, despite the funding bet having come to the same level, in terms of security, ETH still holds a slight edge.

EPT is live! Bullish or bearish? Join to share 480,000 EPT!

SUI Ranks 5th in DEX Volume But Lacks Trend Strength to Sustain Rally

SUI is gaining traction with a surge in DEX activity and rising RSI, yet trend strength remains fragile as it eyes a critical breakout point.

VIPBitget VIP Weekly Research Insights

It's been nearly two months since the trend of celebrities and politicians launching memecoins began. During this period, liquidity in the Solana ecosystem almost dried up. Pump.fun, which once saw over 2000 successful launches landing on DEXs daily, hit a low of just slightly over 50 new projects per day, marking a drop of nearly 97%. During the two months, Pump.fun also rolled out its own DEX, Pump Swap, while major centralized exchanges (CEXs) accelerated their transition and put toward products combining spot and on-chain transactions. These offerings help bridge the liquidity gap between CEXs and on-chain trading, in order to capture opportunities in early-stage tokens' hype and drive a faster recovery in Solana's on-chain liquidity.