Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR60.80%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$87120.19 (-0.57%)Fear at Greed Index44(Fear)

Total spot Bitcoin ETF netflow +$85M (1D); +$546.2M (7D).Coins listed in Pre-MarketPAWS,WCTWelcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR60.80%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$87120.19 (-0.57%)Fear at Greed Index44(Fear)

Total spot Bitcoin ETF netflow +$85M (1D); +$546.2M (7D).Coins listed in Pre-MarketPAWS,WCTWelcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

Bitget: Top 4 in global daily trading volume!

Please also display BTC in AR60.80%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$87120.19 (-0.57%)Fear at Greed Index44(Fear)

Total spot Bitcoin ETF netflow +$85M (1D); +$546.2M (7D).Coins listed in Pre-MarketPAWS,WCTWelcome gift package para sa mga bagong user na nagkakahalaga ng 6200 USDT.Claim now

Trade anumang oras, kahit saan gamit ang Bitget app. I-download ngayon

May kaugnayan sa coin

Price calculator

Kasaysayan ng presyo

Paghula ng presyo

Teknikal na pagsusuri

Gabay sa pagbili ng coin

kategorya ng Crypto

Profit calculator

Acet presyoACT

Hindi naka-list

Quote pera:

PHP

Kinukuha ang data mula sa mga third-party na provider. Ang pahinang ito at ang impormasyong ibinigay ay hindi nag-eendorso ng anumang partikular na cryptocurrency. Gustong i-trade ang mga nakalistang barya? Click here

₱5.08-1.30%1D

Price chart

Last updated as of 2025-03-28 02:42:38(UTC+0)

Market cap:₱6,386,072,191.01

Ganap na diluted market cap:₱6,386,072,191.01

Volume (24h):₱16,712,161.46

24h volume / market cap:0.26%

24h high:₱5.31

24h low:₱4.94

All-time high:₱110.96

All-time low:₱0.1228

Umiikot na Supply:1,258,035,100 ACT

Total supply:

2,230,764,830.37ACT

Rate ng sirkulasyon:56.00%

Max supply:

--ACT

Price in BTC:0.{5}1016 BTC

Price in ETH:0.{4}4407 ETH

Price at BTC market cap:

₱78,834.36

Price at ETH market cap:

₱11,046.96

Mga kontrata:

0x9f3b...86ac31d(BNB Smart Chain (BEP20))

Higit pa

Ano ang nararamdaman mo tungkol sa Acet ngayon?

Tandaan: Ang impormasyong ito ay para sa sanggunian lamang.

Presyo ng Acet ngayon

Ang live na presyo ng Acet ay ₱5.08 bawat (ACT / PHP) ngayon na may kasalukuyang market cap na ₱6.39B PHP. Ang 24 na oras na dami ng trading ay ₱16.71M PHP. Ang presyong ACT hanggang PHP ay ina-update sa real time. Ang Acet ay -1.30% sa nakalipas na 24 na oras. Mayroon itong umiikot na supply ng 1,258,035,100 .

Ano ang pinakamataas na presyo ng ACT?

Ang ACT ay may all-time high (ATH) na ₱110.96, na naitala noong 2021-11-03.

Ano ang pinakamababang presyo ng ACT?

Ang ACT ay may all-time low (ATL) na ₱0.1228, na naitala noong 2024-07-09.

Bitcoin price prediction

Kailan magandang oras para bumili ng ACT? Dapat ba akong bumili o magbenta ng ACT ngayon?

Kapag nagpapasya kung buy o mag sell ng ACT, kailangan mo munang isaalang-alang ang iyong sariling diskarte sa pag-trading. Magiiba din ang aktibidad ng pangangalakal ng mga long-term traders at short-term traders. Ang Bitget ACT teknikal na pagsusuri ay maaaring magbigay sa iyo ng sanggunian para sa trading.

Ayon sa ACT 4 na teknikal na pagsusuri, ang signal ng kalakalan ay Buy.

Ayon sa ACT 1d teknikal na pagsusuri, ang signal ng kalakalan ay Malakas bumili.

Ayon sa ACT 1w teknikal na pagsusuri, ang signal ng kalakalan ay Buy.

Ano ang magiging presyo ng ACT sa 2026?

Batay sa makasaysayang modelo ng hula sa pagganap ng presyo ni ACT, ang presyo ng ACT ay inaasahang aabot sa ₱4.88 sa 2026.

Ano ang magiging presyo ng ACT sa 2031?

Sa 2031, ang presyo ng ACT ay inaasahang tataas ng +30.00%. Sa pagtatapos ng 2031, ang presyo ng ACT ay inaasahang aabot sa ₱12.84, na may pinagsama-samang ROI na +150.17%.

Acet price history (PHP)

The price of Acet is +133.00% over the last year. The highest price of in PHP in the last year was ₱51.38 and the lowest price of in PHP in the last year was ₱0.1228.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h-1.30%₱4.94₱5.31

7d+13.59%₱4.39₱5.73

30d+125.03%₱2.07₱5.73

90d+578.90%₱0.5398₱5.73

1y+133.00%₱0.1228₱51.38

All-time-84.29%₱0.1228(2024-07-09, 262 araw ang nakalipas )₱110.96(2021-11-03, 3 taon na ang nakalipas )

Acet impormasyon sa merkado

Acet's market cap history

Acet holdings by concentration

Whales

Investors

Retail

Acet addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

Acet na mga rating

Mga average na rating mula sa komunidad

4.6

Ang nilalamang ito ay para sa mga layuning pang-impormasyon lamang.

ACT sa lokal na pera

1 ACT To MXN$1.81 ACT To GTQQ0.681 ACT To CLP$82.571 ACT To UGXSh323.821 ACT To HNLL2.261 ACT To ZARR1.611 ACT To TNDد.ت0.271 ACT To IQDع.د115.761 ACT To TWDNT$2.931 ACT To RSDдин.9.61 ACT To DOP$5.591 ACT To MYRRM0.391 ACT To GEL₾0.251 ACT To UYU$3.721 ACT To MADد.م.0.851 ACT To AZN₼0.151 ACT To OMRر.ع.0.031 ACT To SEKkr0.881 ACT To KESSh11.431 ACT To UAH₴3.67

- 1

- 2

- 3

- 4

- 5

Last updated as of 2025-03-28 02:42:38(UTC+0)

Acet balita

Meta Gorgonite: Bakit ang potensyal ng $ACT ay malayo pa sa katapusan

推特观点精选•2024-11-23 02:50

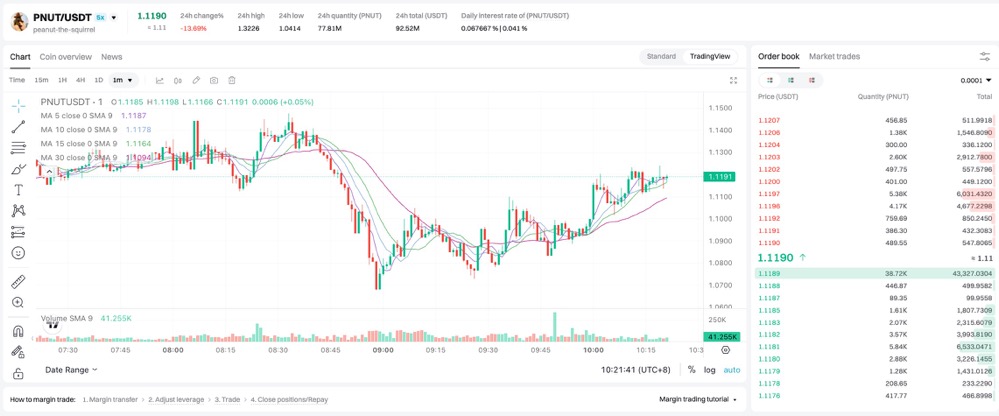

Sun at Moon Xiao Chu: Bakit patuloy akong nagdadagdag ng posisyon sa pag-pullback ng $PNUT at $ACT?

Twitter Opinion Selection•2024-11-23 02:24

![Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 22]](https://img.bgstatic.com/multiLang/web/8e1199d7822fef00d2ec95133764186d.png)

Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 22]

Renata•2024-11-22 09:22

![Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 18]](https://img.bgstatic.com/multiLang/web/8e1199d7822fef00d2ec95133764186d.png)

Dapat Basahin Ngayon | Mga Itinatampok na Tanawin sa Twitter [Nobyembre 18]

Renata•2024-11-18 07:48

Buy more

Ang mga tao ay nagtatanong din tungkol sa presyo ng Acet.

Ano ang kasalukuyang presyo ng Acet?

The live price of Acet is ₱5.08 per (ACT/PHP) with a current market cap of ₱6,386,072,191.01 PHP. Acet's value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. Acet's current price in real-time and its historical data is available on Bitget.

Ano ang 24 na oras na dami ng trading ng Acet?

Sa nakalipas na 24 na oras, ang dami ng trading ng Acet ay ₱16.71M.

Ano ang all-time high ng Acet?

Ang all-time high ng Acet ay ₱110.96. Ang pinakamataas na presyong ito sa lahat ng oras ay ang pinakamataas na presyo para sa Acet mula noong inilunsad ito.

Maaari ba akong bumili ng Acet sa Bitget?

Oo, ang Acet ay kasalukuyang magagamit sa sentralisadong palitan ng Bitget. Para sa mas detalyadong mga tagubilin, tingnan ang aming kapaki-pakinabang na gabay na Paano bumili ng .

Maaari ba akong makakuha ng matatag na kita mula sa investing sa Acet?

Siyempre, nagbibigay ang Bitget ng estratehikong platform ng trading, na may mga matatalinong bot sa pangangalakal upang i-automate ang iyong mga pangangalakal at kumita ng kita.

Saan ako makakabili ng Acet na may pinakamababang bayad?

Ikinalulugod naming ipahayag na ang estratehikong platform ng trading ay magagamit na ngayon sa Bitget exchange. Nag-ooffer ang Bitget ng nangunguna sa industriya ng mga trading fee at depth upang matiyak ang kumikitang pamumuhunan para sa mga trader.

Saan ako makakabili ng crypto?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Ang mga investment sa Cryptocurrency, kabilang ang pagbili ng Acet online sa pamamagitan ng Bitget, ay napapailalim sa market risk. Nagbibigay ang Bitget ng madali at convenient paraan para makabili ka ng Acet, at sinusubukan namin ang aming makakaya upang ganap na ipaalam sa aming mga user ang tungkol sa bawat cryptocurrency na i-eooffer namin sa exchange. Gayunpaman, hindi kami mananagot para sa mga resulta na maaaring lumabas mula sa iyong pagbili ng Acet. Ang page na ito at anumang impormasyong kasama ay hindi isang pag-endorso ng anumang partikular na cryptocurrency.

Binance ChainBNB Chain Ecosystem

Bitget Insights

Miss_Tanzila

2h

Memecoin Performance Since Trump’s Return to Office:

Since Trump’s re-election, several memecoins have seen explosive growth, while others have faced sharp declines. These tokens, driven by hype, memes, and speculation, continue to dominate parts of the crypto market.

🔥 Top Memecoins in the Spotlight

🚀 $DOGE | $TRUMP | $SHIB | $PEPE | $BONK | $FLOKI | #MELANIA | #BABYDOGE | $SPX | #FARTCOIN

💥 Some of these coins have delivered massive gains, while others have struggled to live up to expectations.

💡 Why Does This Matter?

Memecoins often act as a sentiment gauge for the broader crypto market:

✅ Strong rallies suggest high risk appetite among investors.

⚠️ Sharp declines can signal a shift in sentiment—when they drop, they drop hard!

🔮 What’s Next?

With political narratives gaining traction and the crypto market heating up, another wave of memecoin hype could be on the horizon. However, these tokens remain highly volatile, so always do your own research before investing...

FARTCOIN-0.20%

DOGE+0.33%

padrepio

4h

How Community Fundraising Fuels the Growth of Projects Like BANANAS31

Community fundraising plays a crucial role in fueling the growth of projects like BANANAS31 by providing essential capital, fostering a dedicated user base, and increasing engagement. Unlike traditional fundraising methods that rely on venture capital or institutional investors, community-driven fundraising harnesses grassroots support to build a decentralized, enthusiastic, and financially committed community.

One of the primary ways BANANAS31 benefits from community fundraising is through token presales and fair launches. These events allow early supporters to acquire tokens at a lower price, incentivizing long-term holding and active participation. When a strong community believes in a project, they are more likely to contribute financially and spread awareness, driving organic growth.

Additionally, decentralized fundraising mechanisms such as Initial DEX Offerings (IDOs) or community crowdfunding campaigns enable wider participation. Projects like BANANAS31 leverage these strategies to ensure fair token distribution while simultaneously attracting investors who are genuinely interested in its long-term success. A well-executed fundraising campaign can also act as a marketing tool, creating hype and drawing attention from larger investors.

Beyond financial contributions, community-driven funding helps validate a project’s vision and utility. When thousands of individuals contribute, it signals strong market demand and enhances credibility. This collective support often translates into a network effect, where the growing community further attracts developers, partnerships, and additional funding sources.

Moreover, governance and decision-making within community-funded projects often remain decentralized. BANANAS31’s supporters can participate in governance proposals, helping shape the project’s future direction. This democratic involvement strengthens user loyalty and ensures that the project aligns with the interests of its core community.

$BANANAS31

CORE-0.09%

BANANAS31-9.97%

Aicoin-EN-Bitcoincom

6h

Bipartisan Legislation Seeks to Distinguish Securities and Commodities in the Crypto Market

The bill seeks to clarify jurisdictional boundaries for regulators and provide market certainty for innovators and investors by distinguishing digital assets from the securities contracts they may be tied to. Current law does not separate assets from their associated investment contracts, creating compliance challenges for decentralized projects that evolve beyond initial fundraising stages.

“Entrepreneurs need clarity to calculate risk accurately, create new investment opportunities, and grow our economy,” Emmer said, emphasizing that unclear definitions hinder innovation. Soto added that the bill would “maximize the potential of virtual currencies” while protecting investors and consumers.

Industry groups, including Coin Center and the Blockchain Association, endorsed the legislation. Peter Van Valkenburgh of Coin Center called it “the smartest approach” to applying securities law to digital assets, while Kristin Smith of the Blockchain Association said it offers “clear rules of the road” for companies.

The act defines “investment contract assets” as distinct from securities offerings, enabling tokens to transition from regulated securities to commodities as projects decentralize. Advocates argue this prevents outdated frameworks from stifling utility-driven token use.

Previously included in the House-passed FIT21 Act of 2024, the revived proposal reinforces efforts to position the U.S. as a leader in blockchain innovation. Backers say it balances consumer protections with fostering competition in the global digital economy.

The Chamber of Digital Commerce and Crypto Council for Innovation also support the bill, citing urgent needs for legal frameworks. Emmer’s office noted that the legislation is technology-neutral, applying to all assets tied to investment contracts

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

ACT-0.15%

S-1.39%

Stanz007

6h

KILO (KiloEx): Bullish or Bearish? A 2025 Trader’s Guide

The cryptocurrency market is a rollercoaster, and KILO (KiloEx) is no exception. With its price swinging wildly and mixed signals from analysts, traders and holders face a critical question: *Do you trade the volatility or hold for long-term gains?* Let’s break down the case for both strategies.

*Current Snapshot of KILO

- **Price**: $0.1216 (down 16.66% in 24 hours) .

- **Market Cap**: $25.74M, with a 24-hour trading volume of $53.44M .

- **All-Time High (ATH)**: $0.1622 (set on March 27, 2025) .

- **Technical Signals**:

- **4-hour chart**: Strong buy signal .

- **Daily/weekly charts**: Undefined trend, suggesting uncertainty .

---

### **The Bullish Case: Why KILO Could Rally**

1. **Technical Rebound Potential**:

- The 4-hour chart shows a “Strong Buy” signal, indicating short-term bullish momentum .

- If KILO holds support near its current price ($0.1216) and breaks above $0.13, a retest of its ATH ($0.1622) is plausible. Fibonacci retracement levels (e.g., 0.618 golden ratio) often act as critical reversal zones in crypto markets, and KILO’s volatility aligns with this pattern .

2. **High Trading Volume**:

- A 24-hour trading volume of $53.44M signals liquidity and trader interest. High volume during price dips can indicate accumulation by whales or institutions .

3. **Market Sentiment**:

- Bitcoin’s bullish momentum (driven by options expiries and ETF inflows) often lifts altcoins like KILO. A positive shift in BTC’s price could trigger a “risk-on” rally for smaller caps .

**Trade Strategy for Bulls**:

- Buy dips near $0.12 with a stop-loss at $0.1128 (ATH low) .

- Target $0.15 (23.6% Fibonacci extension) or $0.1622 (ATH retest) for short-term gains .

---

### **The Bearish Risks: Why KILO Could Drop**

1. **Lack of Fundamentals**:

- KILO’s use case and long-term roadmap are unclear. Without utility or partnerships, speculative pumps may fizzle out .

2. **Technical Breakdown**:

- A drop below $0.1128 (ATH low) could trigger panic selling. The 1-day chart’s “undefined” signal hints at weak bullish conviction .

3. **Macro Pressures**:

- Rising interest rates and regulatory crackdowns on speculative assets could drain liquidity from altcoins like KILO .

**Trade Strategy for Bears**:

- Short KILO if it breaks below $0.1128, targeting $0.10 (psychological support).

- Use put options or inverse ETFs to hedge against downside .

---

### **Hold vs. Trade: Key Considerations**

| **Factor** | **Traders** | **Holders** |

|----------------------|---------------------------------------------|---------------------------------------------|

| **Time Horizon** | Focus on 4h–1d charts; capitalize on volatility. | Prioritize multi-month/year timelines. |

| **Risk Tolerance** | High (leverage, tight stop-losses). | Moderate (dollar-cost averaging). |

| **Market Catalysts** | News-driven pumps (e.g., exchange listings). | Long-term adoption or protocol upgrades. |

---

### **Technical Levels to Watch**

- **Support**:

- **Critical**: $0.1128 (ATH low) – A breakdown here = bearish .

- **Secondary**: $0.10 (psychological level).

- **Resistance**:

- **Immediate**: $0.13 (23.6% Fib level).

- **ATH Retest**: $0.1622 .

---

### **Long-Term Holding: Is It Viable?**

- **Pros**:

- Reduced tax burdens on long-term capital gains .

- Potential recovery if KILO integrates into DeFi or AI trends .

- **Cons**:

- No clear utility or roadmap raises existential risks .

- Price predictions for 2026/2031 project $0.00, signaling skepticism .

**Strategy for Holders**:

- Dollar-cost average (DCA) to mitigate volatility.

- Diversify into stablecoins or blue-chip cryptos (BTC/ETH) to hedge .

---

**Final Verdict**

- **Short-Term (1–4 weeks)**: **Bullish** if KILO holds $0.1128 and BTC rallies. Trade the volatility with tight risk management.

- **Long-Term (6+ months)**: **Bearish** unless KILO develops fundamentals. Hold only with strict diversification.

**Key Takeaway**: KILO is a high-risk, high-reward play. Traders can profit from swings, but holders need patience—and a strong stomach.

*Sources: Bitget, TradingView, CoinGlass*

*Disclaimer: This is not financial advice. Cryptocurrencies are volatile—always conduct your own research.$KILO

BTC-0.10%

BLUE-2.94%

Crypto-Ticker

11h

Solana Price Ready to Explode or Fakeout Incoming?

Solana (SOL) , one of the top-performing altcoins of the last cycle, is now facing a critical technical moment. After a turbulent start to 2025 marked by a prolonged downtrend, the token is showing early signs of a potential trend shift. With recent price stabilization and a gradual climb from local lows, traders and investors alike are watching closely for the next big move. Is Solana preparing for a breakout that could reignite bullish momentum, or is this just another deceptive bounce before further downside? Let’s dive into the charts and indicators to find out what’s next.

Solana (SOL) has been slowly climbing out of a multi-week downtrend that began after its local high near $210 in late December 2024. After bottoming out near the $120 level in early March, SOL price has shown signs of stabilization. This latest consolidation phase hints at an impending breakout—or a potential fakeout that could catch traders off guard.

On the daily chart, SOL price has reclaimed the 20-day Simple Moving Average (SMA) and is attempting to establish support above it. However, the price is still below the 50-day and 100-day SMAs, which currently act as dynamic resistance levels near $154 and $183, respectively. The 200-day SMA—hovering at approximately $183.28—remains a long-term ceiling, emphasizing that SOL still needs to prove itself before a full-blown bullish trend resumes.

>>Click Here to Buy Solana on Bitget<<

Momentum indicators paint a mixed picture. The Relative Strength Index (RSI) sits at 48.29, marginally below the neutral 50 mark. While this shows recovery from the oversold levels seen earlier in March, it also reflects hesitation. RSI’s inability to push above 50 suggests that buying pressure remains tentative, and a sharp move in either direction could follow.

It’s worth noting that the RSI has formed a higher low, which typically precedes a price rally. But for confirmation, the RSI must break above 55–60 territory. Until then, the risk of range-bound or downward movement still lingers.

On the support side, $130 stands out as the immediate psychological and technical level. If SOL fails to hold above this zone, the next major demand region lies around $120, where the recent bottom was formed.

On the upside, the $145–$155 range represents the first major challenge, aligning with both price structure and the 50-day SMA. A clean breakout above this band would open the gates to $170 and potentially retest $183—where the 200-day SMA looms. A daily close above $183 would be a strong bullish signal, possibly triggering a momentum-driven rally toward $200+ levels.

>>Click Here to Buy Solana on Bitget<<

The current chart structure resembles a rounded bottom pattern with a tightening price range. This pattern often precedes a breakout move, and the confluence of narrowing candles with rising volume could confirm such a move soon. However, without a decisive close above $155 and sustained buying pressure, the risk of a bull trap remains high.

Volume analysis and RSI divergence will be critical in the next few sessions. If buyers step in strongly on higher-than-average volume while RSI climbs above 50, it may validate a genuine breakout. On the contrary, a failed test of the $145–$150 resistance zone followed by a breakdown below $130 would likely trigger a retest of March lows.

If bulls manage to push Solana price above $155 in the next few days, the next price target lies around $170, with a bullish extension potentially reaching $200 within the next few weeks. However, failure to do so could result in a pullback toward $130 or even $120 before any sustainable rally takes place.

Overall, Solana is at a pivotal technical juncture. The price is compressing between short-term moving averages and horizontal resistance, indicating a strong move is imminent. Whether it's upward or downward depends on how price reacts to the $145–$155 resistance range in the coming sessions.

NEAR+0.43%

ACT-0.15%

Mga kaugnay na asset

Mga sikat na cryptocurrencies

Isang seleksyon ng nangungunang 8 cryptocurrencies ayon sa market cap.

Kamakailang idinagdag

Ang pinakahuling idinagdag na cryptocurrency.

Maihahambing na market cap

Sa lahat ng asset ng Bitget, ang 8 na ito ang pinakamalapit sa Acet sa market cap.