- Bitget

- Riset

- Daily Research Report

- Bitget Research: BTC Surpasses $72,000 to Set New High, Cancun Upgrade Contains Wealth Creation Opportunities

Bitget Research: BTC Surpasses $72,000 to Set New High, Cancun Upgrade Contains Wealth Creation Opportunities

Aaron & Tommy

2024/03/12

In the past 24 hours, many new popular tokens and topics have emerged in the market, which could potentially be the next wealth creation opportunity.

Overview

The bull market driver, MicroStrategy, continues its strong momentum. The company spent about $800 million to buy 12,000 BTC, helping BTC break through the $72,000 mark and reach a new historical high. The highlights are as follows:

-

Sectors with strong wealth creation effect: Blue-chip token sector and old blockchain projects.

-

Top searched tokens and topics by users: Blast ecosystem's top DApps, METIS, UNIBOT, CELO, and GROK.

-

Potential airdrop opportunities: Mode Network and Stack.

Historically, March 12 has witnessed significant pullbacks in the crypto market, leading investors to adopt a cautiously bullish strategy. The trend of MicroStrategy and Wall Street capitals continuously buying BTC remains unchanged, suggesting BTC is likely to continue its upward trajectory. The Cancun upgrade, set to activate on the mainnet on March 13, is likely to present wealth opportunities for the tokens of benefiting projects, including ARB, METIS, and IMX.

Data collection time: March 12, 2024, 4:00 AM (UTC)

1. Market Environment

In the past 24 hours, BTC broke through the $72,000 barrier, reaching a new historical high, and ETH has surged past $4000, setting a new short-term high. The bull market driver MicroStrategy's purchase of approximately 12,000 BTC for about $800 million is a key reason for BTC's crucial breakthrough. With bullish sentiment surging and the funds unusually active in the market, BTC's upward trend is likely to persist.

Yesterday, two U.S. presidential candidates each conveyed messages favorable to the crypto market: Biden mentioned that the Federal Reserve is about to cut interest rates, and Trump stated that he would not suppress BTC if elected president. Fiscal policies tend to be more aggressive during presidential election years, and macro liquidity favors the continued upward movement of the crypto market. Influenced by liquidity, the meme sector may continue to see unusual activity, suggesting to pay attention.

2. Wealth Creation Sectors

1) Sector Movements — Blue-chip sector (BTC and ETH)

Primary reasons: 1. MicroStrategy's direct investment of $800 million in BTC; 2. Continuous net inflows into BTC ETFs.

Price increase: BTC broke through the $72,000 mark, reaching a new historical high; ETH stabilized at $4000.

Factors affecting future market conditions:

-

Sustainability of BTC ETF net inflows: Net inflows have been maintained for several trading days, with the volume of net inflows gradually decreasing. It's important to monitor whether the net inflows for BTC ETFs can continue. A first occurrence of net outflows should prompt consideration of reducing leverage.

-

Crypto market sentiment: Today is March 12, a date historically associated with significant pullbacks in the crypto market. Market participants may be wary of the risk of a pullback, hence adopting a cautiously bullish strategy. It is advisable to set reasonable stop-loss lines in the next couple of trading days to mitigate the risk of an unexpected pullback.

2) Sector Movements: Old blockchain projects (XRP and LTC)

Primary reasons: 1. The surge in BTC and ETH prices led to an upward trend in the overall market; 2. Hot money inflow led to a significant increase in the open interests of XRP and LTC.

Price increase: XRP, LTC, and RVN rose by approximately 15%.

Factors affecting future market conditions:

-

Change in trading strategies: After BTC reached a new high, XRP and LTC have significantly underperformed compared to the broader market, leading to a catch-up rally. Taking LTC as an example, its current price is $100, with the low support zone at $70 and the previous high at $270. LTC's maximum drawdown is 30%, with a potential return of 270%, resulting in a high risk-reward ratio that has attracted market attention. XRP and LTC are likely to experience catch-up rallies soon, which is worth monitoring.

-

Changes in the open interest amount: The surge occurred yesterday in open interest for XRP and LTC indicating an influx of hot money. Funds need to drive up the spot prices of XRP and LTC before closing positions to take profit. Based on recent trends of major funds driving up prices, spot assets are likely to undergo two to three rounds of pumping and adjustment. Therefore, it is essential to pay close attention to changes in the open interest amount of XRP and LTC.

3) Sectors to focus on next — Cancun upgrade sector

Primary reason: The ETH Cancun upgrade is scheduled to be activated tomorrow (March 13), which will improve the transaction execution efficiency of the ETH network and enhance the narrative space for ecosystem projects.

Specific token list:

-

ARB: The TVL of the Arbitrum ecosystem has continuously risen during the bear market, providing foundational funding for ecosystem development and project deployment. However, the ARB token has shown weak performance, indicating potential for a catch-up rally.

-

METIS: It is the first to use both OP Rollup and ZKPs Rollup. The Cancun upgrade will significantly enhance its network performance. METIS has recently been actively listed by exchanges, offering substantial potential for future gains.

-

IMX: A top gaming Layer 2 project. After the Cancun upgrade, the TPS will significantly improve, making it easier to record game data on the blockchain and reducing user interaction costs. IMX will directly benefit from the Cancun upgrade.

3. User Trending Searches

1) Popular DApps

Leading DApps in the Blast ecosystem (Orbit Protocol and Pac Finance)

Blast officially announced that the annualized yield of Blast ecosystem stablecoin USDB will be adjusted upwards following MakerDAO's yield parameter updates, offering USDB holders a 15% annualized yield rate and Blast credits. The TVL of two leading lending protocols on Blast, Orbit Protocol and Pac Finance, surged over the past 7 days, with increases of 367% and 423%, respectively, reaching $400 million and $280 million. Depositing stablecoins in these lending protocols as USDB can earn a triple return of "USDT-margined high annualized yield + Blast credits + lending project credits or rewards".

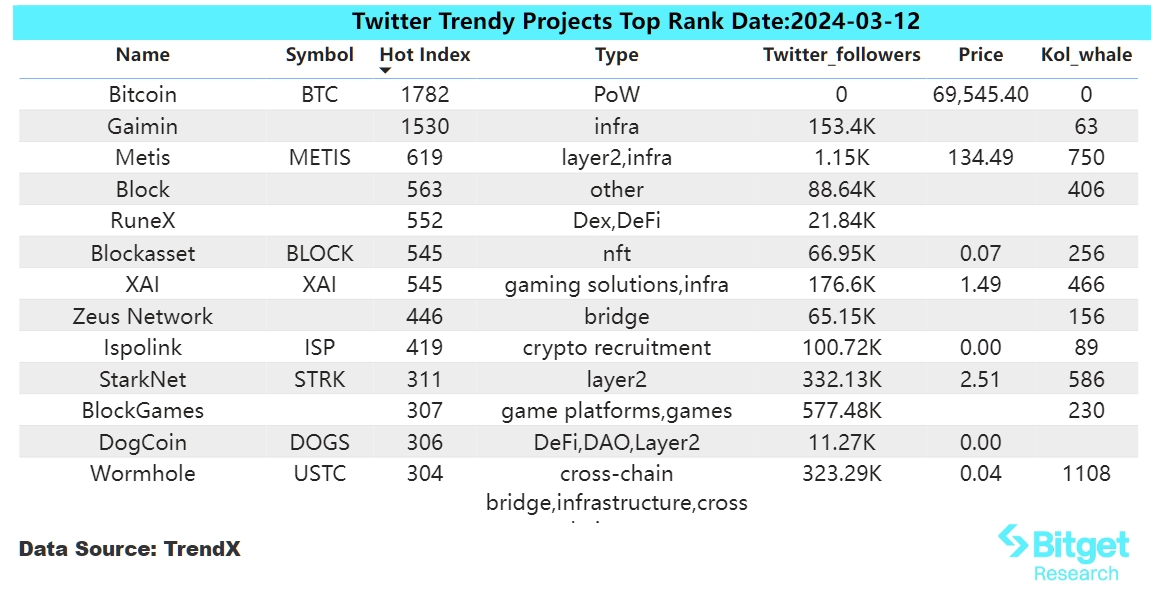

2) Twitter

Metis (METIS):

METIS is the first to innovate with a "decentralized sequencer" within the ETH Layer 2 space, currently with a TVL of $1.06 billion, ranking it 7th among ETH Layer 2 solutions, situated between Base and Mantle. The project has also drawn market attention because one of its founders is Vitalik Buterin's mother. Yesterday, Binance announced the listing of METIS, causing the token's price to briefly surge above $145, with its current price at $132. In December last year, MetisDAO launched a $110 million ecosystem development fund, which has yet to make a significant impact. However, METIS and its ecosystem projects still have considerable growth potential in this bull market.

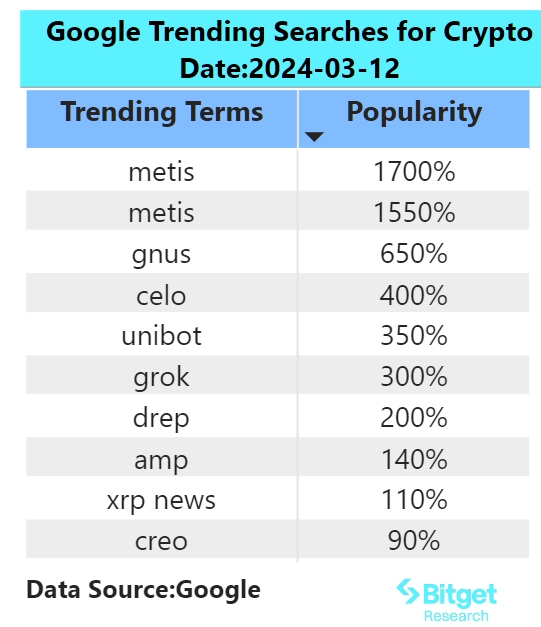

3) Google Search (Global and Regional)

From a global perspective:

(1) METIS

It was described in the previous section.

(2) UNIBOT

Yesterday, Unibot announced it had ended its collaboration with the team that deployed Unibot on

Solana, citing an inability to guarantee the safety of funds in Unibot Solana's bots, resulting in a 50% drop in the token's price. Recently, 80% of memecoin trading volume on Unibot products came from the Solana blockchain, and such negative news has significantly impacted the once-leading Telegram Bot project. However, Unibot's product stability and profitability have been proven in the previous ETH blockchain meme season. If the Unibot team can introduce more innovative solutions in the future or properly address the issues with the Solana Bot, the plummeted UNIBOT could represent a valuable investment in the current market.

From a regional perspective:

(1) Europe and the USA have shown interest in CELO and GROK:

CELO, a Layer 1 blockchain focused on DeFi and EVM compatibility, saw its token price surge by 50% short-term after

Tether announced the launch of USDT on the Celo blockchain. This news trended in multiple countries, including the USA, the UK, Switzerland, Spain, Germany, France, and Australia.

GROK also appeared in trending searches in Europe and the USA with high frequency. Yesterday, Elon Musk announced that his company xAI would open-source its chatbot product Grok, causing the memecoin named GROK to double in price. The open-sourcing of Grok marks a new phase in the competition between OpenAI and xAI, with more small and medium AI enterprises likely joining one of the two camps, potentially benefiting the hardware seller Nvidia. Topics such as AI, computing power, and storage are expected to remain hot, with tokens related to these sectors being hyped repeatedly.

(2) Attention in Asia is mainly on METIS:

METIS has been trending in most Southeast Asian and South Asian countries. Additionally, Monad, which has not issued its token yet, appeared as the second trending keyword in India, primarily due to the news that "Paradigm is in talks to raise over $200 million for the Layer 1 blockchain project Monad Labs, valuing the company at $3 billion." The mainnet interaction of Monad is worth watching in the future, as it may offer opportunities for significant airdrops.

4. Potential Airdrop Opportunities

Mode Network: An airdrop project with a grant from OP, offers a

low entry threshold and quick expected returns

Mode is one of the projects built on the OP Stack, planning to distribute 550 million MODE tokens (5.5% of the total supply) in April for airdrop incentives.

To participate, simply bridge tokens like ETH to the Mode mainnet to earn credit, with token use in ecosystem interactions yielding double credits. Additional tips: If you wish to bridge your funds back, cross-chaining from the official bridge to the ETH mainnet requires a 7-day wait. However, using Orbiter for cross-chaining allows for immediate transfers and saves on gas fees by utilizing other Layer 2 chains while also earning Orbiter cross-chain bridge credits.

Stack: A Coinbase-backed on-chain credit solution with early-stage potential

Stack offers an on-chain solution for converting credits into ERC20 tokens and launched its mainnet yesterday. It is a "credit chain" specifically designed for on-chain loyalty programs. The project completed a $3 million seed funding round led by Archetype and followed by Coinbase. Beyond the current buzz around airdrop credit trading, the launch of GameFi Summer in 2024 could see more AAA game credits available for trading, suggesting significant growth potential for Stack.

For those looking to participate, it's advisable to start by registering an account and joining the project's community. Starting to explore and engage with the project now means catching an early-stage opportunity.