- Bitget

- Riset

- Daily Research Report

- Bitget Research: BTC Breaks All-Time High, GameFi Sector Begins to Rise

Bitget Research: BTC Breaks All-Time High, GameFi Sector Begins to Rise

Victoria & Jarseed

2024/03/11

In the past 24 hours, many new popular tokens and topics have emerged in the market, which could potentially be the next wealth creation opportunity.

Overview

Bitcoin surged past $71,000, setting a new historical high before adjusting between $69,000 and $71,000, with altcoins gradually gaining strength. The highlights are as follows:

-

Sectors with strong wealth generation effect: GameFi and large market cap altcoins experiencing a catch-up rally.

-

Top searched tokens and topics by users: ZRX, PIXEL, Gaimin, and AERO.

-

Potential airdrop opportunities: Nostra and Ekubo.

Following Bitcoin's new all-time high, the gaming sector received significant attention from the speculative capital, with an abundance of capital rotating into large market cap tokens that had been lagging. Investors should keep an eye on GameFi sector projects like YGG, GALA, and PIXEL, as well as social sector IDs and leading tokens in the oracle sector like LINK and PYTH, which are among the top 100 by market cap. With the upcoming Nvidia GTC conference, leading AI tokens such as RNDR, WLD, and FET represent high-certainty opportunities for investors to consider entering at lower prices.

Data collection time: March 11, 2024, 4:00 AM (UTC+0)

1. Market Environment

Over the weekend, BTC surged past $70,000, setting a new historical high before stabilizing and adjusting between $69,000 and $71,000. The introduction of Bitcoin ETFs has significantly increased the overall trading volume, with the amount of Bitcoin ETFs bought last week reaching five times the miners' output. Sector rotation continues, with profits from the AI sector partially flowing into the blockchain gaming sector. GameFi sector tokens such as GALA, YGG, and PIXEL are likely to maintain their upward trend and are worth monitoring.

Macroeconomic data is favorable for the

cryptocurrency market. The yield on U.S.10-year Treasury notes has reached a one-month low, while the U.S. Dollar Index's decline has also reached a new one-month low. Additionally, compared to the short-term fluctuations of the U.S. stock market, the impressive performance of cryptocurrencies, led by BTC, is attracting more funds to the cryptocurrency market. Typically, after BTC reaches a new all-time high and begins to fluctuate, altcoins start to make their move. Therefore, it is advisable to pay attention to altcoin trading opportunities in popular sectors such as AI,

memecoins, and GameFi.

2. Wealth Creation Sectors

1) Sector movements — GameFi sector (GALA, YGG, and PIXEL)

Primary reason:

-

Increased community attention: Following Bitcoin's new all-time high, the blockchain gaming sector saw a general rise. YGG and GALA's prices have rebounded by more than 80% in the last two weeks, with high search volumes on Twitter. DWF is the market maker of both projects, leading to a unified bullish expectation.

-

Increased user base: PIXEL's token price hit a new high, with monthly on-chain transactions exceeding 1.5 million and DAU reaching 500,000, doubling from the previous month's 250,000 DAU.

Price increase: Over the past 24 hours, GALA, YGG, and PIXEL have risen by 31%, 18%, and 13%, respectively.

Factors affecting future market conditions:

-

Market to hype up the global blockchain gaming conference: The 2024 Game Developers Conference (GDC) is scheduled from March 18 to March 22, with external investors, institutions, and traditional game developers in attendance. Developers often release positive news during the conference, allowing for early investment in blockchain gaming projects like YGG, GALA, and AXS.

-

PIXEL poised to lead a second wave in gaming: PIXEL has become the first Web 3 game with more than 100,000 daily active users, with a strong community foundation and potential purchasing power. PIXEL has announced a deep partnership with YGG to co-build the Guild of Guilds (GoG), suggesting significant room for token price growth and support for the entire blockchain gaming sector.

2) Token movements — Large market cap altcoins like ID, PYTH, LINK saw catch-up rally

Primary reason: Capital inflows through BTC ETFs into the crypto market, with BTC and ETH experiencing significant rises and surpassing previous highs over the weekend, activated the market funds and led to a catch-up rally.

Price increase: In the past 24 hours, ID saw a 24% increase, PYTH increased over 20%, and LINK saw a 12%.

Factors affecting future market conditions:

-

The combination of social applications with the AI concept is worth attention: SPACE ID, a full-chain domain service provider on the BNB Chain, allows users to link their identities across multiple chains, enabling the use of the same domain name on different chains. With the official release of SPACE ID 3.0, compared to Worldcoin (WLD), which is in the AI identity verification sector, SPACE ID integrates AI and DID identity to jointly promote the rapid development of AGI. Other assets that will benefit from this include WLD and GAL, which have significant potential for future price increases.

-

The performance of PYTH, a leading oracle project in the SOL ecosystem, is worth attention: PYTH is not only used in the Solana ecosystem but also by over 15 applications on Blast, including the perpetual futures DEX protocol, DTX. Moving forward, the adoption of PYTH and the scale of participation in the staking promotion should be closely watched. If the number of stakers and the volume of staked assets continue to rise, this will be beneficial for the token price.

3) Sectors to focus on next — AI sector (RNDR, WLD, and FET)

Primary reason: The 2024 NVIDIA GTC conference will be held from March 17 to 21 in San Jose, California. This AI conference is considered the largest global AI event, with founders of RNDR and other AI projects in the Web 3 domain announcing their participation. Participating in this conference significantly increases the exposure of these projects, likely leading to major funds leveraging this positive news to drive up prices. Therefore, investments in related leading AI tokens should be considered before the event.

Specific token list:

-

RNDR: This project is a decentralized GPU rendering platform that has expanded its GPU computing power to AI and ML domains, providing distributed GPU resources to numerous computing clients. As a foundational infrastructure in the AI sector, RNDR is regarded as a leading project in the AI field.

-

WLD: Despite recent regulatory controversies in some countries, the consensus around the AI boom, and the positive background of being invested in by the founder of OpenAI, external capital inflow is expected to continue driving the token's price up.

-

FET: Fetch.ai has created an AI platform and services enabling anyone to build and deploy AI services at scale, anytime and anywhere. Following its investment in computing power facilities and the expansion of FET's staking and use cases on March 5, the token price has been on an upward trend. If the project makes substantial progress in the computing power field, the price has even more potential for growth.

3. User Trending Searches

1) Popular DApps

Aerodrome (AERO)

Aerodrome is a swap and liquidity trading platform on the Base chain, boasting the largest TVL on the Base chain at $245 million. The project primarily addresses the initial token distribution and liquidity issues for new projects on the Base chain, making it a cornerstone project for the development of the DeFi ecosystem on the Base chain. The Base Foundation has recently invested in this project, and its token currently sees significant trading volume on the Coinbase exchange. Since the investment announcement, the token's price has surged by approximately 470%. Supported by both the project's fundamentals and its strategic position within the Base ecosystem, investors could consider buying during dips. The project is expected to grow alongside the development of the Base ecosystem.

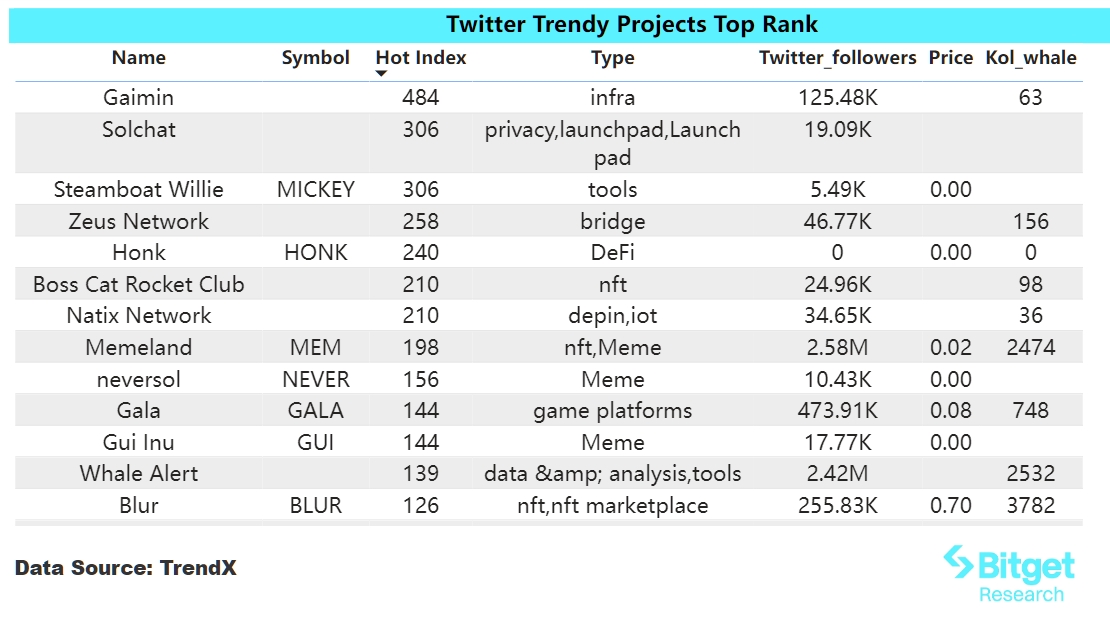

2) Twitter

Gaimin (Has no token issued yet)

This project, incubated by Coinmarketcap Labs, is a BNB Layer 2 project dedicated to gaming infrastructure, encompassing decentralized computing power, a game distribution platform, IGO Launchpad, and a gaming community. On March 9, the project launched an Airdrop Farming event, allowing users to earn project tokens by retweeting, commenting on, and liking specified tweets. Currently, influencers and esports stars on Twitter are actively promoting the project, including renowned NFT player Dingaling and the esports team Gaimin Gladiators. Investors might consider participating in the current Airdrop Farming event to secure airdropped tokens.

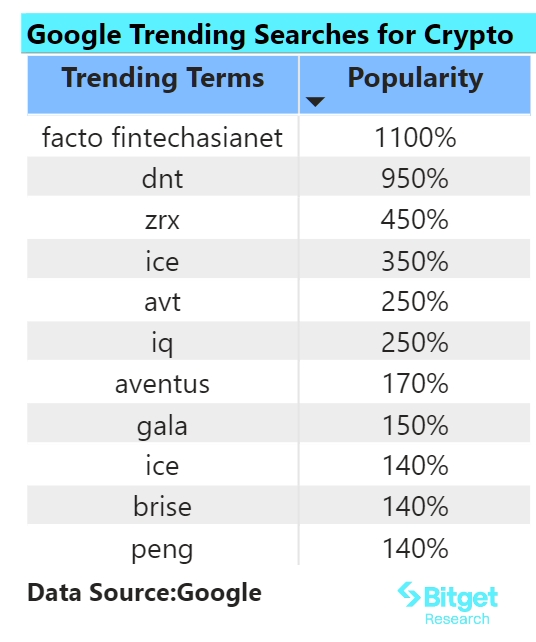

3) Google Search

From a global perspective:

0xProtocol token ZRX is highly discussed:

0xProtocol has always been an active and popular decentralized aggregator on the

Ethereum blockchain, providing liquidity support and services to various projects with its products, 0x and Macha. As an important liquidity provider in the DeFi sector, its token's market cap has been low. The recent increase in its token price reflects the market's reevaluation of the high-quality project 0xProtocol. The future performance of its token price will depend on the overall performance of the DeFi sector and any policy adjustments by the 0xProtocol itself that may benefit its token price.

From a regional perspective:

(1) English-speaking countries and Europe have shown a keen interest in gaming tokens (GALA and PIXEL):

During the weekend, tokens in the gaming sector experienced a collective rally, with the prominent gaming projects like GALA and PIXEL leading the gains. PIXEL, a project that recently launched on Binance LaunchPool with an active player community, saw its token price increase by up to 80.4%. The market widely expects Binance and Animoca to heavily promote Web3 gaming projects in March, suggesting investors should watch for high-quality, undervalued opportunities in the gaming sector, such as Mavia and Portal.

(2) Asia has shown interest in Solana ecosystem memecoins (PENG and IQ50):

The Solana ecosystem's meme projects have been numerous and showing strong performance recently, clearly suggesting these projects are operated by clearly identified renowned teams and receive financial backing, with examples like PENG receiving investment from Gobit Hedge Fund and IQ50 launching its IDO on BakerySwap. For such projects with clearly identified teams and financial backing, investors might consider participating in early IDOs or private rounds, as they are highly likely to yield considerable returns.

4. Potential Airdrop Opportunities

Nostra — The leading comprehensive DeFi project by TVL on Starknet

Nostra is the largest comprehensive DeFi project on the Starknet network, featuring lending, swaps, and other functionalities. The project currently offers a points system, where users can earn points by participating in lending and adding liquidity, which may qualify them for a potential airdrop. Additionally, Nostra has been selected for the Starknet DeFi Spring incentive program, offering users extra STRK token rewards for adding liquidity.

To date, Nostra's TVL is $95.47 million, with an APR for major liquidity pools around 30%.

To participate, visit the official website, connect your wallet, select the appropriate deposit or lending token, and proceed to receive point rewards in real-time. The Starknet DeFi Spring incentive program includes four trading pairs: STRK/ETH, STRK/USDC, USDC/USDT, and

ETH/USDC. Users can add liquidity to these pools to earn points and additional STRK token rewards.

Ekubo — A leading AMM DEX by TVL on Starknet

Ekubo is a leading AMM DEX on the Starknet network by TVL. This project also offers a points system, where users can earn points for adding liquidity or inviting new users, potentially qualifying for an airdrop. Ekubo has also been selected for the Starknet DeFi Spring incentive program, allowing users to earn additional STRK tokens for adding liquidity.

To date, Ekubo's TVL is $42.14 million, with an average APR for major liquidity pools above 50%. Uniswap exchanged $12 million worth of UNI tokens for a 20% stake in the future protocol governance tokens of Ekubo Protocol.

To participate, visit the official website, connect your wallet, and add your token pairs as LP to the specified liquidity pools (STRK/ETH, STRK/USDC, USDC/USDT, and ETH/USDC) to earn points and STRK tokens.