- Solana (SOL)-based memecoin launch platform, Pump.fun has liquidated $78 million worth of SOL, forcing a nosedive from the recent high of $170.

- A Solana whale is also reported to have sold 22,726 SOL ($3.86 million), however, he still holds 20,000 SOL ($3.33 million).

Solana (SOL) -based Memecoin-launch platform Pump.fun is reported to have generated total revenue of a whopping 969,945 SOL ($162M). Out of this, about 50%, representing 503,343 SOL ($78.7M), has been sold at an average price of $156. According to Lookonchain data analyzed by CNF, its latest SOL sales occurred on October 22 when $6.6 million worth of the token was liquidated. Based on our research, these transactions were executed on the Kraken exchange.

Looking into its liquidation history, we discovered that Pump.fun sold 9,940 SOL ($1.33 million) in September, taking the total sales at that time to 274,311 SOL. According to research, this amount was part of the total fee earnings of 712,797 SOL ($95.87 million) generated by mid-September. Meanwhile, Odaily data has disclosed that the platform’s addresses have reached 85,000, with 37,000 of them being new wallets. On top of that, about 2.5 million tokens are reported to have gone through the platform since its launch in March.

Impact of Pump.fun’s Liquidation and Other Factors on Solana’s (SOL) Price

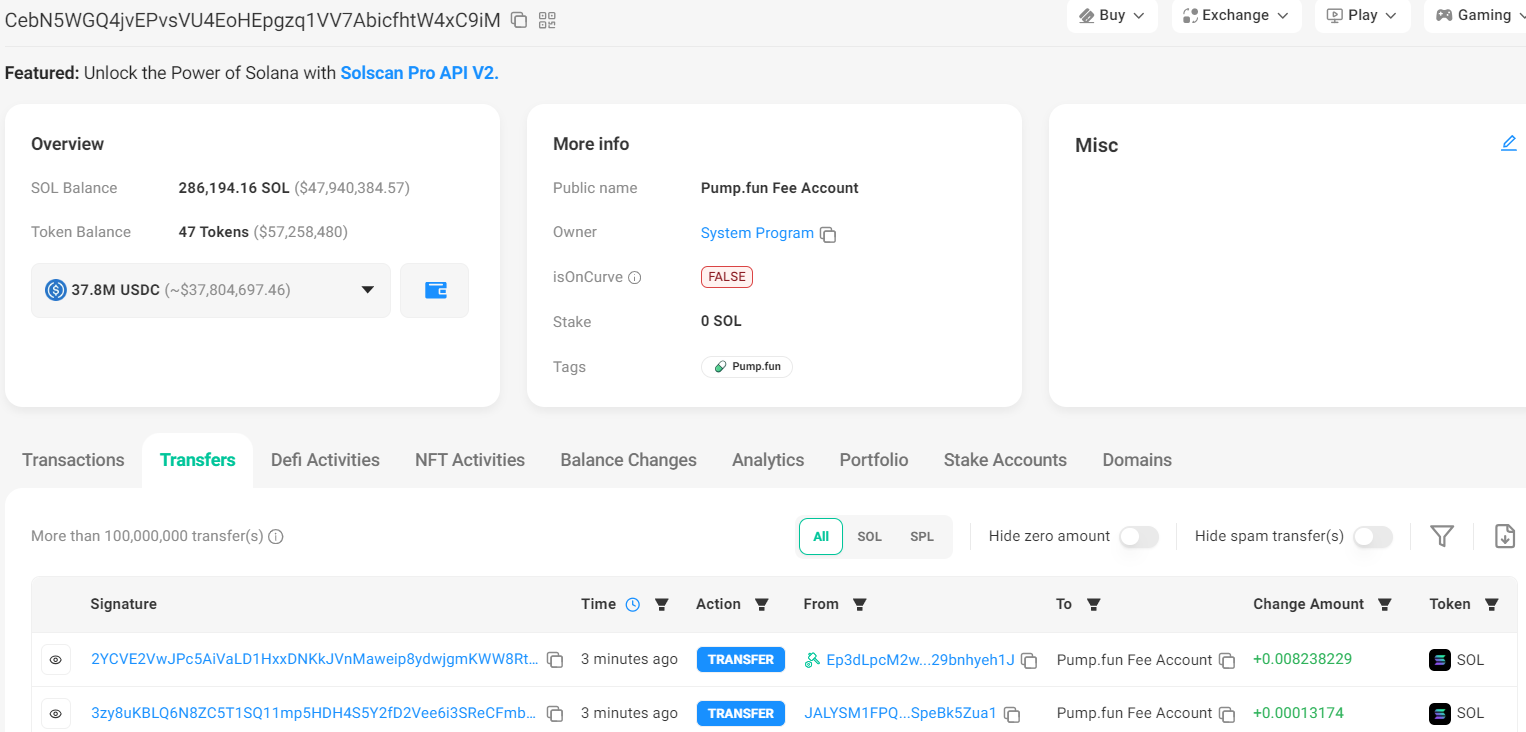

On September 4, the price of SOL declined by 12% to trade at $128 after $41 million worth of the asset was sold by Pump.fun for $157.5 per coin. Solscan shows that the fee account still holds $47.9 million worth of the asset. This implies that more selling pressure could be introduced.

Adding to this, we have observed that the scheduled release of SOL has turned out to be a massive headwind “fighting” against the upward momentum of the asset. Based on our investigation, around 524,030 SOL tokens ($88.46 million) are expected to enter circulation. Between October 1 and October 7, $81 million worth of SOL entered circulation. Within this period, the SOL price lost 6% of its value.

Whales are also reported to have contributed to the recent price declines. On October 21 for instance, a major whale sold 22,726 SOL ($3.86 million). Data shows that this particular whale has been consistently purchasing the dip and selling at a higher price. Meanwhile, he still holds 20,000 SOL ($3.33 million) in his wallet.

For crypto trader Luke Martin, Solana’s potential rally was just reduced into a “crab walk” when Pump.fun users began a mass launch of meme coins on the platform. Meanwhile, other analysts believe that SOL would recover in just a few weeks as it did in the previous liquidations.

When you overlay Pump.fun launches on top of the Solana price chart. $SOL stopped going up almost exactly when people started launching tons of meme coins.

Against the backdrop of this, SOL has shown serious resilience as it still retains a 6.5% gain on its weekly chart. At the current price of $165, our data shows that the asset has a positive Return on Investment (ROI) of 75,153%.