The Bitcoin Lightning Network Evolution: A Snapshot

The Bitcoin Lightning Network has skyrocketed by a whopping 1,212% in two years. But why is this crucial for cryptocurrency enthusiasts?

The Bitcoin Lightning Network Explained

Think of the Lightning Network as Bitcoin's turbo-charged sidekick. It functions above the primary Bitcoin blockchain, allowing users to set up private payment channels. The beauty? They can conduct countless transactions privately. Only the final balance, after all the back-and-forth, gets recorded on the main Bitcoin ledger.

Here are Lightning Network's key features and functionalities:

Instant Transactions: The Lightning Network enables near-instantaneous transactions, which are significantly faster than the usual Bitcoin transaction time that can range from a few minutes to several hours or even longer during congested periods.

Scalability: The Lightning Network increases the transaction throughput of Bitcoin, allowing it to handle millions to billions of transactions per second across the network.

Reduced Fees: Transactions on the Lightning Network generally have much lower fees than those conducted directly on the Bitcoin blockchain. This makes microtransactions economically viable, which was challenging on the main Bitcoin network due to the higher fees.

It has been seven years since the Lightning Network whitepaper was published by Joseph Poon and Tadge Dryja and over five years since the network has gone live. Ever since the Lightning Network has grown into the biggest second-layer scalability solution for Bitcoin. It enables millions of people to trustlessly and instantly move money back and forth without having to settle each transaction on the Bitcoin blockchain.

The State of Lightning Network

According to the latest report from River, a Bitcoin technology and financial services company, there is a lower bound of 6.6 million routed Lightning transactions in August 2023. This represents a 1,212% increase since August 2021.

Source: River’s 2023 Lightning Report

Then, how should this growth in transactions from Lightning be perceived five years after the network first emerged? An interesting observation is the 45% drop in 'Bitcoin' search trends on Google between August 2021 and August 2023, paired with a 44% fall in its market price. With Bitcoin's overall appeal witnessing a decline, the surge in Bitcoin Lightning Network's transactions seems to stem from its existing user base. The 1,212% boost in Lightning transactions, in light of this context, is indeed noteworthy.

Key Insights from the Report

1. Growth Origins: The majority of the transaction growth finds its roots in gaming, social media tipping, and streaming, accounting for 27% of overall growth.

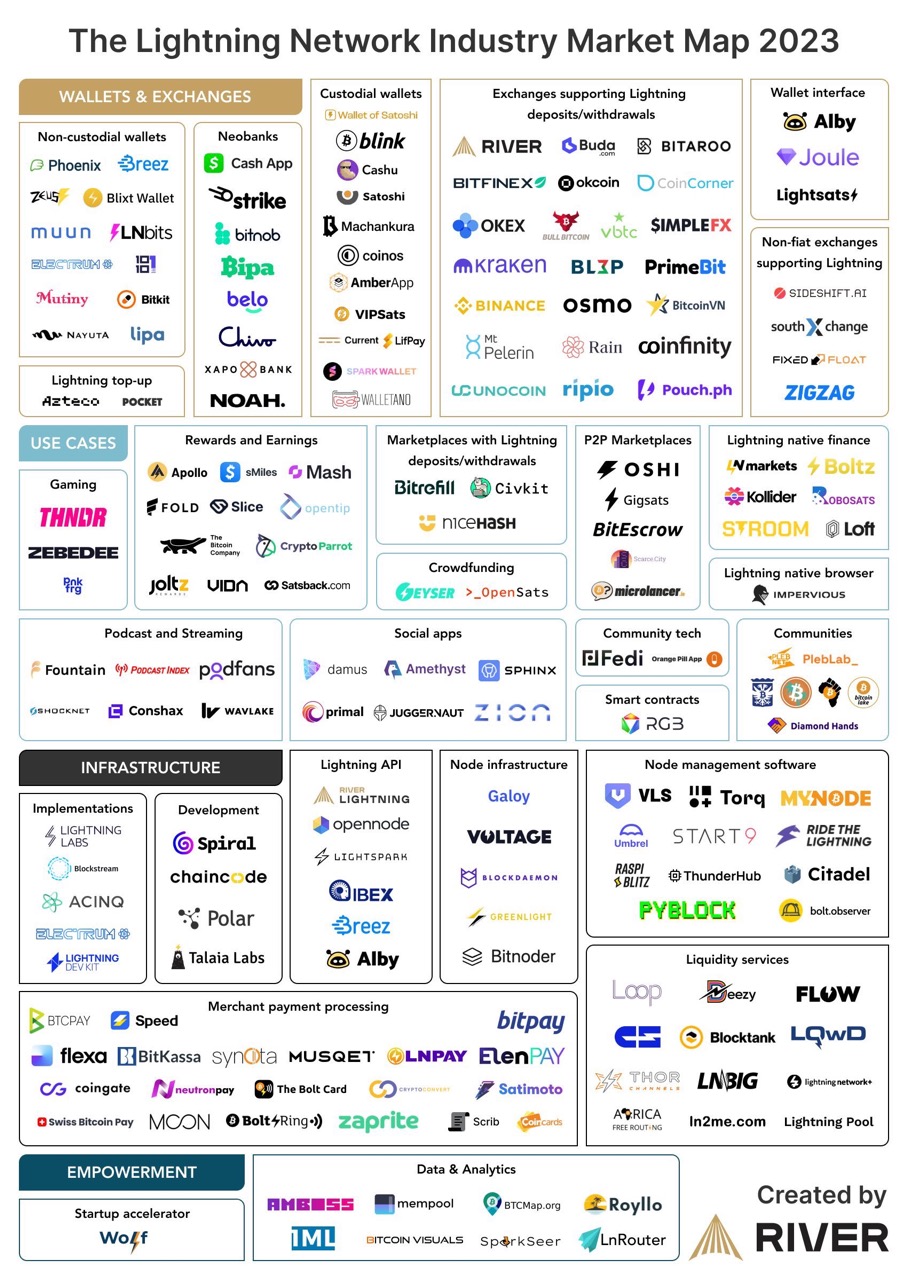

2. The Lightning Ecosystem: There are 173 companies involved in the Lightning industry across 28 categories, with a staggering $530.93 million raised by 39 Lightning companies from 2018 to the end of 2022.

Source: River’s 2023 Lightning Report

3. Companies Embracing Lightning: Various businesses, including wallets, exchanges, fintechs, payment processors, gaming, streaming, rewards, e-commerce, and cross-border payments, are showing keen interest. Here's why:

- Unique Selling Point (USP): Lightning's novelty and reputation make it a standout choice.

- Cost Savings: On-chain transaction fees can be a significant expense, but integrating Lightning makes transactions cheaper.

- New Revenue Streams: Lightning opens doors to previously unattainable revenue streams and business models.

- Supporting Bitcoin: Companies realize that supporting Bitcoin is essential for long-term sustainability, and Lightning is a major scaling upgrade.

- Insurance Against High Fees: Lightning acts as an insurance policy against costly on-chain fees during bull markets.

Closing thoughts

The Bitcoin Lightning Network has grown significantly in the past two years. It's a great solution for fast transactions, saving money, and scalability. Many companies are recognizing its potential and investing in it. With more growth and development, we're excited to see how it will change the cryptocurrency world.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

- Crypto trendsHow to Buy Crypto with the Best Price in Russia TL;DR - This article shows how to buy crypto with the best price in a secure way in Russia. Russia's approach to cryptocurrency has been marked by a blend of cautious evaluation and cautious optimism. The government has been meticulously examining the regulatory framework for digital assets, and recent developments indicate a willingness to embrace the crypto market. One notable milestone occurred in September 2022 when the Bank of Russia and the Ministry of Finance reached an agreement to per

2023-09-18

- Crypto trendsAlephium (ALPH): The Rising Star and Where to Trade, Deposit, and Withdraw ALPH Alephium (ALPH) has become a rising star in the European cryptocurrency community. With its unique Proof of Work (PoW) mining mechanism, Alephium is capturing the attention of both novice and experienced crypto enthusiasts. As computing power increases and the price of ALPH rises, more and more people are taking notice. If you're among the growing number of people interested in Alephium and looking for a reliable platform to trade or store your ALPH, Bitget is an excellent choice as it is on

2024-08-21

- Crypto trendsDiscovering Token Potential for Trading & Exchange Listing Key Takeaways The Bitget and Nansen Research teams employ different methods to evaluate token potential depending on the token cycle. For early-stage tokens, the focus is on off-chain metrics and traction. For established chain-governance tokens, on-chain leading metrics are used to predict token prices. Early-Stage Tokens: Overcoming Data Challenges Discovering early-stage “hidden gems” presents a significant challenge, as there is often limited on-chain data available for exchanges to rely on

2024-08-20